Wealth management platform space is ripe for tech disruption

The shift towards non-aligned platform advice forced structural change within wealth management in a way never seen before. Findings from the Banking Royal Commission helped drive the push towards independent platforms and product providers with a renewed client focus.

New technology-based platforms have given financial advisers the ability to hold, transact and administer on a much larger product range across new and unique asset classes that solely benefit the underlying client, with no red tape and fewer limitations. It has also triggered a movement of advisers and clients to move away from the old banking platforms. With the onset of COVID-19 and the lockdowns that followed, wealth management transitioned again, this time due to digitisation and technology adoption across the industry throughout the pandemic.

Following the rise of three innovative platforms, the wealth space has become highly competitive, with the trio having disrupted the status quo and leap-frogged ahead. They are:

- HUB24: $43 billion in funds under administration (FUA)

- Netwealth: $38.8 billion in FUA

- Praemium: $34.3 billion in FUA

While such radical change was long overdue, it raises the question – Has the change been beneficial to the client?

While platforms can be commended for leading the push away from a vertically integrated product model, there remain real questions about whether they can provide an end-to-end product suite for both advisers and clients.

An editorial written by IFA late last year, titled “lack of investment choice sees advisers shun platform,” said it all in the title. There is no one platform capable of providing a client with a full suite of investment products. For example, 59% of advisers were administering a portion of their clients’ assets off-platform. Popular with high-net-worth clients, off-platform products are maintained and administered by very few: Powerwrap and to a lesser extent Netwealth are the only platforms with the capability to do so. No other platform has such an extensive off-platform product suite. Here are the top reasons advisers shunned a particular platform:

- Certain asset classes were not available on the platform – such as off-platform or alternatives

- The top reasons for not using a platform for certain investments is because fees charged by the platforms were too high

- Clients refusing to move to a new platform or wanting to retain an element of control in their investments

The other surprising fact is that advisers do not manage all their client’s assets on-platform. This includes term deposits, direct shares, ETFs, private equity and alternative funds or direct property.

Platforms took twice as long and found it difficult to collate and manage off-platform administration.

Another drawback to the platform world is their effectiveness. Each wealth management platform has its own rules, its own way of doing things and its own product suite. Of course, none of the platforms talk to each other, which means a client is limited to the product suite to which their adviser has signed-up.

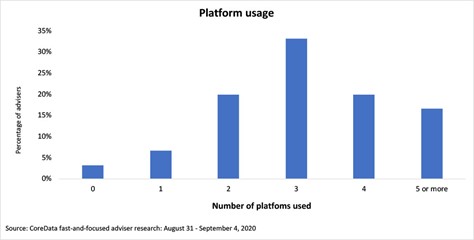

Late last year, CoreData released a “fast-and-focused” survey that found that one in five advisers use two platforms and one in five advisers use four platforms; not exactly a vote of confidence.

Another research report by Investment Trends found on average the number of platforms used by advisers had increased to 2.6-3.0, the highest level in three years. Each adviser has a staggering three platforms on average across which its client base is spread: that’s three platforms just to manage client holdings, administration and reporting. For an adviser, this is a royal pain in the backside. There is also a clear disparity between the platform an adviser will use most, and platforms an adviser would prefer to use. CoreData Research suggests the platform decision may not even be the adviser’s choice. Advisers need to satisfy clients’ best interests, so in most cases, the choice is made by the clients, and it snowballs from there.

How a platform SHOULD be:

An adviser should use ONE platform that can deliver to all client segments, catering for all forms of managed accounts and investments, including custodial and non-custodial assets.

According to IFA.com.au, UK-based advice technology provider intelliflo believes “Australia’s advice market will “echo” the UK market and enter a period of sustained growth, albeit at an accelerated pace” given the level of technology adoption Australia has seen across the industry during COVID-19.” It seems the UK wealth management space is very similar to ours, that is, a few years ahead. The difference being UK advisers seem to operate in an “open and integrated” platform space. What that means is that an adviser can operate on one platform where there is the choice to invest in other funds offered by any competitor to the platform.

Hypothetically, if there were such a platform, it would give an adviser access to every platform, i.e. Netwealth, HUB24, Praemium, BT, MLC etc and their entire product suite, bank or non-bank, off-platform or alternative – think of it as similar to a Webjet of the travel world. There would be no more switching between three platforms, paying three separate fees, moving clients back and forth, and no more tedious time-wasting. In effect, it would be one platform to rule them all; or more specifically, one platform built using real “open architecture” that talks to them all.

While Australia’s wealth management space is midway through a transition from a vertically integrated bank world to a non-aligned platform space, we think COVID-19 may have brought forward the next disruption. The millennials of tomorrow that are saving and investing, are already creating wealth. By 2030, they are expected to control more than US$20 trillion ($$26 trillion) of assets globally.

A massive wealth transfer will take place soon, and that means assets will change hands. Millennials won’t hesitate to dump a platform that cannot offer what they want. This cohort is looking to access a wider range of alternative and socially-responsible investments through an omni-channel, tech-assisted platform; one that delivers personalised advice and considers their life goals; one that has access to socially-responsible investing and will sacrifice returns for social benefits; a platform that doesn’t charge feesm because millennials are not interested in paying high fees for a middleman service. An article on website intheblack.com says “PwC suggests wealth management firms can survive only if they speed-up the adoption of digital infrastructure that integrates the back office and how they service clients; harness the potential of digital technologies and data to better realise efficiencies and manage costs; and partner with fintech innovators to quickly deliver technological solutions.”

Over the next five years these changes, and their impact, will be widely felt. Unless the platforms of today collaborate and start to talk with one another and with the upcoming fintech start-ups, the platforms of today face a tough journey ahead.