-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Alternatives

-

Asset Allocation

-

Crypto

-

Defensive assets

-

Equities

-

ESG

-

ETF

-

Fixed Income

-

Growth assets

-

Private debt

-

Private Equity

-

Property

ASX claws back, energy hit, IT takeover rally spreads The ASX 200 (ASX: XJO) spent most of the day clawing back from early losses, ultimately finishing down just 0.2% despite a weak lead from the US market. The story was similar to yesterday with 8 of the 11 sectors down but technology continuing to drive performance, up…

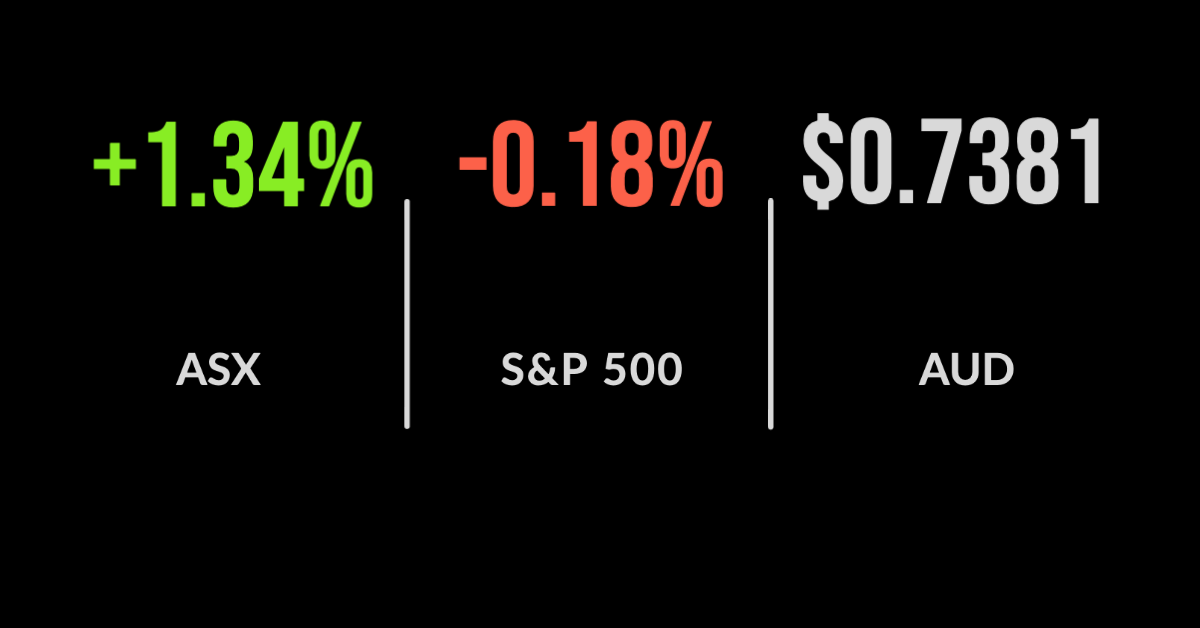

Afterpay powers ASX to record, Santos takes out Oil Search, iron ore tanks The ASX 200 (ASX: XJO) powered to another record close on Monday, jumping 1.3% on what has been dubbed ‘the biggest day in Australian sharemarket history’; the IT sector added 6.5%. Whilst every sector finished the day higher, it wasn’t smooth sailing for materials,…

Growing concerns on China’s corporate bond market defaults have investors worried that it could manifest into something bigger. Bond defaults have been rising since 2017 with corporate debt standing at US$1.3 trillion ($1.7 trillion), which is more than 30% higher than total US corporate debt. While affecting mainly private companies, Beijing has decided to withdraw…

This week saw confirmation that private equity was once again the leading asset class over 2021. According to the Chant West super fund survey, the median private equity return for the financial year was 40%, well ahead of Australian equities and bonds. Yet the illiquid asset class requires investors to lock away capital for as…

Gold has intrigued investors for almost as long as its existence, first as a store of wealth and currency and now as, well, what? Asset consultancy Frontier has taken a look at gold’s worth to professional investors. And it’s not about an inflation hedge. Frontier’s Chris Trevillyan, director of investment strategy, and Nicholas Thomas, senior…

As concerns grow about record-breaking US and Australian equity market valuations, the nascent recovery in Europe is opening opportunities for value seeking investors. That’s the view of ETF Securities, the multibillion-dollar exchange-traded fund issuer and manager. In a recent article, the research team highlighted a number of companies exposed to the recovery theme. The region…

Munro Partners and its chief investment officer, Nick Griffin, seem to have a unique ability to look beyond the day-to-day noise that occurs in financial markets and frame the opportunity for global growth equities in seemingly simple terms. Since starting from scratch at $0 in assets in 2016 the group recently surpassed $1 billion in…

Rough finish to a flat week, materials hit more records, NAB’s buyback The ASX 200 (ASX: XJO) finished 0.3% lower on Friday, ending the week down just 0.02%. Behind the stagnant market was a growing level of divergence between industry performances. Materials and mining continued to power ahead behind record results and all-time highs for Fortescue Metals Group…

Platinum Asset Management delivered its latest quarterly report last week, which was largely a mixed bag of results. Five of the eight funds beat their respective benchmarks, while the remainder missed. Of those that outperformed, the Platinum International Brands Fund, Platinum Global Fund and the Platinum Japan outperformed convincingly. However, one of Platinum’s biggest active…

In conversation with Ticky Fullerton, business editor-at-large for “The Australian,” Magellan co-founder Hamish Douglass said that two major factors loom as catalysts for an “investment day of reckoning”: the potential for the emergence of vaccine-resistant Covid strains (a case strengthened by the delta variant, which has sent Douglass himself into lockdown with the rest of…

How difficult is it to be a successful growth manager in today’s turbulent markets? Let’s hear from Francyne Mu, a portfolio manager of the Franklin Global Growth Fund. Growth stocks have driven global equity markets higher over the past few years, but greater volatility in early 2021 may suggest that growth investors face a more challenging…

Multi-asset manager Ruffer LLP’s Rory McIvor tells the story of when he sat at Ruffer’s Victoria Street office in London, five years ago, across the table from two portfolio managers, when they asked him, “What is a bond?” He ummed and ahh’d. The interviewers gave him the textbook definition which he had failed to provide….