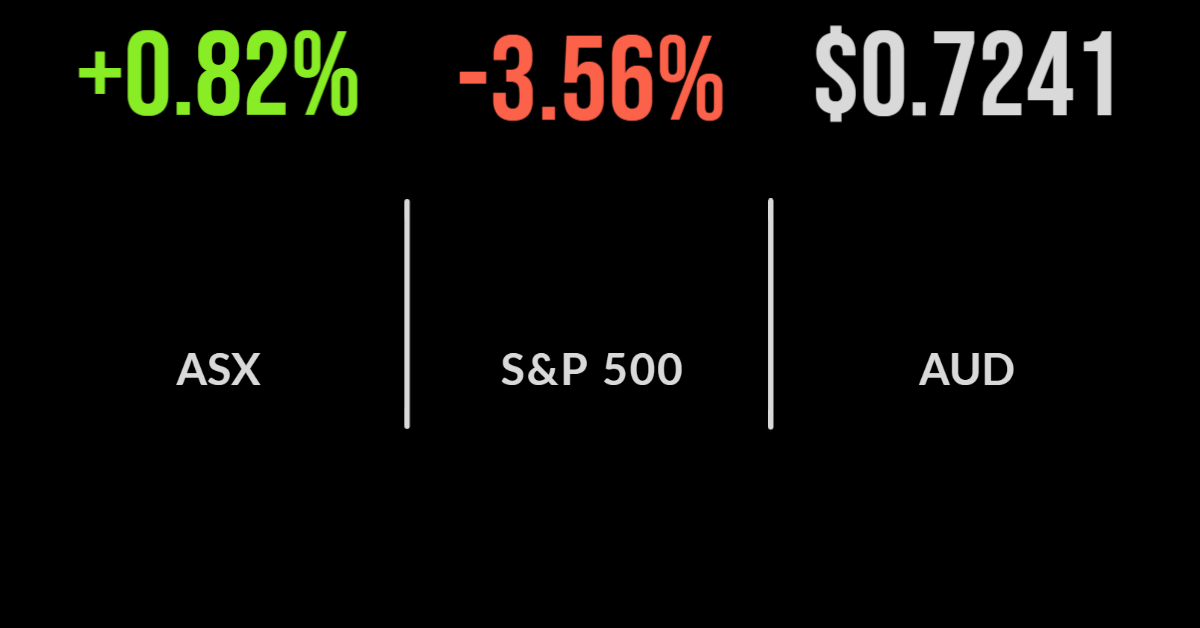

The Australian share market followed Wall Street on Thursday, sharing the American market’s optimism that the Federal Reserve could tame inflation without triggering a recession. The benchmark S&P/ASX 200 index finished Thursday up 60 points, or 0.8 per cent, to 7,364.7, while the broader S&P/All Ordinaries gauge rose 74.4 points, or just under 1 per…

During March, Australia’s sharemarket unexpectedly claimed pole position against the majority of the world’s larger and more developed markets.

The near $1 billion Martin Currie Real Income Fund has been preparing for an outbreak of inflation since 2021, according to Ashton Reid, Portfolio Manager of the domestically focused strategy.

“We are at a critical crossroad, with an aging population, and the “Great Australian Wealth Transfer” at our doorstep” explained Lifespan Financial Planning CEO Eugene Ardino in an open letter to Scott Morrison and Anthony Albanese on the eve of the Federal Election.

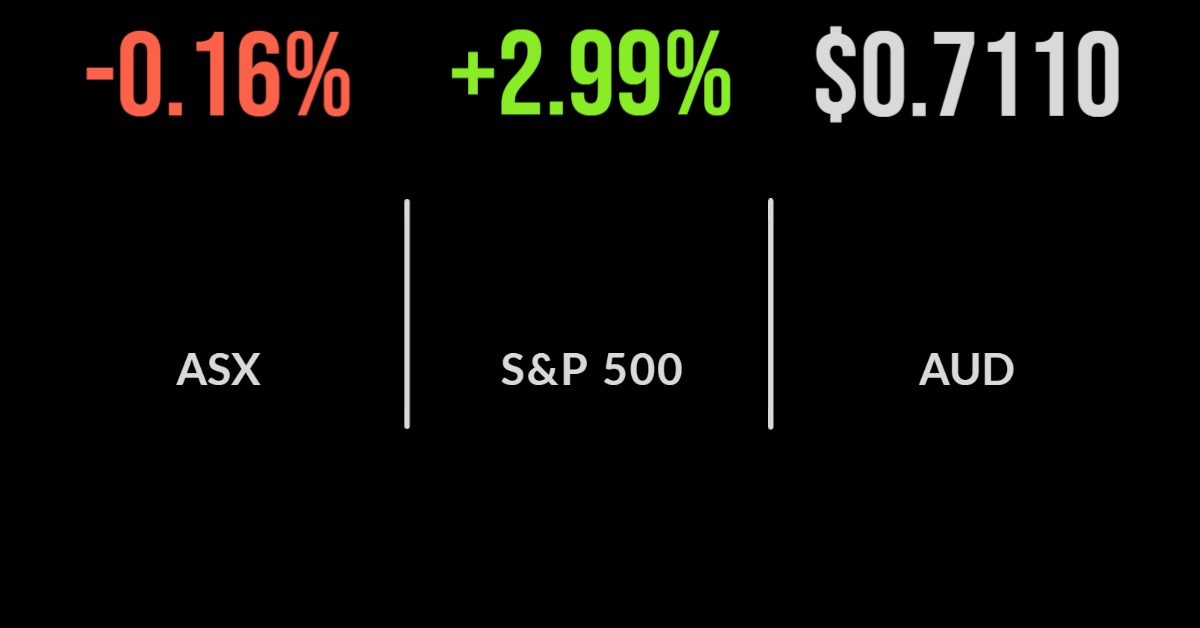

The first day of a new interest-rate environment was a slight downer for the Australian share market, with the benchmark S&P/ASX 200 easing 11.5 points, or 0.2 per cent, to 7304.7 points. The gauge has lost 1.8 per cent this week, to be down 1.9 per cent since the start of the year. The S&P/All…

The first interest rate hike in Australia in 11-and-a-half years took centre stage on the Australian markets yesterday. The Reserve Bank of Australia (RBA) lifted the cash rate by 25 basis points, or 0.25 percentage points, taking it to 0.35 per cent, and signalled that more rate rises were ahead, as the central bank seeks…

From the outset, it is important to highlight that I do not disagree that interest rates should be higher than the current ’emergency’ settings by the Reserve Bank of Australia.

ESG investing and everything that comes with it have grown in both popularity and importance in recent years.

The domestic market continues to outperform our global peers, with the S&P/ASX200 gaining 1.1 per cent on Friday, but still finishing the week 0.5 per cent lower. Every sector was higher, led by technology and communications which gained 2.2 and 1.9 per cent, and nine of the market’s 11 sectors gained more than 1 per…

2022 has been a difficult time for most investors, but for none more so than bond fund managers. The New Year’s resolution of global central banks to (finally) aggressively combat accelerating inflation has seen an incredible surge in bond yields in Australia and around the world. A case in point is the Australian 10 Year…