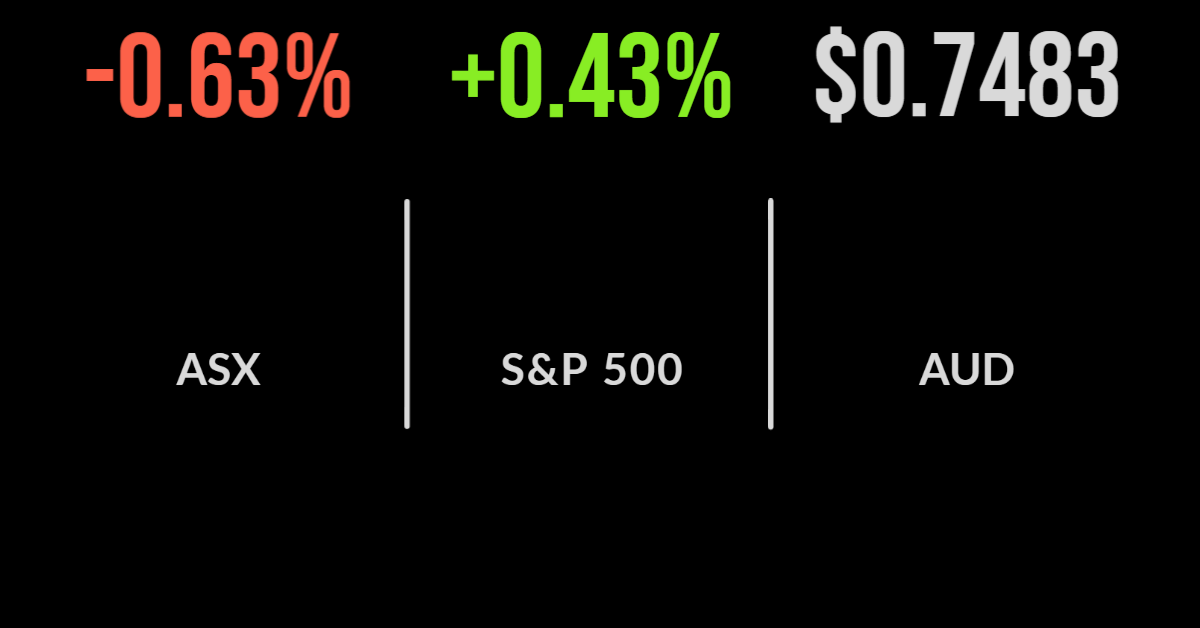

The threat of quantitative tightening extended to Australia on Thursday, with the S&P/ASX200 being dragged down another 0.6 per cent almost solely due to the technology sector. Just three sectors finished higher during the session, being perceived defensive companies in the utilities and staples sector, with the technology sector falling another 3.4 per cent. The…

Leading responsible and sustainable investment manager Australian Ethical (ASX:AEF) this week announced their intention to merge with industry fund Christian Super. If completed, the combined entity would manage some $9 billion and serve around 100,000 members across the country. Christian Super, and similar religious-leaning super funds were some of the earliest adopters of the ESG…

There has been a saying in markets for the last few years that fixed-income investments, favoured for their guaranteed returns and correlation benefits, have actually become “fixed-loss.” The driving factor was the threat (and now, realisation) that bond yields and cash rates were set to turn higher, reversing a four-decade tailwind. Naturally, these types of…

