Ausbil gets active on dividend management with income-seeking investment play

In order to generate the highest dividend income possible, it takes a lot more than simply picking the highest dividend-paying stocks. The challenge facing dividend income funds is to create the ideal fund that effectively increases income without compromising total return.

Ausbil Investment Management’s equity income portfolio manager, Michael Price, spoke at The Inside Network‘s Income & Defensive Assets Symposium where he shared with investors the niche investment style that has helped Ausbil solve this dividend income problem.

According to Price, when it comes to dividend income funds there are three different investment strategies in which income generation is achieved.

“First is through the selection of high income paying stocks. But the challenge is, it’s hard to achieve extra income without affecting total return and risk. The second investment strategy achieves it by giving up share market upside by selling options over the fund. But this also has a drawback; it lowers the total return in the long run,” he said.

Price explained that the only way to effectively increase the dividends in a fund is through a process called active dividend management. This is the third investment strategy.

“It’s a recent approach that Ausbil utilises in its dividend fund. It takes advantage of the fact that not every company pays a dividend on the same day, to get more dividends over the year rather than higher dividends,’ he said.

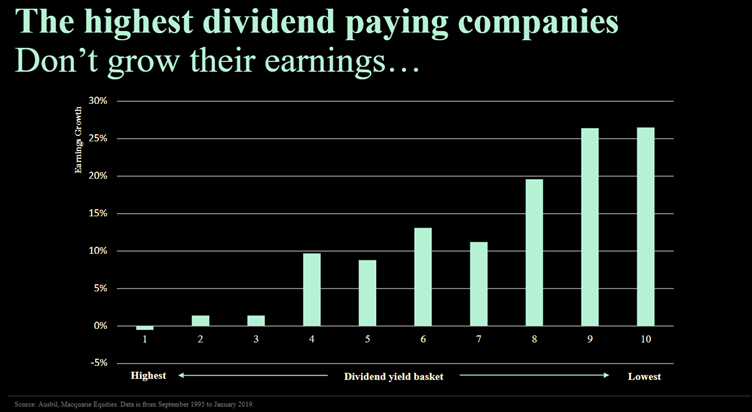

Price conducted thorough quantitative back-testing, where he used 25 years’ worth of ASX data divided into ten baskets, high-yield to low-yield. He looked at the highest dividend paying companies versus earnings growth.

What he found was that the highest dividend paying stocks had little to no earnings growth, and in some cases even negative growth. Non-dividend paying stocks had high earnings growth.

“Trying to get that high level of dividend growth, it’s unlikely you will find earnings growth and hence no share price growth,” he said.

“What’s also interesting is that the most volatile stocks are also the highest dividend paying stocks. The volatility comes in the form of high gearing, distressed earnings, or earnings volatility in paying such a high dividend.”

Price then compared these dividend paying stocks against volatility. What he found was that the highest dividend paying companies didn’t provide the best risk-adjusted return outcomes. He determined that it was ok to receive a little bit in extra dividends, but too much starts affecting other factors. Price concluded that active dividend management was the best approach.

“Not every company pays its dividend on the same day. Eight months a year, substantial dividends are being paid, where at least 10 per cent of dividends are being paid,” he said.

“The aim is to see what companies are about to pay their dividends and tactically go overweight around the payment of those dividends. And reduce weight of the most similar stocks. Increase dividends without increasing risk or removing alpha generating opportunities.”

Price noted that when selecting stocks it can sometimes be within a sector or within a certain commodity. Sometimes it can vary across the sector such as CBA paying out of synch with the other three banks.

According to Price, by going overweight around the payment date of dividends, the portfolio is able to increase dividends without increasing risk or removing alpha generating opportunities.

“Within those eight months of stocks paying dividends, if 10 per cent of the portfolio was placed overweight in those stocks paying dividends then 50 per cent more dividends are received while the remaining 90 per cent of the portfolio is dedicated towards maximising the total return of the fund,” he said.