Further 7pc of advisers linked to unis: Principals Community brings scale to grad drive

A new partnership between advice network The Principals Community and Deakin University will create the most significant graduate funnel program to-date, with the new venture giving over 1,000 advisers the chance to pitch the profession to students and secure graduate placements into practices across the country.

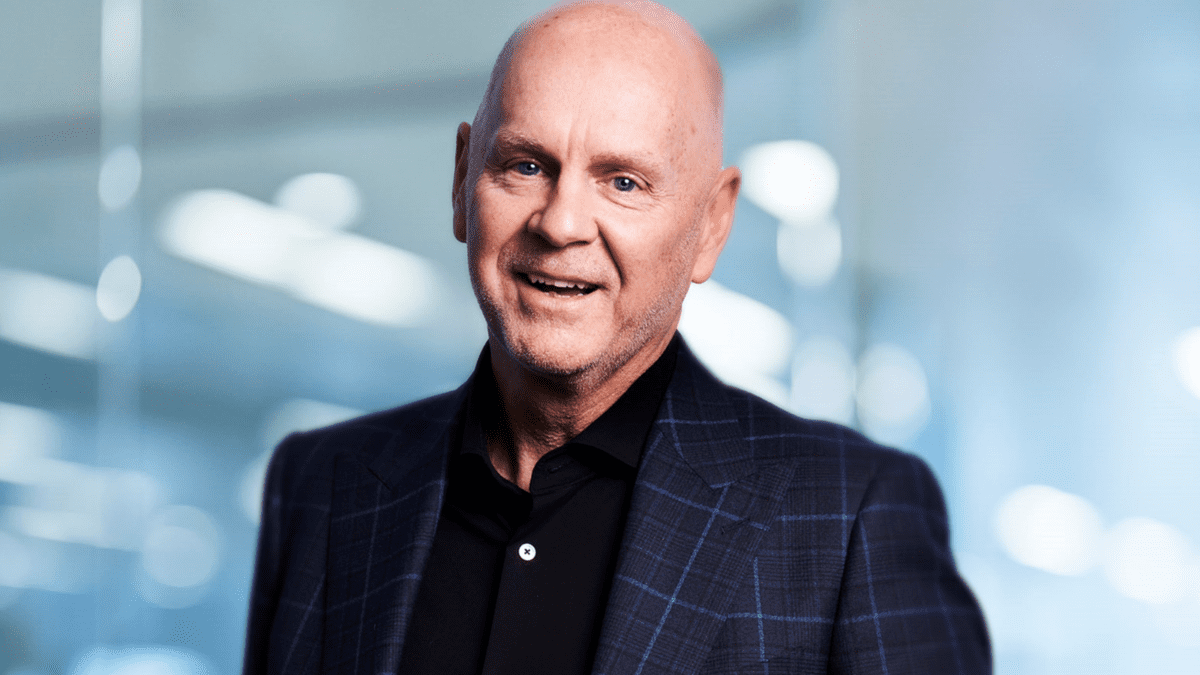

Earlier this week The Principals Community managing director Kon Costas sent a missive to the group’s 127 practice principals advising of an initiative “designed to foster the placement and ultimately, the employment of Financial Planning graduates into our Principals’ Community practices”.

The program will see willing advisers present on the profession to Deakin University students, get involved in network and award events, and ultimately connect with interns and graduates via placement programs.

Speaking to The Inside Adviser, Costas explained how the recent adviser exodus, combined with the current dearth of new advice talent, created a need for advisers to get within reach of the education system.

“Our principals and their members are cognisant that we need to find and develop future advisers from grass roots nowadays,” he says. “So I reached out to Deakin and a couple of other universities to have conversations about how the financial planning programs are running and what the barriers are to getting more talent in.

“We know there’s a significant challenge in the profession,” Costas continues. “There’s such a reduced number of experienced authorised reps out there and not enough grads coming through, so we wanted to find a way to not only promote the profession in universities but then connect grads to advice practices.”

Scaling it up

The Principals Community itself split from traditional home BT when Westpac announced the group would be excised in December last year as part of its retreat from wealth.

Rather than fold the group, Costas transitioned The Principals Community into an independent entity. Instead of leaking members in line with industry contraction, the community has the same numbers it did then – even after several key advice businesses from the group closed down.

The AFSL-holding principal members that make up the community now oversee 1,263 independent advisers, which is about 7.5 per cent of licensed advisers in the country.

It’s this scale that Deakin’s financial planning program director Marc Olynyk was keen to leverage.

Olynyk says a number of practices and even a few licensees have reached out to the university and established “strategic partnerships” designed to promote the profession and connect students to advice practices. But none of them were able to bring such a large cohort of advisers to the table.

“Recently there has been a huge demand for financial planning new entrants,” Olynyk says. “But this is the first time we’ve had a group of independent licensees come to us with the intention of forming a partnership.

“It serves everyone’s interest that we’ve got these groupings that can come to us with one common outlet or goal, rather than individual practices. From our point of view that makes it much easier.”