The Ukraine invasion is having a surprising impact on the climate challenge

With the pandemic in the rear-vision mirror and reporting season over, the crisis in Ukraine has become an ongoing market concern that is creating uncertainty in an already volatile environment. According to Schroders’ head of Australian equities, Martin Conlon, there is light at the end of the tunnel. He says the impact of the conflict on the energy transition and the global climate challenge has been surprisingly positive.

As climate change investors, Schroders says “the war has thrown into sharp focus the fault-lines in Europe’s energy system. Russia is the largest supplier of gas, crude oil and coal into the EU, accounting for 45%, 27% and 46% of imports respectively. President Putin’s aggressions have triggered a rapid and fundamental reshaping of European energy policy, with energy security now the continent’s primary concern. In the short term, all options are on the table, including extending the use of coal-fired power generation and potentially intervening in the carbon market.”

While every EU member has its own decarbonisation plans, many have elected to fast-track these plans as a way to end energy reliance on Russia for sustainable energy solutions. “The logical conclusion of net-zero always meant moving towards 100% renewable energy generation in Europe, so whilst that goal has not changed, this crisis has created an additional impetus to move to a future free of fossil fuels more quickly,” says Mr.Conlon.

In-fact the European Commission is now looking to reduce reliance on Russian gas by two-thirds by the end of 2022, and become Russian-fossil-fuel-free well before 2030. It will be a remarkable achievement if achieved but at the same time, it does present some challenges.

“The short-term measures focus on diversifying the gas supply, ensuring Europe’s gas storages are filled up ahead of next winter, and protecting vulnerable consumers and businesses against soaring power prices. The structural measures are all about the energy transition: hastening the renewable build-out, electrifying heating through the rollout of heat pumps, increasing the short-term targets on ‘green’ hydrogen, and addressing the energy efficiency of buildings,” says Conlon.

The EU’s new stance was summed up by its executive vice-president for the European Green Deal, Frans Timmermans. He said, “It is time we tackle our vulnerabilities and rapidly become more independent in our energy choices. Let’s dash into renewable energy at lightning speed. Renewables are a cheap, clean, and potentially endless source of energy and instead of funding the fossil-fuel industry elsewhere, they create jobs here. Putin’s war in Ukraine demonstrates the urgency of accelerating our clean energy transition.”

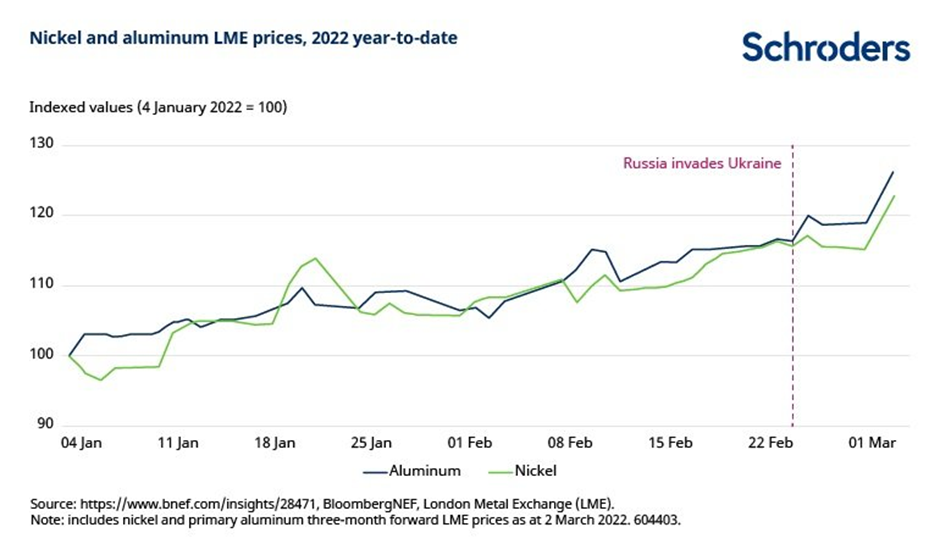

Conlon says the ‘tools’ of decarbonisation will be wind turbines, high voltage power cables, solar panels, electric vehicles (EVs), energy storage, heat pumps, and “let’s not forget the raw materials required to make these technologies.” The knock-on effects, however, are soaring commodity prices from the increased demand. The price of nickel (used in EV batteries) and aluminium (used in solar panel frames, cabling, EVs) have skyrocketed on the back of the war.

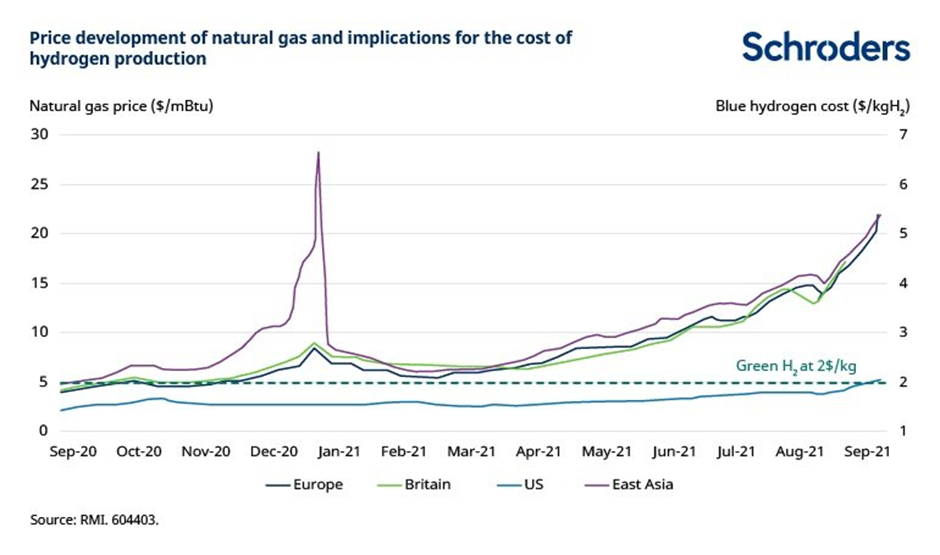

“Finally, elevated gas prices have also driven the parity of ‘green’ and ‘grey’ hydrogen years earlier than anticipated. Given that we don’t expect gas prices to ease soon, this improves the economic case for creating hydrogen from electrolysers powered by renewable electricity,” says Conlon.

“Over the last two years, the proliferation of net-zero policies showed that the world was waking up to the need to address climate change, but the actual progress on decarbonisation was painfully slow. Perhaps it has taken Putin’s appalling war and the new energy security imperative to finally catalyse an energy revolution,” says Conlon.