The Australian market couldn’t carry over a positive week for the US market, falling throughout the day to finish 1.1 per cent lower. There were very few highlights outside of the healthcare sector, which gained 0.1 per cent, while every other sector finished lower. Materials and technology continue to be hit on the back of…

As one of the lawyers at the coalface of supporting impacted consumers both before and after the revelations of the Royal Commission, Maurice Blackburn is in a unique position to provide input into the Quality of Advice review.

News that the rollout of the Your Future Your Super (YFYS) test beyond My Super products would be paused has been met with positive and negative commentary from the investment industry.

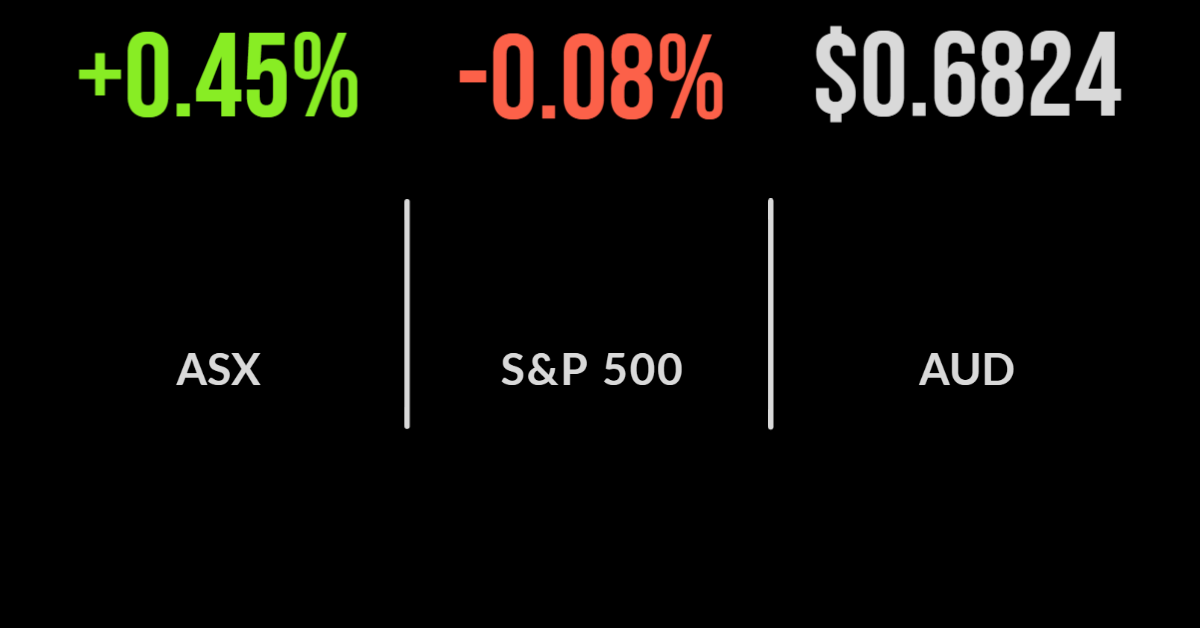

It was a solid week last week for the Australian market, advancing on four of the five days. The S&P/ASX 200 gained 138.1 points, or 2.1 per cent, for the week, to end at 6,678, while the broader S&P/ASX All Ordinaries index added 156.6 points, or 2.3 per cent, to 6,877. The All Tech index…

The benchmark S&P/ASX200 index finished at the highs of the day on Thursday, up 53.5 points, or 0.81 per cent, to 6648.0. The broader All Ordinaries rose 52.6 points, or 0.78 per cent, to 6836.9. A 1.9 per cent rise in Singapore iron ore futures, to $US113.30 a tonne, helped the big miners, with BHP up…

Under the updated RG276, ASIC has made it clear that any retirement calculator must be agnostic to product.

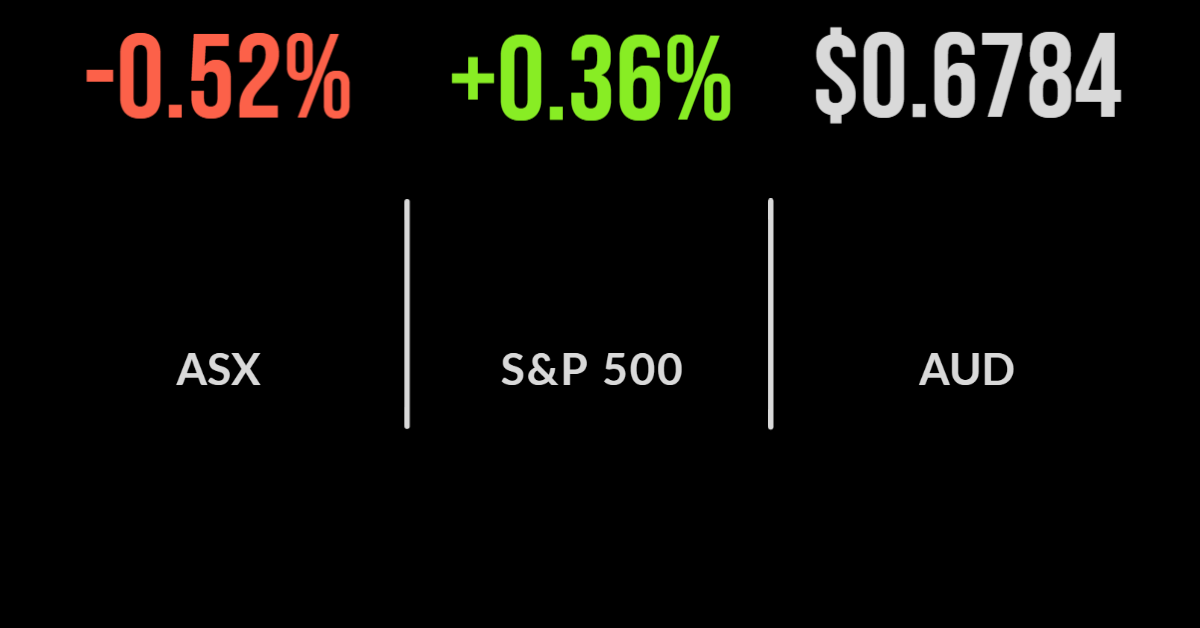

A tech rebound – possibly a dead-cat bounce – tried to drive the Australian market higher on Wednesday, but the concerns on commodity prices more than outweighed this. By the close, the benchmark S&P/ASX 200 had shed 34.8 points, or 0.52 per cent, to 6,594.5, while the broader All Ordinaries surrendered 33.8 points, or 0.5…

As widely expected, the RBA raised the cash rate by 0.5 percentage points yesterday, taking it to 1.35%, as widely expected. This is the fastest back-to-back increase in rates since increases of 0.75% and 1% in November and December 1994 respectively. But the RBA remains upbeat on the economy and employment, despite remaining concerned about…

The Australian share market ended in the green on Monday, despite investor skittishness ahead of today’s Reserve Bank board meeting. The central bank is widely predicted to lift its cash rate by another 50 basis points today, which would take it to 1.35 per cent, in the intensifying effort to rein in surging inflation, which…

“Greenwashing” has once again been highlighted as the major challenge for the financial advice industry when it comes to embracing responsible and ethical investment options.