Will Taiwan tension derail emerging market allocations?

As investors start to look past the pandemic, the economic cost and scarring from Covid-19 has been significant. The International Monetary Fund (IMF) says “unlike the 2008 crisis, emerging markets and developing economies are expected to suffer more scarring than advanced economies”.

In the same way that the US and Australia were able to provide support by injecting stimulus via a Covid-19 relief package, emerging markets policymakers will more than likely provide similar support to the worst-hit sectors and workers, to limit scarring. As a result, measures to lift investment, reallocate, retrain, and reskill workers will become the primary focus to limit long-term GDP losses.

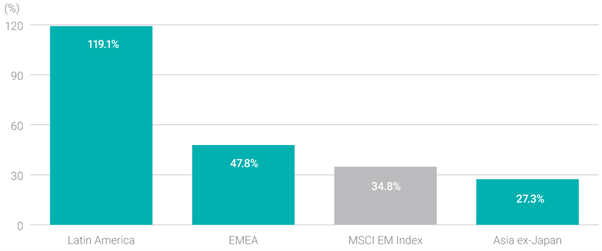

This presents investors a unique opportunity to capture this massive upside potential from a vaccine-led emerging markets cyclical rebound. While risk and volatility will be on the high side, the growth opportunity is huge; especially because this region of the world has a higher population and will experience faster growth compared to the rest of the world. For those that don’t know, the MSCI’s 10 main emerging markets economies are, in alphabetical order: Argentina, Brazil, China, India, Indonesia, Mexico, Poland, South Africa, South Korea and Turkey.

Following those are Egypt, Iran, Nigeria, Pakistan, Russia, Saudi Arabia, Taiwan, and Thailand. Three Asian countries – China, Taiwan and South Korea – make up the bulk of the MSCI EM index, roughly two-thirds. All three are closely linked and have weathered the pandemic extremely well. Taiwan having one of lowest incidence of Covid cases in the world.

The outlook for the remainder of 2021-2022 is positive with the vaccine rollout accelerating, led by the World Health Organization (WHO) and the GAVI Alliance. Many consider emerging markets on the cheaper side, despite the MSCI Emerging Markets Index returning similar numbers to the S&P 500 Index in 2020.

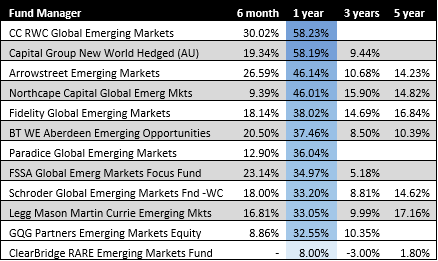

So, it is only natural that many investors have been jumping on the emerging markets bandwagon hoping to enjoy the ride ahead. Here are some of the best performing Emerging Market equity strategies over the last 12-months:

Interestingly, the source of growth for many emerging market funds came from just a few sectors – infrastructure, information technology and semiconductor producers.

According to Russell Investments, “The cyclically-adjusted price-earnings ratio (which “normalises” earnings to “average” levels) stands at 10.5 times for EM. The developed market equivalent is over 20 times.”

When selecting an emerging market fund, it’s not enough to rely on previous performance. In most cases where an obscure fund manager has returned an abnormally high yearly return, you know what they say, “past performance is no guarantee of future results.” Investors need to look for funds that cover trends within EM that look set to continue. COVID-19 has disrupted the daily lives of billions of people but at the same time it accelerated the move to digital. Here are some trends to look for:

- Online from Offline – Companies that have made the transition to digital will benefit.

- R&D and innovation: Investment spend for areas in high-growth disruption such as AI driving technology, healthcare, or e-commerce etc.

- Ongoing industry consolidation: Small firms are priced out or unable to transition. The stronger players in turn grow via acquisition.

- Supply-chain shifts: Move to reduce Chinese trade dependence and to redirect to South East Asia.

And so, we focus on three of the most popular emerging markets strategies to take a temperature check on the sector.

The Fidelity Global Emerging Markets fund returned 38% over the year, making it the eighth-best fund in the emerging market universe we reviewed. The other four funds were CC RWC Global Emerging Markets, which returned 56.7%; Northcape Capital Global Emerging Markets, which returned 50.5%; Macquarie Arrowstreet Emerging Markets, which returned 50.4%; and Aberdeen Standard Emerging Opportunities, which returned 42.1%. A short summary on each follows:

- CC RWC Global Emerging Markets (CHN8850AU) – Seeks out growing companies in emerging and frontier markets globally with a focus on those with strong and sustainable cash flow.

- Fidelity Global Emerging Markets (FID0031AU) – Was led by Alex Duff, but Fidelity announced that the fund would be taken over by Amit Goel and Punam Sharma from 28 May, 2021.

- Schroder Global Emerging Markets Fund (SCH0034AU)- Selects sustainable companies in Emerging Markets on the basis of both attractive valuations and business quality.

- Legg Mason Martin Currie Emerging Markets – A high-conviction portfolio of the best emerging market companies where the investment team believes long-term growth prospects are not yet reflected in their stock prices.

- GQG Partners Emerging Markets Equity (ETL4207AU) – Seeks long term capital appreciation by investing directly or indirectly in equity securities and equity-linked securities anywhere in the world that GQG Partners believes can sustain long-term earnings growth and are available at a reasonable price.

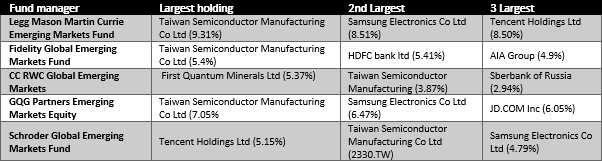

Going through each of the above funds in finer detail, we found a common factor hiding behind all the flashy marketing and descriptive words. Looking at the table below you will notice the same companies or similar companies in the top three holdings.

Taiwan Semiconductor Manufacturing (Taiwan) was listed as the top stock in 83% of Emerging Markets portfolios. Following that stocks such as Tencent (China) and Samsung Electronics (South Korea) were also listed as top picks.

The worst semiconductor drought in half a century is underway. Taiwan manufactures more than 63% of the world’s supply via two companies Taiwan Semiconductor Manufacturing Co (TSMC) and UMC. The remainder is made by South Korea (Samsung) and various others. China is playing catch-up. TSMC dominates the entire market, especially at the high end, and is very profitable.

Depending on your view the concentration in a single stock may be seen as a positive, given its strong market position; or signs of a crowded trade, particular with the China-Taiwan relationship under increasing pressure. Only time will tell.