-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Analysis

-

Asset management

-

Economics

-

Retirement

-

Value proposition

Covid-19 continues to wreak havoc in some parts of Asia, resulting in humanitarian losses that will potentially have a deep and lasting impact on societal values and governance structures. The pandemic has highlighted wide gaps in public health and social security infrastructure that became matters of life and death in some countries. We believe the…

It is an all-too-common occurrence these days that a financial adviser meets a prospective client following a significant inheritance, divorce or in the worst-case death of a partner, with the surviving party having little in the way of financial let alone investment experience. The sheer strength of asset markets in recent years is that almost…

Leading equity manager Martin Currie has suggested the superannuation, advice and wealth management industry may have it all wrong, in its new research piece titled ‘Investing for a sufficient retirement income’. In the paper, chief investment officer Reece Birtles advocates for a “rethink” of the traditional risk-return-dominated approach to portfolio construction, suggesting a “sufficient income…

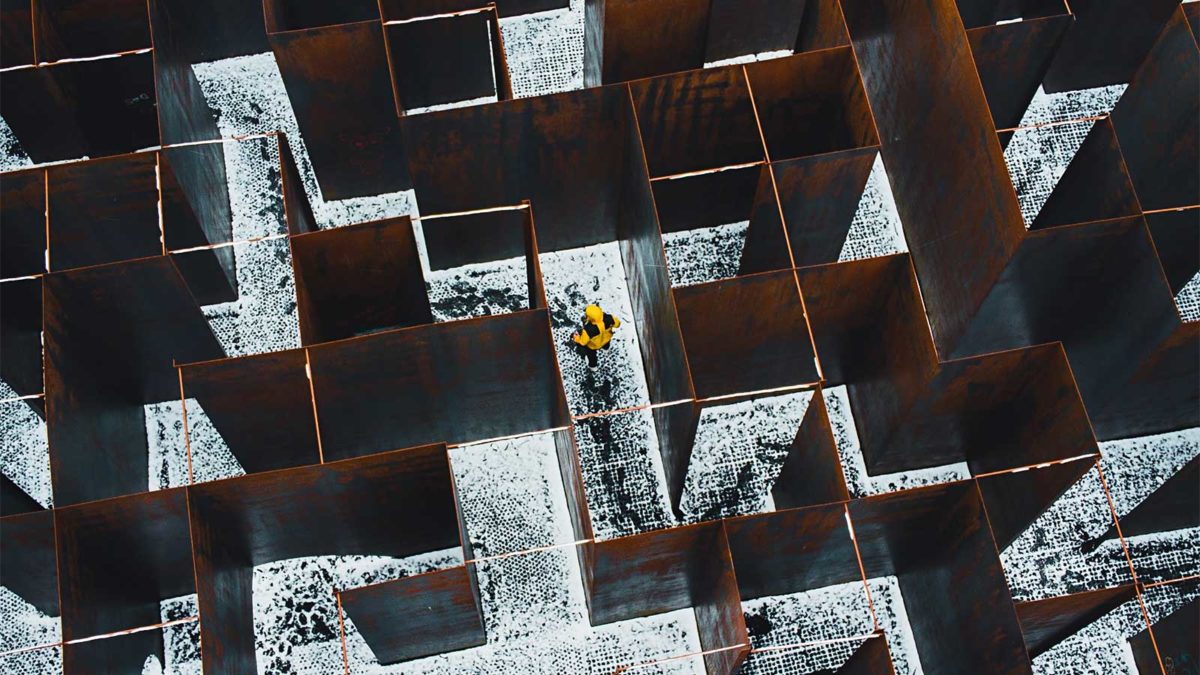

Why make it so hard? Occasionally, maybe even frequently, we come across investment strategies that are unexplored or even unknown. Naturally, the first port of call is a search engine to see what we can learn. Regrettably the outcome is rarely enlightening. Most have a promo picture and vapid words, a list of the team…

Themes and long-term investing go hand in hand with wide divergence between the merits of ETFs and active funds. A recent plethora of appealingly named ETFs hit on the current hot topics. These quantitatively screened funds can only go so far providing appropriate exposures relying on current data rather than what might evolve. They also…

Inflation has been among the most popular terms across news headlines, research reports and economic forecasts. Whilst the loudest voices tend to dominate in the conversation, inflation is far from a certainty but global asset manager Eaton Vance suggest ‘it’s not an unlikely scenario’ and must be considered. Emerging markets bonds have been increasing in…

After an impressive rise in 2020, tech stocks have been hit by selling pressure so far this year. One tech sector that has defied the recent trend is robotics and automation. The ETFS ROBO Global Robotics and Automation ETF (ROBO) is up more than 4.9 per cent in the first five months of the year,…

Everyone is losing their minds over inflation signals that don’t matter. It is hard to pick up a paper or piece of market commentary at the moment that doesn’t point to some piece of ‘evidence’ that inflation is here and roaring. We have been doing a lot of reading recently around the topic in the…

One of the boxes ticked when selecting a fund manager is whether the investment team has its own money in the strategy, or even better, has ownership in the organisation. The logic is self-evident: ‘skin in the game’ should matter. Yet there are, inevitably, drawbacks. The fund’s risk /return appetite may be unduly influenced by…

Magellan Financial Group (ASX: MFG) last week released its long-awaited new retirement product, called FuturePay. The product launch comes at an important time for the investment and superannuation industry in general, which has seen very little innovation or new product releases focused on delivering more sustainable retirement incomes. So, what is Magellan FuturePay? The product…

Inflation has dominated the headlines in May, with one higher-than-anticipated print in the US triggering a broad consensus that the Federal Reserve is wrong, and will be forced to act far quicker than expected. Yet as with most economic “consensus,” it’s important to look beyond the headlines. This is what respected government bond manager Jamieson…

Zenith CEO David Wright has warned that advisers are turning away from alternative assets at a time when they may become more important than ever. Speaking to media on Thursday, Wright voiced concerns that advisers were abandoning alternative assets despite the possibility of “stronger than forecast inflation” and heightened market volatility. “There does appear to…