‘Anomalous’ short-term underperformance of EM set to reverse

“Have we really thought about the investment implications of a world in which inflation is persistent?” That was the question posed by Dr Joseph Lai of Ox Capital. Speaking at The Inside Network’s Equities and Growth Symposium recently, Lai said the challenge was to identify and discuss unique opportunities for outperformance across growth assets globally.

With 17 years investing in emerging markets, but particularly in Asia, Lai is clearly well-positioned to comment. Providing context, he highlighted the exceptional returns that markets have delivered, buoyed by the fight against deflation, with the Nasdaq gaining close to 15 per cent a year.

“Buying the dip” has worked to great effect during this period, but the market has been clear in telling us “not to buy the dip” said Lai, as well-known technology names continue to suffer.

A long-time source of diversification, emerging markets have suffered from the twin impact of COVID-zero policies in China and Russia’s ill-fated decision to invade Ukraine. This has resulted in a five-year period of underperformance between emerging and developed markets, which Lai described as “anomalous”. Why it’s anomalous, he suggests, is because over the last 50 years emerging markets have consistently outperformed developed markets, backed by faster-growing economies.

So, what’s the reason for the underperformance? It’s actually quite simple, he explained, with commodity and oil prices a key input. While not an emerging market, Australia stands out as a case in point in which the economy and markets do well when commodity prices are doing well. And by and large, this is the same for many emerging market economies, from Indonesia to Brazil: they still rely on high oil (and other commodity) prices.

Lai offered evidence of this fact by charting movements in the oil price overlaid with the emerging market share indices, with the relationship extremely clear. So, when the investment team at Ox Capital sits down to identify the sectors most likely to deliver solid long-term growth in emerging markets, it has naturally gravitated to energy and materials, while many of its competitors focused on technology.

The energy and oil price story is supported by a gross under-investment in additional capacity, caused by a focus on cost-cutting and dividend payments by some of the largest oil companies in the world. Even before the war, the COVID bump excluded, the oil price was naturally moving higher, and is set to “take over the baton” from long-duration growth stocks.

At its core, the energy theme is about supply and demand. Demand is set to remain strong, particularly for natural gas, despite a surge in renewables, with some 5 billion people still in the midst of an urbanisation process. And the supply side has barely moved, meaning companies as large as Shell, which fits the broad mandate of the strategy, offer significant free cash flow yields, but still trade on light multiples.

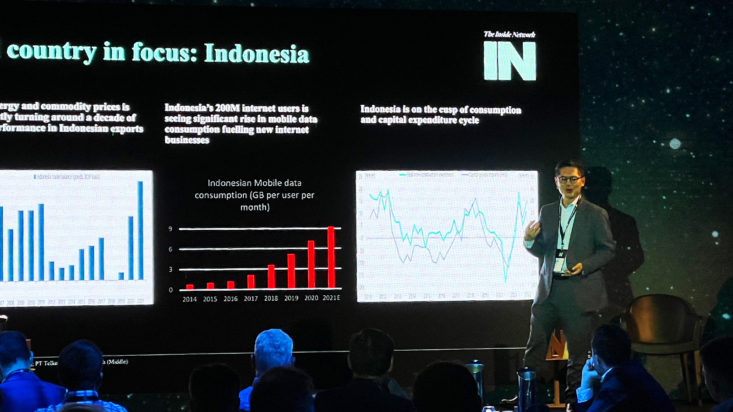

The opportunity extends into Indonesia, which Lai highlights as a rare opportunity to invest in one of the fastest-growing economies in the world. After decades of weak growth, surging oil and nickel prices, with Indonesia being one of the world’s largest producers of the latter, are having a broad-based impact on the economy, as is a decade of extensive reform. The economy is becoming a mobile and technology powerhouse, affording a broad range of opportunities for patient investors.

Any emerging markets discussion wouldn’t be complete without discussion around China, where Lai is becoming optimistic. “China is difficult, you need to be selective,” he explained, while highlighting those two of the three most important cycles in the country are now reversing. The first is geopolitical risk, which clearly won’t go away, however, the regulatory and monetary tightening cycle are clearly nearing an end. “Valuations in China are dirt cheap” he concludes.