-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Analysis

-

Asset management

-

Economics

-

Retirement

-

Value proposition

Head of Australian Equities at T. Rowe Price, Randal Jenneke, has released a note to clients that conveys a somewhat cautious tone towards the Australian equity market.

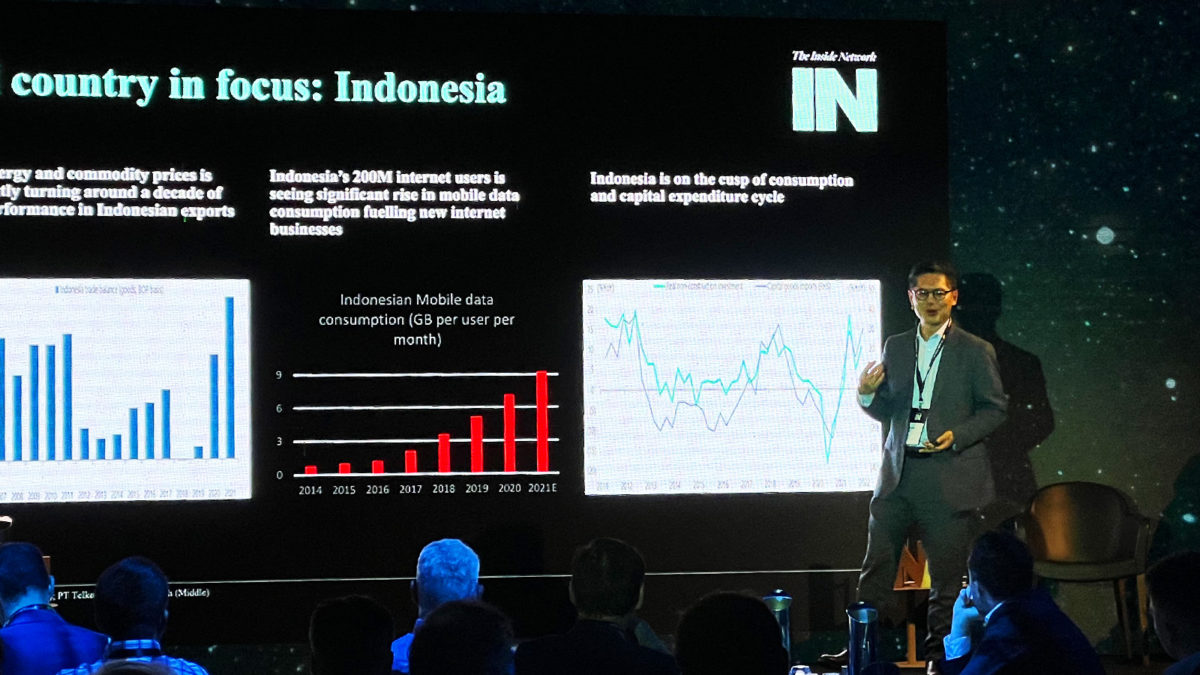

News that two major Chinese cities are finally emerging from their COVID-19 lockdown slumber has once again highlighted the huge opportunity set available in Asia.

Many people at the top of funds management travel around the world to work in various locations, to build a career.

‘An era of structural inflation is upon us” explained Con Michalakis, head of investments at Statewide Super, speaking at The Inside Network’s Equities and Growth Assets Symposium, held recently in Adelaide for the first time. Challenged with setting the scene for the full-day discussion on equity and growth allocations, Michalakis drew upon his extensive experience…

“Have we really thought about the investment implications of a world in which inflation is persistent?” That was the question posed by Dr Joseph Lai of Ox Capital.

Here, I focus on five myths about China’s economy and its financial system. In offering more realistic assessments, my hope is to help investors better judge the opportunities and risks of investing in China.

Markets have been incredibly difficult. At the moment there are so many different things going on all at once, slowing growth, rising inflation and on top of that the emergence of black swan events, have caught many, by surprise.

The United Nations has described the managers of global real estate assets as ‘one of the most important decision-making groups on Earth’.

The Morningstar-owned private markets publication Pitchbook this week highlighted the growing risks in the economy along with the potential impact of higher interest rates on the popular venture capital and private equity sectors.

Private equity is eating the ASX alive. Nearly every other month there is another billionaire dollar private equity approach of an ASX company.

China’s bid for global power, climate change and the transition away from fossil fuels are three of the defining megatrends of our time.

Ruffer LLP’s single strategy approach, which is a multi-asset class, diversified fund seeking to deliver consistent returns and limit drawdowns in every market cycle is increasingly rare in an environment dominated by thematics.