A promising February on the Australian ran into a roadblock on Friday, with the benchmark S&P/ASX 200 Index surrendering 71.2 points on the day, or 1.0 per cent, to 7217.3 points. While that was the biggest loss in more than two weeks, the index was still up 1.4% for the week, in its second straight rising week. Ten…

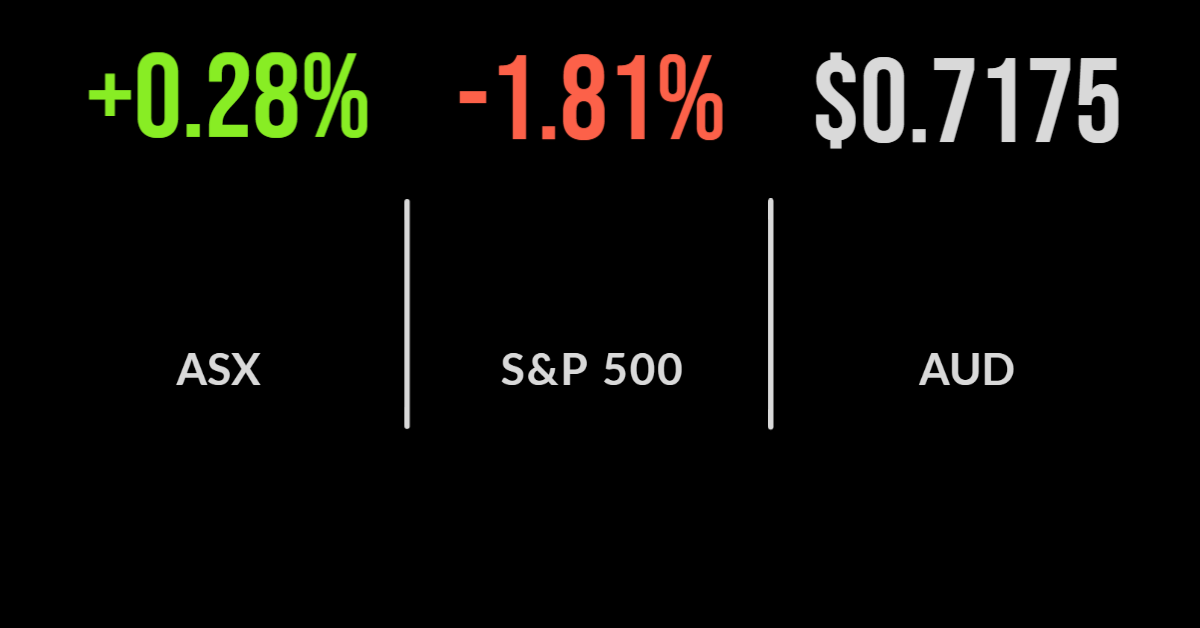

After a bruising 6.4% loss in January, the Australian share market is trying to pick up the pieces, with Thursday being its sixth positive session in eight trading days so far in February, and a third straight gain. The benchmark S&P/ASX 200 index gained 20.2 points, or 0.3 per cent, to 7,288, while the broader All Ordinaries also closed about 0.3 per cent…

Global consulting firm McKinsey recently posed the question “have you ever asked why it is so difficult to get things done in business today – despite seemingly endless meetings and emails?” Apparently Zoom fatigue is a real thing and despite more time being ‘present’ with colleagues, productivity is leaving a lot to be desired. A…

January fund manager returns are beginning to creep in, and it doesn’t look pretty. The Nasdaq finished as much as 9 per cent lower, with the S&P500 and Dow Jones down more than 5 and 3 per cent respectively. The dispersion of fund manager returns continues to grow, with the worst down as much as…

The S&P/ASX200 continued a recent strong run gaining another 1.1% on Wednesday with Commonwealth Bank (ASX: CBA) a key contributor. The financial and technology sector are seeing strong support as earnings season steps up another gear, they gained 2.6 and 4.2% respectively. In an about-face from recent weeks, the energy and material sectors underperformed after BHP (ASX: BHP) fell due to another warning…

The S&P/ASX200 recovered the ground lost on Monday, increasing 1.1% on Tuesday as the iron ore price showed no signs of slowing down. Having oscillated between a new commodity supercycle and a bear market, a resumption of steel production supported a 2.2% jump in the materials sector and 3.7% for BHP Group (ASX: BHP). Every other sector was higher barring technology, which fell…

The S&P/ASX200 managed a solid fightback during the session falling as much as 1% at the open but finishing down just 0.1% for the day. There were only three sectors higher, being energy, materials and technology gaining 1.6, 0.8 and 0.6% respectively, whilst the healthcare and real estate sectors both fell 1.3%. Among the largest drags on the market, today was ANZ Banking Group (ASX: ANZ)…

Leading investment bank JP Morgan recently released its 2022 Global Alternatives Outlook, which seeks to understand the key trends and risks facing investors over the next 12 to 18 months. Since 2020 the “alternative” assets have seen record capital flows, as advisers sought to add further diversification to portfolios and gain access to the advertised…

Speaking ahead of the Federal Reserve’s much anticipated announcement, Paul O’Connor, head of multi-asset at global manager Janus Henderson, highlights that there are many more risks on the horizon than interest rates alone. In terms of the adjustment that markets are making in light of a potentially higher discount rate, “it is far from obvious…

The 40/60, or balanced, portfolio has seen a growing stream of eulogies as “experts” the world over suggest it is broken. The reason, they surmise, is the diversification-based investment approach relying too much on long-duration assets, and the threat of interest rate hikes seeing bond and equity market correlation move to one. While there are…