It’s a mad, mad world, where discount rates no longer apply to tech stocks: Ruffer

This month’s chart neatly captures the conundrum investors have faced this year: the stark disconnect between rising bond yields and the performance of other interest rate sensitive assets, especially the mega-cap technology stocks.

With inflation proving more persistent than central banks forecast, it has become increasingly clear that interest rates will need to be higher for longer – a point successive Fed members have recently been at pains to make.

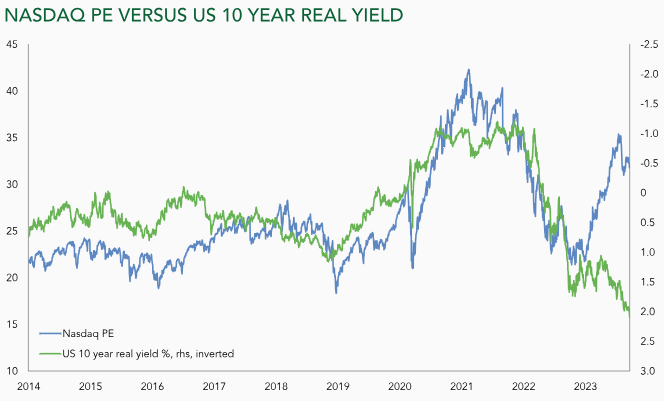

Not surprisingly, this has seen bond yields push higher, continuing the bear market in bonds that kicked off in 2022. US real yields (the difference between nominal bond yields and inflation) have also marched higher, shown by the green line (inverted scale on the right side) in the chart. The 10 year real yield has moved with shocking speed from -1 per cent in 2021 to well over +2 per cent.

However, technology stock valuations, shown here by the PE ratio for the Nasdaq (blue line), have done the opposite, rising sharply even as real yields have surged upwards. This simply shouldn’t be happening.

The relationship between bond yields and equity markets is normally a simple (and rational) one. As interest rates rise (particularly real rates), the discounted value of future profits drops, and so equity valuations tend to fall.

As real interest rates fell during and immediately after the pandemic, the valuation ascribed to technology stocks rose, driving strong returns. All very straightforward.

Similarly, last year as central banks moved to combat inflation, real interest rates rose and the valuation on the Nasdaq fell sharply, leading the index to fall by roughly a third. Again, pretty straightforward.

In 2023, that relationship has been flipped on its head: bond yields have risen sharply, but equity markets – specifically, and counter-intuitively, those sectors most vulnerable to rising rates, such as technology – have defied gravity and continued upwards.

What could explain this? Will the growth from AI technology overwhelm the negative impact of higher interest rates? Perhaps, but not likely. Similar forecasts were made during the 1999-2000 dot.com bubble: the internet was going to change the way the world worked and drive huge growth for technology stocks. Well, that all actually came to pass, just a decade later than everyone thought. In the meantime, even the eventual winners lost up to 90% of their value. The losers went bust.

Alternatively, is government debt now so high that the US’s creditworthiness is in question? This may be true to some degree, but governments, and only governments, can always print money to pay interest and capital. They can also raise tax revenues. This is the US government after all, and, perhaps uniquely, it does have the power to tax the mega-cap tech companies if it so chooses.

We believe a significant downward repricing of equities is required as markets adjust to a world where cash rates of 5% are a viable alternative to investing in risk assets. Whilst this repricing has largely already happened in bond markets, equities – and especially mega-cap tech stocks – remain in our view significantly overvalued. This risks another stock market crisis, against which the Ruffer portfolio holds significant protections. Taking a cautious view can sometimes be painful. But history tells us that, not long after these periods, the risks emerge, leading to significant drawdowns in markets.