One of the most powerful, and potentially long-standing, impacts of the pandemic was the so-called democratisation of investing. With over a billion people stuck at home, many of whom were in secure work, or alternatively the beneficiaries of the largest stimulus package in history, a large portion turned to investing to fill the time. At…

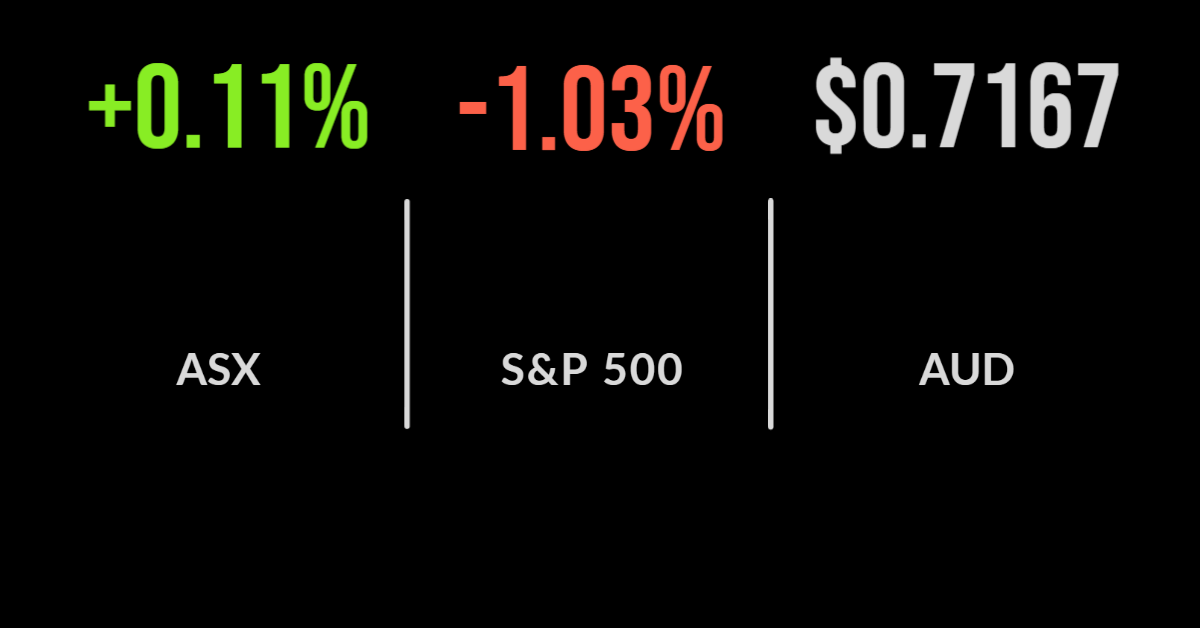

Rates send markets lower, Magellan loses ‘material’ client, gold miners shine The local market benefitted from a strong overseas lead but managed to deliver a gain of just 0.1 per cent on Friday. The technology sector continues to be the largest drag, falling 3.9 per cent for the day and 4.5 per cent for the week, with energy…

Market weaker despite positive lead, unemployment falls, CSL down on acquisition The S&P/ASX200 (ASX: XJO) didn’t follow global markets higher, finishing down 0.4 per cent as CSL (ASX: CSL) dragged both the healthcare sector, down 5.1 per cent and the market lower. The reason was the completion of their capital raising at an 8 per…

The suggestion that investing in a more responsible or sustainable manner detracts, rather than adds to returns has now been debunked, with research proving the gap no longer exists. This message is central to Damian Cottier, Portfolio Manager of the Perennial Better Future Trust, and his mission to deliver strong returns whilst contributing to a…

Given the seeming obsession with the impending inflation outbreak in Australia, and around the world for that matter, one could be excused for thinking this would be among the most-read articles for the year. In fact, it was quite the opposite, with our readership of Australia’s leading financial advisers looking for positivity, not fear. Big-name…

A quiet announcement from one of Australia’s leading industry/union super funds at the beginning of December piqued my interest. The announcement came amid a busy week for investment announcements, with nearly every investor offering up an outlook statement. But this one was much more straightforward and delivered without any fanfare. It was the decision by…

“An Albanese Labor government will properly recognise your experience,” were the words of Labor spokesman Stephen Jones this week when presenting at the Independently Owned Financial Advisers in Australia (AIOFP) conference. The AIOFP has been among the staunchest critics of the massive increase in compliance and regulatory requirements being placed onto the sector, so it…

As the FASEA exam deadline of 1 January 2022 nears, the significant impacts on the financial advice industry continue to garner headlines. According to reports, total adviser numbers have now fallen to below 19,000 with many more set to leave in 2022. Similarly, statistics suggest there are as many as 2 million unadvised clients in…

The Responsible Investment Association of Australasia delivered an early Christmas present for ESG investors and trustees alike, confirming the long-debated question as to whether ‘green’ or ‘responsible’ super funds outperform. The answer was a resounding yes for those funds that are categorised as leaders according to the RIAA’s extensive survey and due diligence process. The…

“Undue complexity”. “Byzantine complexity”. “Elephantine proportions”. These are just a few of the superlatives used to describe one of Australia’s most important pieces of legislation, the Corporations Act 2001. The legislation turned 20 years old this year and whilst it has played an important role in simplifying the financial services landscape, few would disagree with…