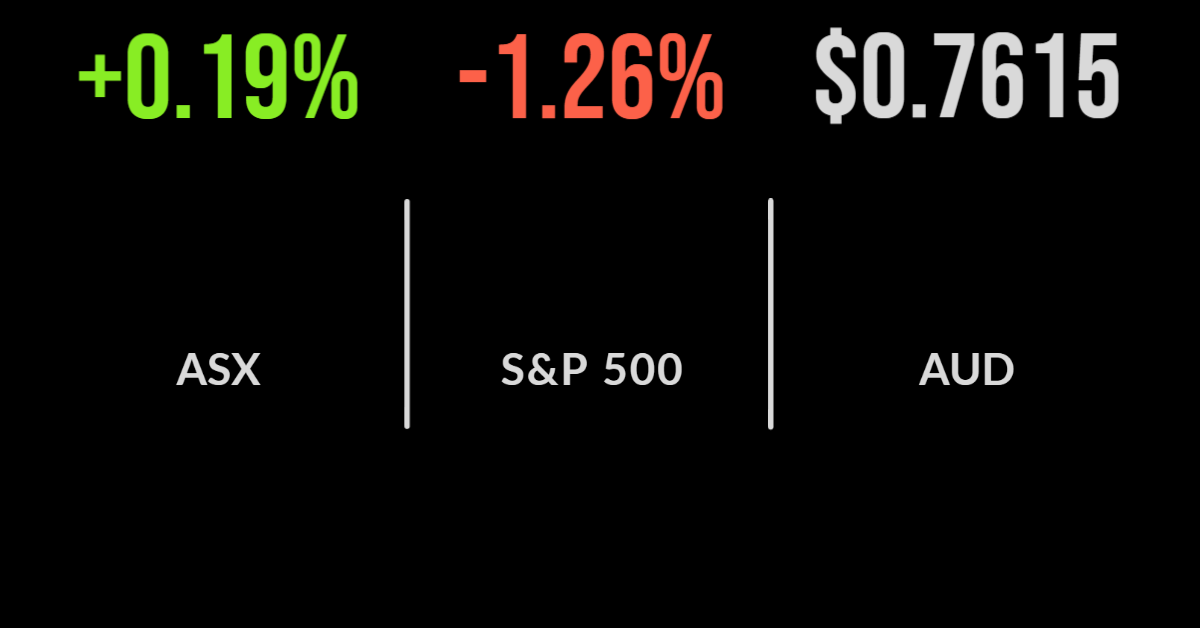

Tuesday was a similarly strong day for the Australian market, with the S&P/ASX200 moving within 1 per cent of an all-time high; despite the incredibly difficult geopolitical backdrop. That was until the Reserve Bank of Australia delivered its latest board meeting result and associated explanation. Whilst rates remained on hold at 0.1 per cent, analysts…

April has begun just as March finished, with the domestic market rallying on what was generally stock-specific news. The S&P/ASX200 gained 0.3 per cent despite a broad spread of performances, with six sectors higher led by utilities, up 1.1 per cent, whilst tech and materials also rallied 1 per cent; Fortescue (ASX: FMG) was a…

The “widow-maker” in the Australian investment context has long referred to those willing or stupid enough to take a short position on the “big four” banks. Being such a huge part of the benchmark and with clear government support, betting against the sector has carried too much career risk for many. But in 2021 and…

The proliferation of data and information has done little to improve the outcomes of self-directed investors. With information on almost any issue and a social media system built to reinforce our own beliefs or views in many cases, making sound investment decisions has never been harder. As an experienced financial adviser, I like to think…

Global investment consultant and support network to the pension fund industry, bfinance, this week released its latest Market Intelligence and Market Trends report, covering the final quarter of 2021. While the world has changed dramatically since the calendar turned over, there are some powerful insights for financial advisers and other asset allocators. According to its…

Among the Federal Budget proposals that received the least fanfare was the extension of the ‘temporary’ relief on the minimum drawdowns for account-based pensions. Whilst the media attention on the legislative change immediately highlights the fact that it benefits the wealth more than the rest, it affords an entire generation of Australians greater flexibility. Few…

The Australian market continues to defy weakening market sentiment, falling less than 0.1 per cent on Friday with the S&P/ASX200 ultimately gaining 1.2 per cent and delivering a third straight week of gains. On Friday, energy and materials came roaring back with BHP (ASX: BHP) the primary contributor, but broad-based gains in lithium stocks also…