Dealing with the complexity of her own UK pension led the adviser to specialising in helping clients to do the same. Since then, she’s become an expert in a field most other advisers shy away from.

“Some kids read cartoons,” the equities manager recalls, “and some read the sports section, but I used to read the stock market tables and try to figure out what was going up and what was going down.”

After witnessing the horror of the GFC, a young Leesa Swain decided to help mitigate the ‘ripple effect’ of bad financial management and start a journey in financial planning that has led her to a new, digitally led solution provider.

Making a connection is at the heart of any financial adviser’s value proposition, the consultant says. But to do that, the right language must be leveraged to understand what a client’s legacy values truly are.

The task of standing out in a crowded market place is not getting easier for product providers. Generative AI may hold the key, Michael Kollo says.

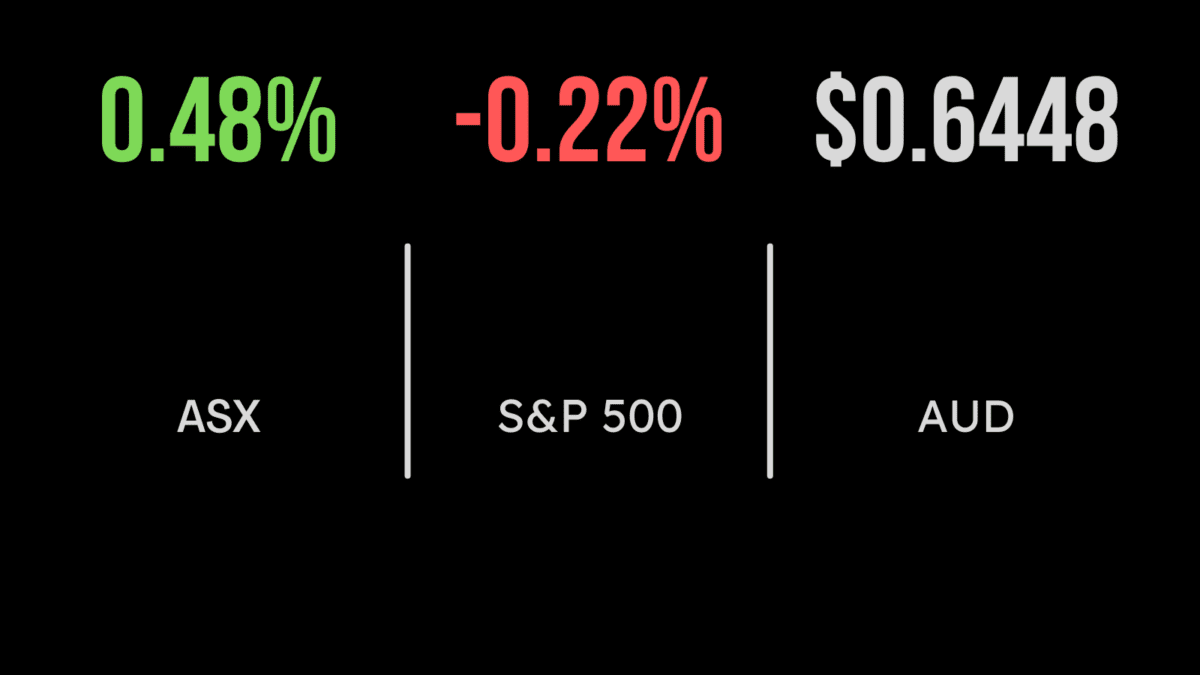

The S&P/ASX 200 Index rose by 0.5 per cent, driven by the increase in iron ore price. This surge propelled Rio Tinto up by 1.7 per cent, while Fortescue advanced by 0.4 per cent, and BHP increased by 1.5 per cent. The materials sector led gains, adding 1 per cent, followed closely by the technology…

The “NewSpace” field has opened up in the wake of government entities pulling back their spaceflight programs across the world, which has given rise to a whole new class of Infrastructure-as-a-Service investment opportunities.

“We’re all humans trying to make a fist of it,” says Muirfield Financial Services adviser Matt Torney. “And sure, finances matter, but people and relationships matter more.”

Melbourne-based specialist investment firm Horizon 3 is backing its knowledge in what is a very broad sector, but one that offers investors the chance to achieve a high level of return with low correlation.

Money managers are rising to meet the capital demands of companies wanting to stay private for longer. These days, though, they’re doing it with a strategic mindset that properly encapsulates a spectrum of investment maturity periods.