T+1 settlement an ‘unstoppable force’ Australia needs to adopt, or risk falling behind

Operations experts have highlighted how important it is that Australia moves towards swifter trade settlement, with the progress other developed markets are making in moving to T+1 (settlement 1 day after trading) underscoring the urgent need for a faster, more efficient exchange system.

The Australian financial market has remained on a T+2 settlement period since 2016. In recent years other nations have been busy moving to T+1, providing a much higher level of trading efficiency.

China and India already operate on a T+1 basis, while Canada, the US, Mexico and Argentina will do so in late May. The UK and other European markets are actively exploring the option of moving to T+1.

The Australian Stock Exchange (ASX) has indicated a willingness to explore the “feasibility and implications” of moving to a T+1 settlement model, releasing a consultation whitepaper on the topic in April. It has a working group on the move including relevant stakeholders such as FinClear Services, Computershare, Goldman Sachs, UBS Securities, BNP Paribas and the Australian Custodial Services Association.

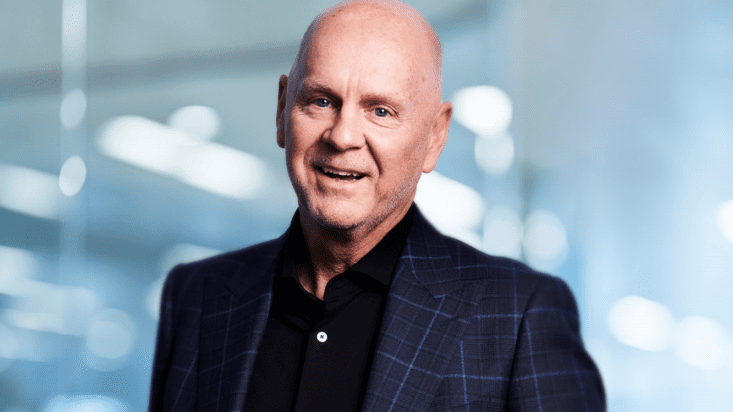

Speaking on a session at the Stockbrokers and Investment Advisers Association’s national conference this week, Computershare global capital markets president Paul Conn called the move to T+1 “a big, big step for markets globally”, adding that the US is already in “final countdown mode” and “barreling towards implementation”.

“The tectonic plates are really starting to shift, and it will not be long before there is pressure on all markets to adopt a T+1 settlement period,” Conn told the audience of stockbrokers and advisers. “There are really important decisions that need to be made by markets. Australia is not different.”

According to FinClear chief executive and managing director David Ferrall, Australia should be more ambitious and now target a T+0 settlement period.

“We’re already seeing that the frictionless movement of assets is going to become more commonplace,” Ferrall said. “One of the things that we have to become accustomed to here is that technology and markets are going to keep moving much faster than we appreciate.”

Complicating the issue is the ASX’s intention to replace the ageing CHESS clearing system, a project which had a calamitous start after efforts to implement distributed ledger technology failed. Yet Ferrall believes the two initiatives could complement each other.

“The debate needs to focus on what position Australia’s in if we can’t transition to a more efficient T+1 [or] T+0 timeframe while CHESS replacement happens,” he argued.

The ASX says it will work with regulators and industry stakeholders on a possible transition to T+1 at this stage, with the response period for its consultation ending on June 18 and a decision targeted for November.

The stock exchange will not rush any move to T+1 after the last attempted development went so badly, however, adding that a binary “yes/no” is unlikely.

“The decision to move (or not) to T+1 has several dimensions including the timing and nature of change and the interplay with the CHESS replacement project,” the ASX stated in its whitepaper.