-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Alternatives

-

Asset Allocation

-

Crypto

-

Defensive assets

-

Equities

-

ESG

-

ETF

-

Fixed Income

-

Growth assets

-

Private debt

-

Private Equity

-

Property

This week we had the pleasure of speaking with fixed income gurus Mark Mitchell and Justin Tyler from Daintree Capital to get their view on the interest rate and inflation outlook together with some insights into their Core Income Fund. Daintree is a specialist Australian active fixed income manager and part of the Perennial Group…

Technology has been the best performing sector for 10 years. And it has outperformed for the correct reason: it makes more money. The past decade, the tech sector saw its profits – as measured by earnings per share (EPS) – swell more than any other sector. Making matters better for tech, the rate of profit…

As part of the government’s commitment to ensure Australian’s can access quality financial advice, a new disciplinary system for financial planners has been proposed that includes a raft of changes including many previous roles falling under Treasury and ASIC coverage. The Financial Planning Association of Australia (FPA) has thrown its support for the Government’s…

US$429 billion* multi-asset manager Neuberger Berman is ramping up pressure on both sides of capital markets with its NB Votes campaign. The group, which was founded eight decades ago, is adopting a more transparent and potentially powerful approach to ‘engagement’ with the companies in which they invest client’s money. In a recent paper prepared by…

Move over supermarkets, utilities and gold bullion. When it comes to defensive exposures, there’s nothing more compelling than medical device providers that prevent deaths from chronic diseases in rapidly ageing populations. According to global Sydney-based specialist equities manager Cordis Asset Management, chronic conditions such as cardiovascular and respiratory failure and diabetes account for 80 per…

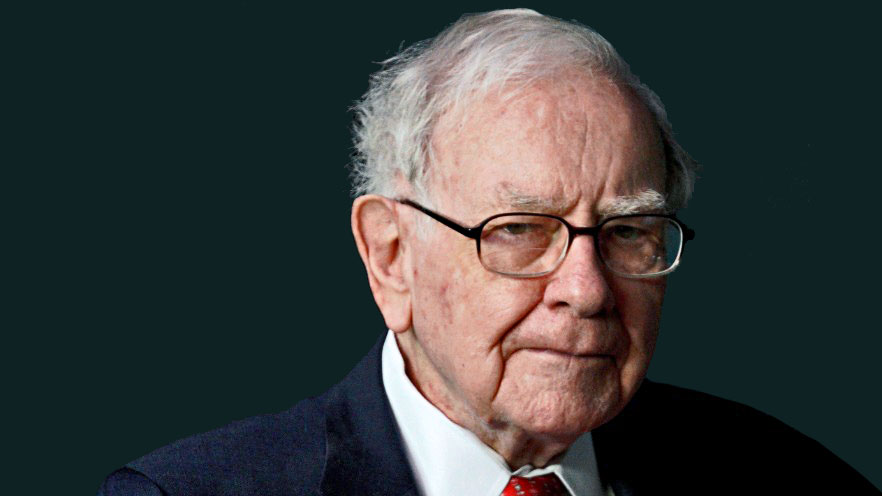

Warren Buffett is the first to admit that active investors can’t get it right every time, doing so once again at the Berkshire Hathaway (NYSE: BRK.A) annual shareholders meeting last week. The quotes of Buffett are an enigma in themselves, with the man himself suggesting investors adopt an indexed approach, but being among the most…

It was roughly ten years ago now, that Nick Griffin, chief investment officer at Munro Partners, marched into the Melbourne office of Sornem Private Wealth and gave a presentation on how a bookstore would one day turn into a superstore. We thought he was crazy. Remember when Amazon sold only books? It’s hard to imagine…

Media pressure continues to grow on Hamish Douglass and the $100 billion Magellan Financial Group. After years of outperformance the flagship fund has been caught off guard by what Douglass himself described as “the best month in 26 years” that was November 2020. As markets continue to move forward, Douglass and Magellan remained steadfast deciding…

As investors start to look past the pandemic, the economic cost and scarring from Covid-19 has been significant. The International Monetary Fund (IMF) says “unlike the 2008 crisis, emerging markets and developing economies are expected to suffer more scarring than advanced economies”. In the same way that the US and Australia were able to provide…

Australia’s longest standing responsible investment firm, Australian Ethical, recently combined with research house, Investment Trends, to survey investors on their ESG views. The survey covered 2,854 investors and 321 financial advisers, all of whom are based in Australia. Despite the growing popularity of ESG strategies and headlines being dominated by “green-focused” policies in the US…

Emerging markets, including China and India, have been among the most popular destinations for investors in recent months, with many attracted to their diversification benefits. There remains a common misconception that these countries are still the “manufacturer for the world,” but the companies that now inhabit these countries, in many cases, have surpassed their developed…

Evergreen Consultants has teamed with Generation Life for the launch of an ESG-orientated multi-manager investment bond, believed to be an industry first. The bond follows a model portfolio developed by Evergreen, called the Responsible Growth Model. The research and ratings firm says the model was created to provide advisers and investors with a long-term portfolio…