-

Sort By

-

Newest

-

Newest

-

Oldest

A new commodities super-cycle is underway, with price increases starting to resemble the resources boom that took place during the mid-2000s. During this time, the prices for commodities used for steel and energy production i.e. iron ore, coal and natural gas, skyrocketed. Global demand for these commodities rose sharply and so did prices. The increase…

After being awarded Fund Manager of the Year for 2020, you could be forgiven for expecting Pendal to rest on its laurels and cruise into the Christmas break. Yet following a year of turmoil and change the group has flagged a number of enhancements to its growing stable of funds, particularly around ESG and ethical…

Environmental (E), Social (S), and Governance (G) analyses consider a multitude of issues within the E, S, G pillars. For example, MSCI, one of the mainstream ESG data and rating providers, scores companies using ten themes and 37 different factors across E, S, and G categories. However, while these scores can provide useful information about…

Progress on diversity across the whole investment industry has remained disappointingly slow, according to a paper from Willis Towers Watson (WTW), the global investment consulting, funds management, and insurance broking firm. It has decided on direct engagement with fund managers to pick up the pace. In its paper published yesterday (October 26), entitled ‘Diversity in the…

The concept of ESG has been a key driver of fund flows, but most importantly marketing strategies, in recent years. Nearly every fund manager worth their salt has a well-written ESG strategy, outlining its views on the most important issues facing investors, management, and boards. Not to mention the expanding set of “sustainable” and ESG-focused…

The mention of emerging markets (EM) opens up a messy vista of many complex and troublesome issues, not least in China, representing the beating heart of EM. Add in a lack of central bank independence, volatile currencies, unpredictable governments and it is little wonder that EM struggles with a risk/return balance. Through to the end…

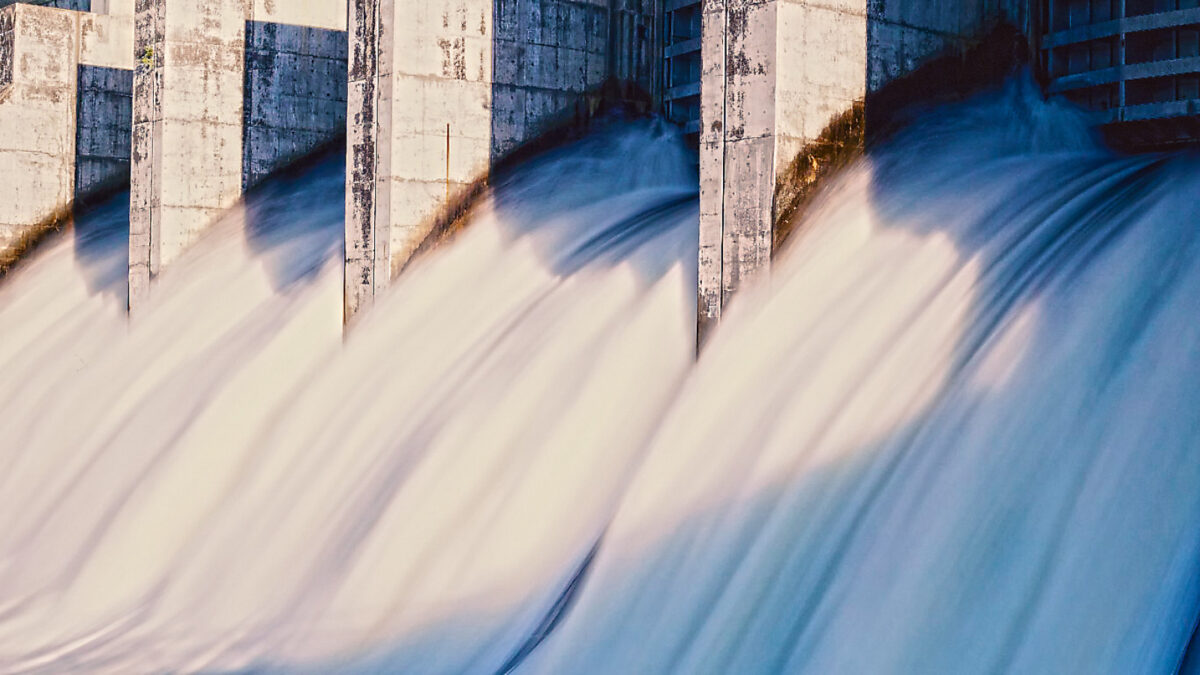

I want to discuss a water utility, which may sound as dull as dishwater – but we global real assets investors have never been averse to safe, predictable, and yes, boring companies. The type of company that pays a dividend that is as dependable as a birthday cheque from Grandma. We have specialist in-house capability…

There are probably few things more certain to glaze the eyes of investors than discussing risk-adjusted returns or efficient frontiers, never mind Sharpe ratios and the like. To be transparent, how many within the industry really focus on these statistics when creating a portfolio? As the momentum shifts away from 60/40 portfolios, the traditional volatility…

Melbourne: ESG (Environmental, Social and Governance) is one of the fastest growing trends ininvesting globally. It has become part of the funds management zeitgeist, aided, in part, by research pointing to betterperformance by fund managers that favour companies with good ESG policies and practices.The recent decision by the Trump administration to restrict the ability of…

Sell off extends to four weeks, tech takes a breather, a win for ESG The ASX 200 (ASX:XJO) fell to a nine-week loss before finishing down 0.8% for the day and 1.1%; making it the fourth straight week of losses. The selling pressure was centred around financials, falling 1.2%, as geopolitical confrontations with China have…

Rio Tinto Ltd (ASX:RIO) today announced that CEO Jean-Sebastian Jacques; head of iron ore, Chris Salisbury; and head of corporate affairs, Simone Niven, will be stepping down from their roles following the Juukan Gorge incident. While someone losing their job should never been seen as a positive, is this the first high-profile ‘win’ for the…

Looking for hidden ESG gems: a new frontier for responsible investing with “improvers” The ongoing Covid-19 crisis is likely to bear long-term consequences on equity investing, reinforcing the ESG vs. traditional non-ESG equity divide, with the former enjoying large structural demand. Such trends emerge from the 2020 fund flows data available thus far, which show…