First Sentier withdrawal just the tip of the iceberg for struggling fundies

Last week, the circa $238 billion First Sentier announced it will close four strategies and hand back $14 billion to investors in order to “simplify its business”, with its venerable Australian fixed income and credit businesses on the chopping block alongside equity income and emerging companies.

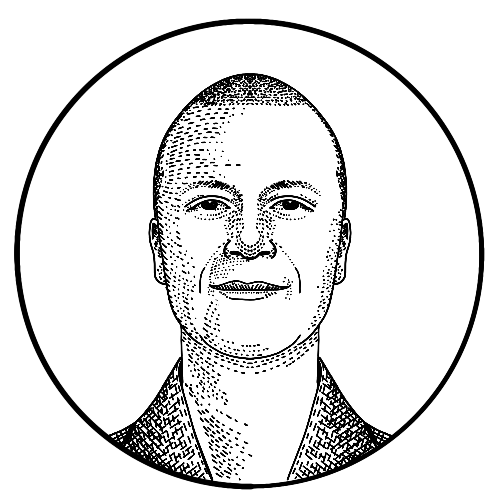

But David Allen, global head of investment management at First Sentier, is careful to characterise the move (which has been met with some dismay by the Australian asset manager community) as a net positive; he says that First Sentier is “very fortunate” to have, in Mitsubishi UFJ, an owner encouraging business growth – and that means focussing on strategies that can make a financial difference and closing those that can’t.

“The decision is based on our long-term view,” Allen says. “It’s not about recent performance issues; it’s not about recent asset losses, because we’ve been okay on the asset front and performance has been good… Those pressures have been around for probably 10 years; internalisation has accelerated over the last three to four, and so has consolidation.

First Sentier is hardly the first Australian manager to suffer those pressures, or to think that future growth will “disproportionately” come from private markets, where it’s difficult – nigh on impossible – for passive competition to erode margins.

Certainly its Australian growth and SMIDs strategies, as well as its systematic business RQI Investors (formerly Realindex) have “very strong credentials” and continue to be “key capabilities”. But big super funds clients are also seeking global strategies to alleviate their home country bias and alternative assets to sock away the massive inflows they receive from the Superannuation Guarantee. For that latter purpose First Sentier can point them towards Igneo, its unlisted infrastructure manager, and AlbaCore, a European private debt manager it acquired last year.

But that move towards the private markets by businesses which have historically been larger investors in public equities and fixed income – a move of which First Sentier is now representative, but not the sole participant – begs the question: if private markets represent the new frontier of Australian funds management, who will tame it?

After all, that frontier is getting pretty crowded. So the smart money is on managers that have been slowly shifting their capabilities towards private markets for a good long time, or that have the scale or asset backing to support the switch. But asset managers trying to escape the triple pressures of fee sensitivity, internalisation and consolidation are entering into an environment that might soon be more competitive than the one they just left.

“We have to deliver a leading capability with strong performance; nothing can excuse mediocre performance,” Allen says. “The teams we work with or any teams that we may acquire or add to are capable of delivering strong investment outcomes for clients.”