-

Sort By

-

Newest

-

Newest

-

Oldest

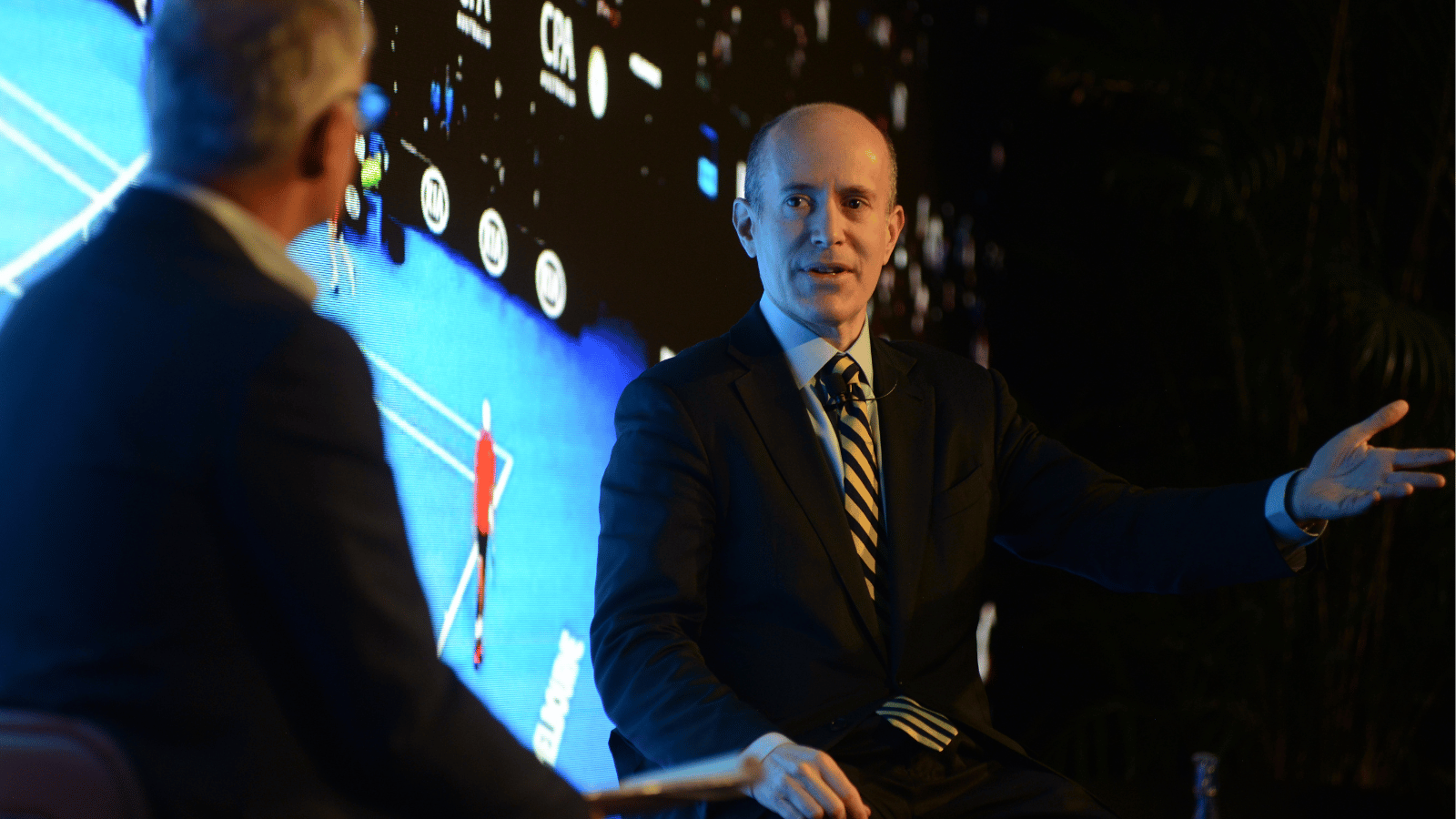

Contrary to popular misconception, senior secured loans actually sit at the safest part of the capital structure and remain backed by company assets. That they’re unsafe is one of several fallacies that needs to be busted, says Invesco’s Ashley O’Connor.

For many, planning to help kids and grandkids out with a first home deposit is something that needs to be done strategically, with timelines, capital growth and tax implications front of mind. Here, investment bonds could be the key.

The Inside Network is launching a new publication aimed at keeping retirement-age Australians informed about investing, with a host of content designed to help them live their best life.

The rise of AI is part of a global knowledge revolution that is reshaping every aspect of our lives, according to AI thought leaders at the Australian Investor Association’s recent investX conference. While it’s new territory, the same investment principles should apply in picking the winners from the losers.

Diversification is one of the most effective tools an investor can use, for the simple reason that spreading risk means you are unlikely to get wiped out if one or two investments go bust. But it is not a foolproof concept, and in fact it is laden with potential traps.

There may be some caveats, but investment bonds can serve as a tax efficient investment vehicle. This is especially so when planning for life events like schooling, inheritances or property purchases.

As an ever-more-connected world makes it harder to deliver uncorrelated portfolios, there are still strategies investors can use to add diversification. Industry leaders recently discussed opportunities in equities and fixed income at The Inside Network’s inaugural Investment Leaders Forum in Queenstown, New Zealand.

For the right investor, investment bonds can provide a seriously beneficial after-tax return according to Foresters Financial chief executive Emma Sakellaris.

It is striking how little little yield premium equities are offering over the official interest rate at them moment, says Ruffer’s Steve Russel. Investors may be tempted, but he warns that a cautious road may suit for the period ahead.

True to form, US stocks are outperforming Aussie shares on the back of a resurgence in technology-related company valuations. Economists warn against straying from diversification, however, with Aussie miners still offering investors capital returns on top of an underlying hedge against a US downturn.

Dollar-cost averaging allows investors to be in the market for the good days as well as the bad. This can help reduce exposure to market declines, as recent research shines light on the difficulty of timing the market.

Lending specialist Daniel Zwirn spoke candidly about investor “credit myths”, and the misunderstandings that hold people back in the selection and movement of assets in portfolio construction.