-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Asset management

-

Economics

-

Retirement

-

Value proposition

The traditional method of protecting client portfolios from drift remains entirely valid. It’s ostensibly cheaper to run portfolios without managed accounts, but it does take more time to do so and probably takes on more risk.

The solutions to practice inefficiency might be completely foreign, but the challenges of service delivery have a habit of changing, so the methods employed to meet those challenges need to evolve in tandem.

An eventual market correction won’t necessarily be marked by its depth, the famed British investor writes, but by its speed. Caution may come at a price, but Ruffer believes that cost will take on a different perspective by the time it’s been paid in full.

The government’s line on its proposed changes to advice in super is incongruous with the actual changes. You can’t re-do the language embedded in the SIS Act while denying that anything will be different.

The assets family offices invest in haven’t changed much but the ways they’re investing in them have, according to BNY Mellon Wealth. Meanwhile, cryptocurrencies are seeing more interest as a new generation takes the reins.

By reneging on long-standing employment deals, AMP has again given the impression that it has welched on an existing agreement once it realised the deal wouldn’t work out in its favour. Do that repeatedly and people stop wanting to do business with you.

Lazy portfolios can be overconcentrated, overdiversified, full of yesterday’s winners, devoid of structured asset allocation, full of misallocated positions or agnostic to markets and client expectations. All of this is happening more than it should.

First Sentier’s decision to close a number of strategies and pivot towards private markets handily illustrates the pressures facing the Australian funds management scene – and the new period of competition into which it is now entering.

Clients have a right to know how advisers justify a fee of $15,000 per year when the investment income on a $1.5 million portfolio is only $75,000, says Drew Meredith. Maybe they should also have a hand in deciding how the fee is calculated.

It’s a spectacular transaction, one that marks not only the likely nadir of Iress but what should be the end of five very frothy years of M&A activity in the investment platform space.

The financial needs of a staggering 64 per cent of retirees sit beyond the comprehension of super funds, a new report states, because there is too much complexity involved when retirement income isn’t enough to satisfy lifestyle ambitions.

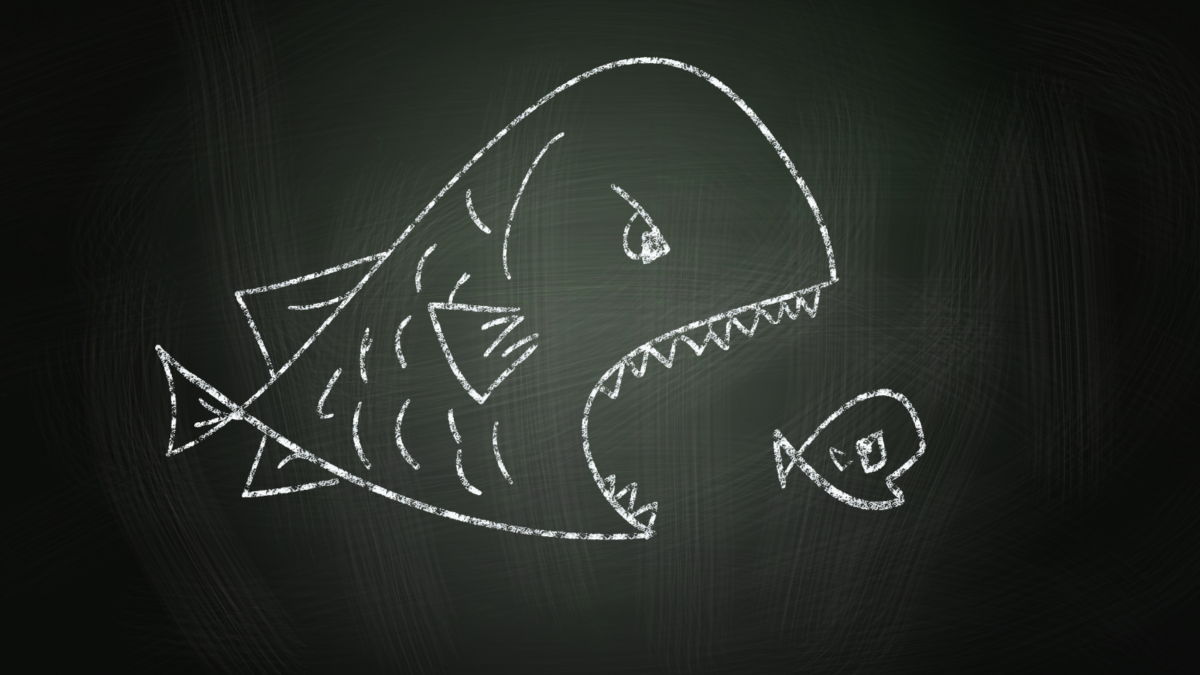

An evolutionary leap in the retail investment product landscape is taking place, with asset consultants displacing financial advisers across rich corners of the value chain. Scarcity Partners’ big bet on Evidentia, and how it’s being received, brings into focus just how seismic the shift really is.