-

Sort By

-

Newest

-

Newest

-

Oldest

Here, I focus on five myths about China’s economy and its financial system. In offering more realistic assessments, my hope is to help investors better judge the opportunities and risks of investing in China.

Markets have been incredibly difficult. At the moment there are so many different things going on all at once, slowing growth, rising inflation and on top of that the emergence of black swan events, have caught many, by surprise.

The events in Russia and Ukraine offered a real time insight into the challenges facing ESG, ethical and sustainable investors around the world.

Funds into thematic exchange traded funds (ETFs) have dried up this year as technology stocks get hit globally.

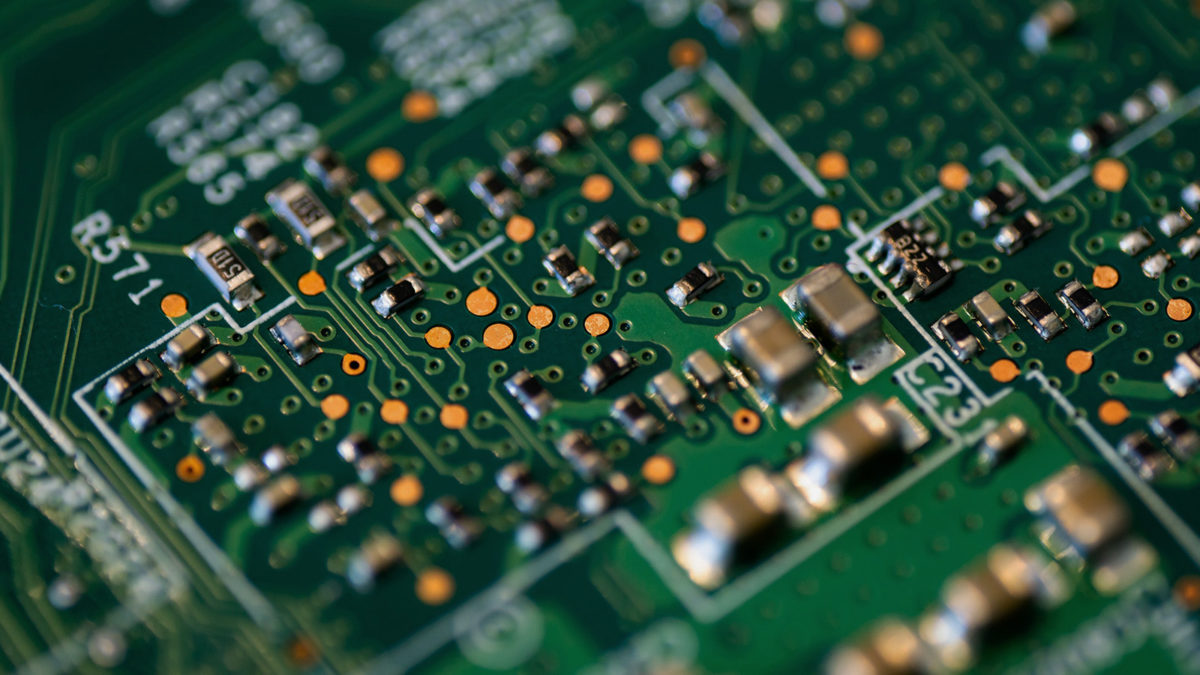

For investors looking to build positions in quality technology firms, the US computer chip giants are trading at attractive price levels, with many brokers now rating them as a buy, according to data from the Wall Street Journal.

“We recently cut risk but stick with stocks over bonds for now. Equity prices now reflect much of the worsening macro-outlook and hawkish Fed” were the latest comments from the Blackrock Investment Institute in their weekly research note.

Value investing has been the clear winner of the first third of 2022, with the tech-heavy Nasdaq leading losses in global sharemarkets.

Ruffer LLP’s single strategy approach, which is a multi-asset class, diversified fund seeking to deliver consistent returns and limit drawdowns in every market cycle is increasingly rare in an environment dominated by thematics.

In their latest quarter fixed income outlook, titled ‘Investing Through Inflation and Growth Uncertainty’ global asset manager Neuberger Berman has flagged somewhat of a non-consensus view on the outlook for inflation, growth and fixed income assets.

The classic way of thinking has been to ditch bond funds as interest rates rise. Why? Because as rates rise, bond prices have an inverse relationship, and drop in value as newer bonds with higher yields become more attractive. Sounds about right?

During March, Australia’s sharemarket unexpectedly claimed pole position against the majority of the world’s larger and more developed markets.

Amid ongoing elevated volatility, some financial advisers are recommending that investors hold alternative investments, including market neutral funds, which could help cushion portfolios against a broad market sell-off.