-

Sort By

-

Newest

-

Newest

-

Oldest

While investing following strong and integrated ESG principles does not readily spring to mind when considering China there is more action going on across the sustainability space there than many people think. The building blocks are already in place: a growing green credit market that is encouraging companies to invest in ESG-related projects, strategic government…

The concept of ESG has been a key driver of fund flows, but most importantly marketing strategies, in recent years. Nearly every fund manager worth their salt has a well-written ESG strategy, outlining its views on the most important issues facing investors, management, and boards. Not to mention the expanding set of “sustainable” and ESG-focused…

“Sustainable” is a trendy word nowadays. It is thrown around in marketing campaigns like a decorative pillow, which looks good, but most of the time feels flat. Companies and brands claim their products are ‘sustainable’ for the buzz and the hype, playing on our generation’s environmental consciousness and demand for products and services that won’t…

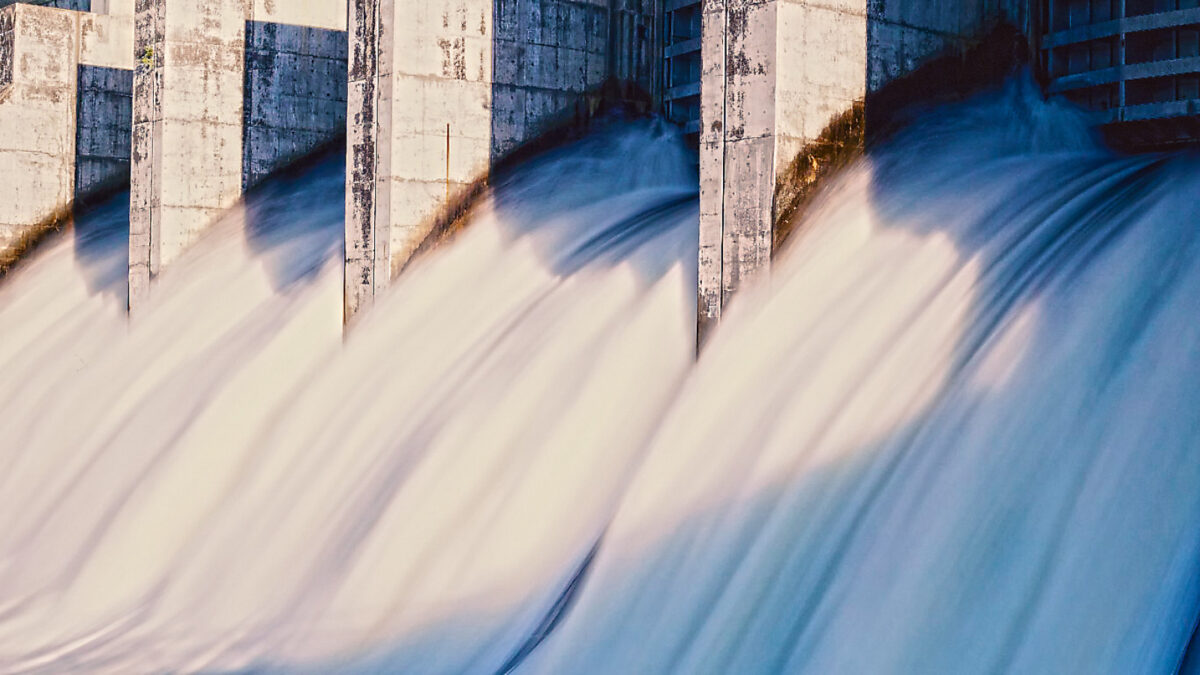

I want to discuss a water utility, which may sound as dull as dishwater – but we global real assets investors have never been averse to safe, predictable, and yes, boring companies. The type of company that pays a dividend that is as dependable as a birthday cheque from Grandma. We have specialist in-house capability…

Governance is the pillar of environmental, social and governance (ESG) principles that investors have been actively considering for the longest period of time. This is not surprising, as in some ways, it could be said that governance is probably the most important aspect of ESG. An organisation’s board’s role is to appoint the CEO and…

While the active versus passive debate rolls on, and on, across the investment world, some active managers have gone to the ‘dark side’, at least partially, by adding more quantitative inputs for new strategies, such as thematic investing. The concept of ‘thematic’ investing, which describes the strategy of identifying sectors of the economy expected to…

Melbourne: ESG (Environmental, Social and Governance) is one of the fastest growing trends ininvesting globally. It has become part of the funds management zeitgeist, aided, in part, by research pointing to betterperformance by fund managers that favour companies with good ESG policies and practices.The recent decision by the Trump administration to restrict the ability of…

In the wake of the pandemic, investors have continued to pile money into variously labelled ESG/sustainable funds. Are they doing what they say?

The well-known fund manager has launched a series of low-cost ETFs which will help further its reach into the retail investor market.

Given the global outlook is clearly one of a high degree of risk, it is surprising that all forms of risk assets seem to continually defy all the negative outlooks. Traditional asset allocations have been heavily tied to equity market growth and the continual decline in risk free interest rates over the past 30 years….