$226M per adviser: Retirement opportunity set ‘never been better’

A confluence of factors including a swelling superannuation base and a declining professional workforce have combined to provide remaining financial advisers with an opportunity to service an increasingly lucrative slice of the nation’s wealth.

Yet for news is not so good for consumers, with the forces creating tailwinds for advisers serving as headwinds for those in desperate need of financial advice to help navigate the complex Australian retirement system.

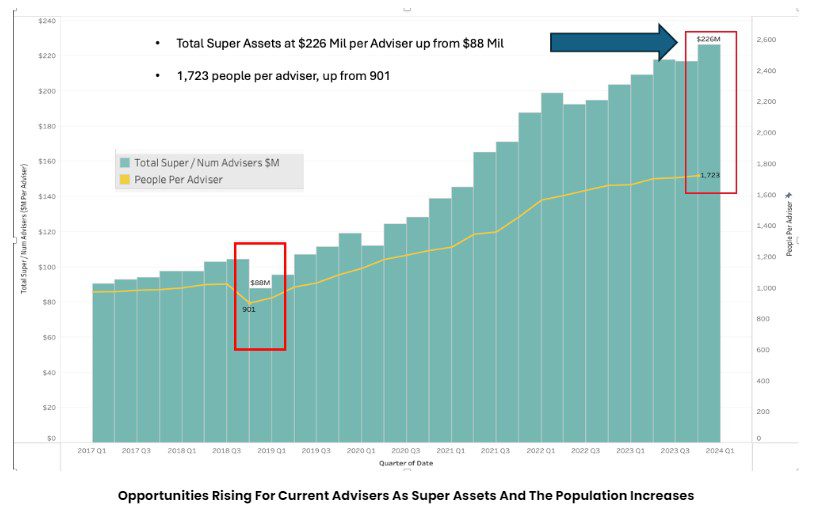

According to recent research from advice consultancy Wealth Data, a simple study of the amount of superannuation assets divided by the number of financial advisers (as at the December 2024 quarter) reveals a number of $226 million per adviser. This represents a 256 per cent jump on the corresponding figure of $99 million in 2019.

Even more stark is an increase in the number of Australians per adviser over the same 5 year span from 901 to 1,723 – a rise of 191 per cent.

The forces at play here are clear; adviser numbers have dropped from around 28,000 in 2018 to just over 15,600 today, while the population has soared past 27 million and the nation’s superannuation coffers have swollen with around $3.2 trillion tucked away for retirement in retail, industry and self-managed funds.

The declining adviser base has become a particular bone of contention, with the 2018 Hayne Royal Commission introducing a raft of regulatory changes and prompting the exodus of institutional wealth providers from the industry, which has had a cascading effect on talent acquisition and retention across the industry.

Five years on from these changes, the government is bending its efforts towards improving access and affordability around advice through its Delivering Better Financial Outcomes reform package, which has proposed a second tier of less qualified advisers be instated within super funds and other providers.

These advisers, however, will be limited to a more general, as yet undefined mode of financial advice while qualified and registered advisers are left to service an exponentially growing number of retirees and their descendants, who are set to benefit from a huge intergenerational transfer of wealth.

“One can look at this as a massive opportunity for the remaining advisers, [but] also how many people will miss out on quality advice due to the scarcity of advisers,” says Wealth Data managing director Colin Williams.

While the number of registered advisers is relatively stagnant – Wealth Data reports that the 15,611 advisers as of last week is 14 down this calendar year – there is a good chance that number will increase, Williams believes.

“The number of advisers has steadied over recent times,” he says. “There is room to increase the adviser numbers given that 19,527 have passed the Financial Adviser (FASEA) Exam, but less than 15,600 advisers are practicing; a potential pool of some 4,000 advisers.”