Rate hikes and mortgage stress will lead to increase in distressed selling: Analysts

Most Australians with a mortgage are worried about meeting repayments if interest rates continue to rise, despite the central bank’s recent pause, new research reveals – and analysts expect distressed property selling to pick up with any further increases.

The Reserve Bank of Australia (RBA) held interest rates steady at its July 4 meeting, citing the need to assess the impact of already-completed increases on curbing inflation, though it said further rises might still be needed. The RBA kept its cash rate at an 11-year high of 4.1 per cent, having lifted rates by 400 basis points since May last year, in its most aggressive tightening cycle ever.

These rate rises are causing anxiety for Australians: recent AMP research found seven out of 10 (69 per cent) Australian mortgage holders are worried about meeting their mortgage repayments now and if interest rates continue to rise. Those aged between 25 and 44 are particularly feeling the pinch, with 80 per cent of this group worried further rate rises will leave them unable to make their repayments. For older Australians aged 65 years and over, 44 per cent said they are worried about this prospect.

Three-quarters (76 per cent) of Australian homeowners have made changes to their spending habits due to rising interest rates, with this figure rising to 86 per cent for those with children under 18. Despite these fears, 73 per cent of mortgage holders classed as having a small safety net – a savings buffer of three months’ mortgage repayments or less – had not contacted their lender for support.

“Rising interest rates are having an increasingly divergent and unequal impact on different household groups, and the most indebted households are making changes to their spending habits,” said Diana Mousina (pictured, right), deputy chief economist at AMP Australia.

The RBA also says higher interest rates have placed much more stress on low-income households than on high-income earners. The share of low-income mortgagors devoting more than one-third of their income to servicing their housing loan has increased from about one-quarter prior to the RBA’s first rate hike to about 45 per cent in January 2023. Only about 5 per cent of borrowers in the highest income quartile spend that much of their income on servicing their housing loan.

“If unemployment were to rise more sharply than expected, the share of households and businesses experiencing financial difficulties – and ultimately falling into arrears on their loans – would increase further,” the Reserve Bank said in its recent Financial Stability Review.

Rise in distressed sales expected

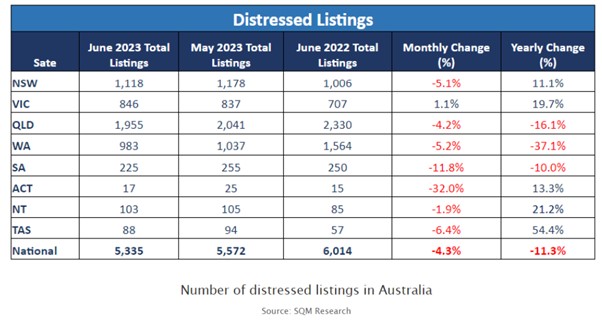

Louis Christopher (pictured), managing director at SQM Research, said distressed property selling – when a property owner wishes to sell urgently and is willing to accept a price below normal market value – is still relatively benign, notwithstanding 12 interest rate rises since May 2022 (see table). But he expects a pickup in distressed sales activity over the next six months as fixed-interest-rate mortgages expire.

“However, we do not expect it to be a major problem in the market unless there is also a substantial rise in the unemployment rate to, say, above 5 per cent,” Christopher said.

“Our view is the large fixed-rate mortgage resets have not as yet materially impacted the market. However, SQM Research will continue to monitor the situation on the ground closely. The market is at significant risk of a double-dip downturn in our capital cities for the second half of 2023, given the additional tightening in monetary policy over the months of May and June.”

ABS data shows that the average loan size for owner-occupier dwellings in May 2023 was largely steady at $585,000 nationwide. However, that was 21.8 per cent higher compared with the pre-pandemic average seen in February 2020.

New South Wales by far had the largest average loan size at $720,000, followed by the Australian Capital Territory at $607,000 and Victoria at $599,000. The average loan size in Queensland was $519,000; it was $504,000 in South Australia, $472,000 in Western Australia and $426,000 in the Northern Territory.

*This story was first published in The Inside Investor.