IPOs and credit – overheated or heating up?

More than a sport, a financial mismatch

There is an awkward, yet in many ways predictable, relationship between investors and the providers of investments. An old-fashioned assessment of demand and supply can be helpful.

If equity market exuberance is high, any listing attracts the heat of attention and can be sold to eager investors hoping it is the next big thing. We are seeing a sliver of this at the moment; Adore Beauty, which landed on the ASX screens last week at a 10% ‘pop,’ is a good example. Yet new equity is generally constrained, putting aside the recapitalisation of existing companies. It can be a costly exercise, requiring mountains of forms, boards, regulation, and reporting. It’s no wonder that the number of companies choosing to list, in the developed world, is ebbing away.

Do we pay attention to which investment bank is involved? Rarely. One assumes that a larger-cap IPO will end up at the international end of town, while smaller-cap issues weight to the local shops. But it would be uncommon to judge the stock on the merits of the promoter.

The inevitable fuss that comes from the publicity of new listings is reflected in the growing number of small-cap managers in the Aussie equity space: everyone wants the next winner. Without a much larger number of IPOs, the number (and size) of fund managers should be more constrained, given a limited pool of great companies.

Private equity steps into the mix. No need for short-termism or loud shareholders: keep it quiet, restructure, and then list, hand the business to another private equity firm as a roll-up, or for another leg in growth. Bingo, the PE investor gets the capital gain (hopefully) and the PE firm gets a fat fee. Private equity has had little trouble in raising funds, arguably substituting for the lack of growth in listed equity and therefore not unreasonable. There are likely endless potential investments for PE, the question is quality.

Here, judgement of the promoter does matter, as it is claimed that good PE operators close funds early and often don’t bother with smaller investors.

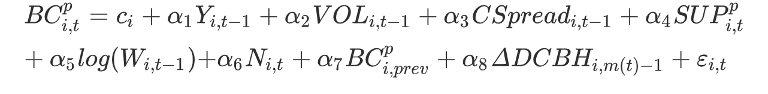

Debt is different. Governments issue new bonds and they trade easily. Yet many carefully follow the data on bid cover while the disparity of buyers means that trades can have dislocations in pricing. It is assumed that bid cover spreads indicate the appetite for an issue. In a recent paper, a study shows that if demand is broad, volatility is low, and primary dealers are engaged, the offer will be well covered. For fun, here is the formula:

Yet this is not always the case. The motivation of bond buyers is diverse. Central banks, sovereign funds, pensions with obligations to hold such assets, trading banks, hedge funds, and a host of others, all have different views. Some are non-economic, others are at the sharp end of trading small spreads regardless of the headline yield. There is no shortage of bonds and buyers, but there are very few that can extract investment returns given low rates.

Credit is again another variation. Providers are morphing as banks change behaviour, large-cap companies don’t need much credit, and lending becomes a direct industry. In parallel to listed equity, the diminishing role of banks is understandable. But the participants in private lending are yet to be properly sorted. The FT reports that 520 asset managers are pitching private credit funds this month, up from 436 at the beginning of the year and the fund size is growing with US$272 billion ($383 billion) looking for a new home. In a structural sense it may be fine, given the changing provider base of debt capital, though the risk of loss is rising as many companies are forced into paying high coupons to source capital.

The fund base in private credit is mixed, with private equity firms, long-term specialists and newbies ranging the plains. More than elsewhere, investors should think carefully about how they assess these providers, given many have a limited history in managing external money and may feel the pull of growing assets at the expense of managing risk. the