Australian investors had some respite on Friday, as volatility disappeared and the S&P/ASX200 gained 2.2% to finish the week. There was little news driving the rebound, aside from perhaps the realisation that whilst rates may rise sooner than expected, they remain fixed near zero. CSL (ASX: CSL) was a major contributor, gaining 3.2% after a difficult week, but it was…

It was an eventful day in global markets, with the US indices initially trading higher after learning that the Federal Reserve were considering increasing the cash rate for the first time in many years in March this year. The market turned quickly, with the selloff in technology accelerating once again. Australia was not immune, with the market…

The last two years have been a near-perfect storm of activity for many financial advisers. The onset of the pandemic placed significant pressure on advisers to respond to client queries at a time of immense stress; many advisers were trying to deal with a flood of new clients as industry numbers dwindled and the big…

“Optimism and opportunity” are the best way to describe the outlook for the Australian equity market in 2022 according to Reece Birtles, of Martin Currie. In his role as chief investment oficer, reading the broader themes is as important as assessing the underlying portfolio companies. As the headlines in the financial press remain fixated on…

While all eyes remain focused squarely on whether inflation is “transitory” or not, “persistent” is the adjective that value manager Allan Gray uses to describe the position of the equity market. Speaking in its monthly update, the firm’s Australian managing director and chief investment officer Simon Mawhinney flagged the “exuberance for some stocks and disdain…

The S&P/ASX200 opened the day reasonably well despite growing negativity in the markets ahead of the Federal Reserve’s impending rate decision. But the release of Australian CPI data reversed that trend with the market trading more than 3 per cent lower but ultimately finished 2.5 per cent or 180 points down. At this point, it is important to keep the…

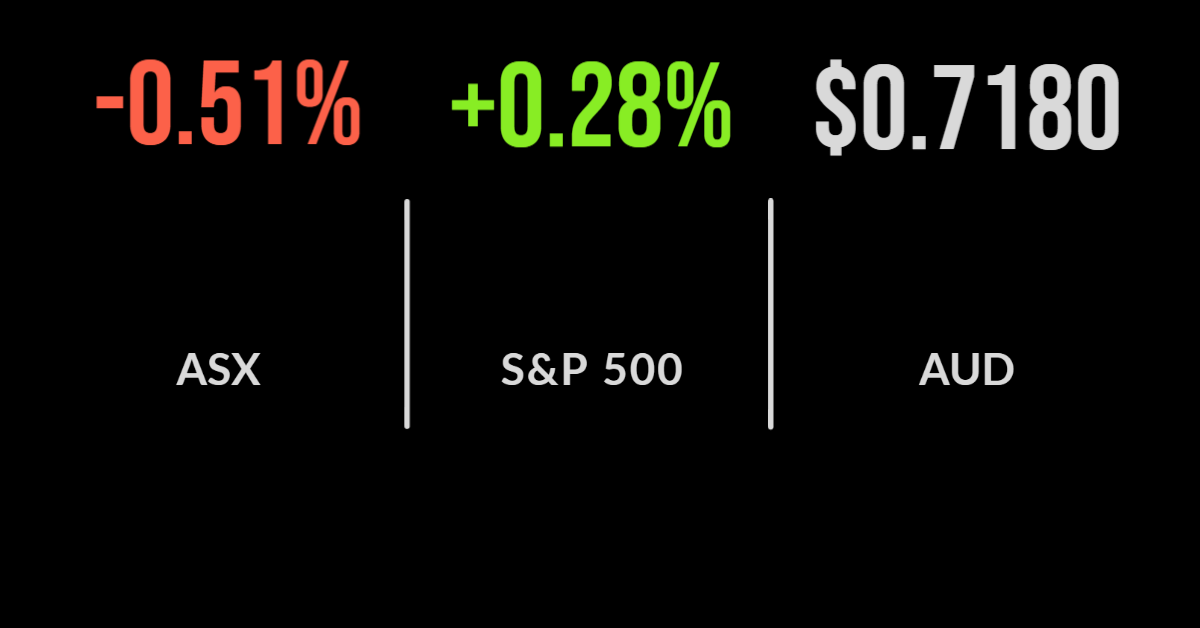

A spate of headlines over the week naturally put pressure on the S&P/ASX200 today, with the index falling 1% at the open but finding support throughout the day to finish down just 0.5%. It was quite a negative day, with the technology, utilities and materials sectors taking the biggest hit, in many cases due to company-specific results. The winners…

“Learning to live with COVID will be the major theme of 2022,” according to Ken Leech, chief investment officer of leading fixed income manager Western Asset. But not necessarily in the way we think. As the Omicron variant ravages Australia and other parts of the developed world, Leech highlights continuing travel restrictions and lower vaccination…

If we are truly honest about the state of the Australian investment industry when it comes to alternatives, we were very much a backwater for many years. That is, at least, at the mass market, retail, or wholesale level. For many years, the best alternative assets advisers could access were the so-called “black boxes” of…

Australian investors ploughed as much as three times more money into equity-focused managed funds in 2021 than they did in 2020. Being the preferred source of investment vehicle for the majority of financial advisory groups and investment platforms, it provides a unique indicator into the sentiment within the advisory market. According to global funds researcher…