Why this trillion-dollar managers prefers stocks over bonds

“We recently cut risk but stick with stocks over bonds for now. Equity prices now reflect much of the worsening macro-outlook and hawkish Fed” were the latest comments from the Blackrock Investment Institute in their weekly research note.

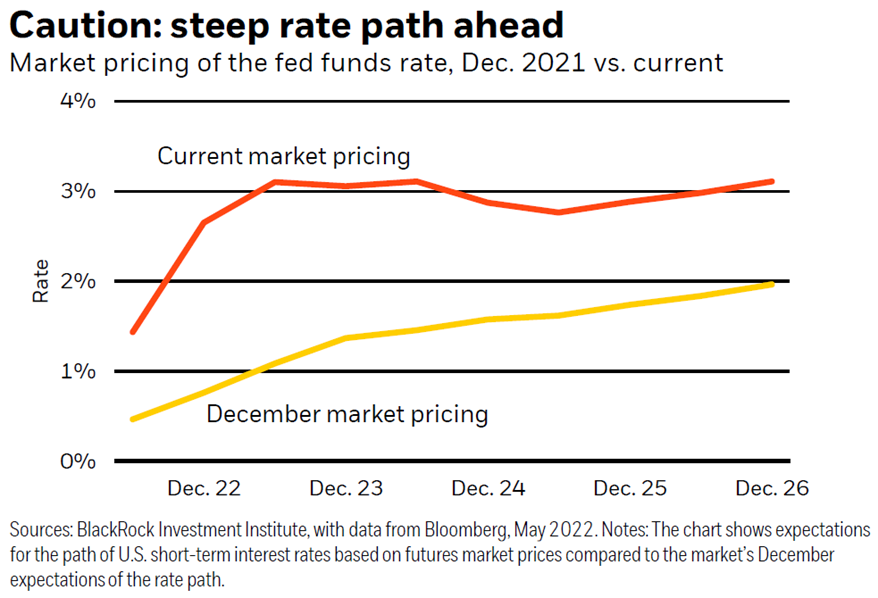

With the recent pullback in equity markets due to rising inflation and interest rates, Blackrock have reduced risk but kept their modest stock overweight position. Their reasoning for retaining an overweight position is because most of the risks are now priced in. “We also believe the Fed’s sum total of rate hikes will be historically low and see recession fears as overblown. We think equities remain more attractive than bonds, even as the historic sell-off in bonds has cut the gap between the two,” says the BlackRock team.

Much of the risks to growth are reflected in stock prices, which are keeping valuations attractive. BlackRock also think that the cumulative total of Federal Reserve interest rate hikes will be low, given the level of inflation. BlackRock says, “We see the Fed ultimately choosing to live with core inflation that’s a bit higher than its 2% target, rather than fight it because of the costs to growth and jobs.” This latter point is key in a world where full employment is clearly attainable.

“The worsening economic outlook has prompted us to reduce portfolio risk this year. We downgraded European equities in March on the energy shock. We followed with a downgrade of Asian assets last week, coupled with an upgrade of investment grade credit and European government bonds. The sell-off in the bond market has narrowed the gap between the stocks

and bonds, in our view, and created pockets of value,” says BlackRock.

The team sees longer-term yields rising as investors demand a higher term premium for holding government bonds during high inflation. Taking this into consideration, the team has decided it will not change their overall bonds underweight and will maintain their relative preference for equities.

BlackRock is staying put with its “overweight equities and underweight bonds” position but they have reduced risk to reflect the worsening macro outlook. The team do not expect the US to be in any recession risk given the strong restart of economic activity. The preference is towards US and Japanese equities. Should the US Federal Reserve do something out of the ordinary and trigger a material slowdown, then the position on equities would need to be revisited.