-

Sort By

-

Newest

-

Newest

-

Oldest

China is far and away the world’s largest carbon dioxide emitter, accounting for close to 30% of global carbon emissions, according to the International Energy Agency (IEA) – double the 15% for the US and 9% for the European Union. Robeco’s Jie Lu has released a detailed research report which takes a thorough look at…

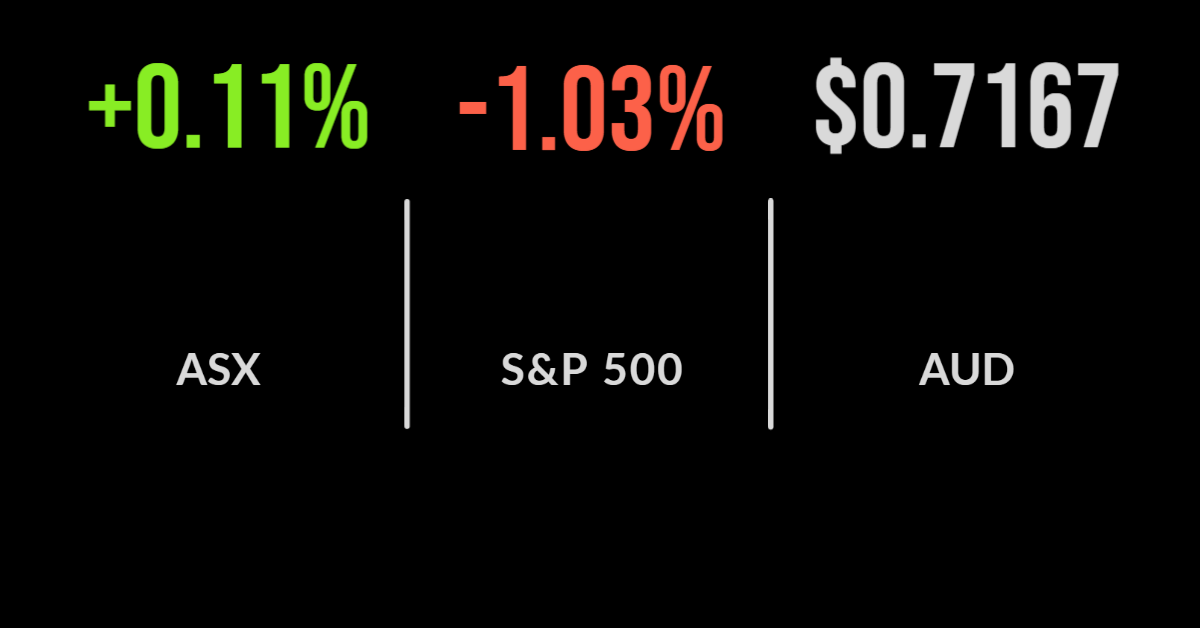

Rates send markets lower, Magellan loses ‘material’ client, gold miners shine The local market benefitted from a strong overseas lead but managed to deliver a gain of just 0.1 per cent on Friday. The technology sector continues to be the largest drag, falling 3.9 per cent for the day and 4.5 per cent for the week, with energy…

Market weaker despite positive lead, unemployment falls, CSL down on acquisition The S&P/ASX200 (ASX: XJO) didn’t follow global markets higher, finishing down 0.4 per cent as CSL (ASX: CSL) dragged both the healthcare sector, down 5.1 per cent and the market lower. The reason was the completion of their capital raising at an 8 per…

The second half of 2021 has produced a mixed bag of results for global growth equity funds. A mass rotation away from China and high bond rates impacting valuations saw global growth funds skewed towards Asia and US tech, underperform. Those tilted towards the US more generally outperformed. Looking at the Hyperion Global Growth Fund,…

Given the seeming obsession with the impending inflation outbreak in Australia, and around the world for that matter, one could be excused for thinking this would be among the most-read articles for the year. In fact, it was quite the opposite, with our readership of Australia’s leading financial advisers looking for positivity, not fear. Big-name…

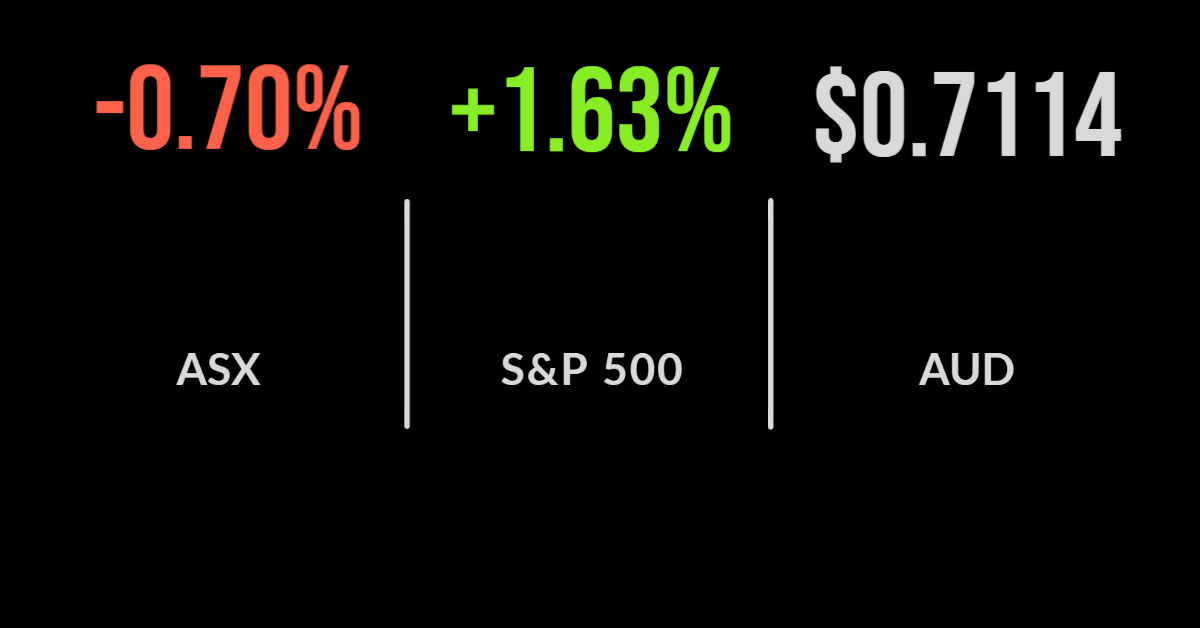

Tech pulls market lower, deals galore across travel, property sectors The technology sector once again dragged the market lower, falling 2.6 per cent and pulling the market down 0.7 per cent along with it. The biggest detractors were Afterpay (ASX: APT) and Zip Co (ASX: Z1P) which fell 3.1 and 6.9 per cent respectively as the flood out of high…

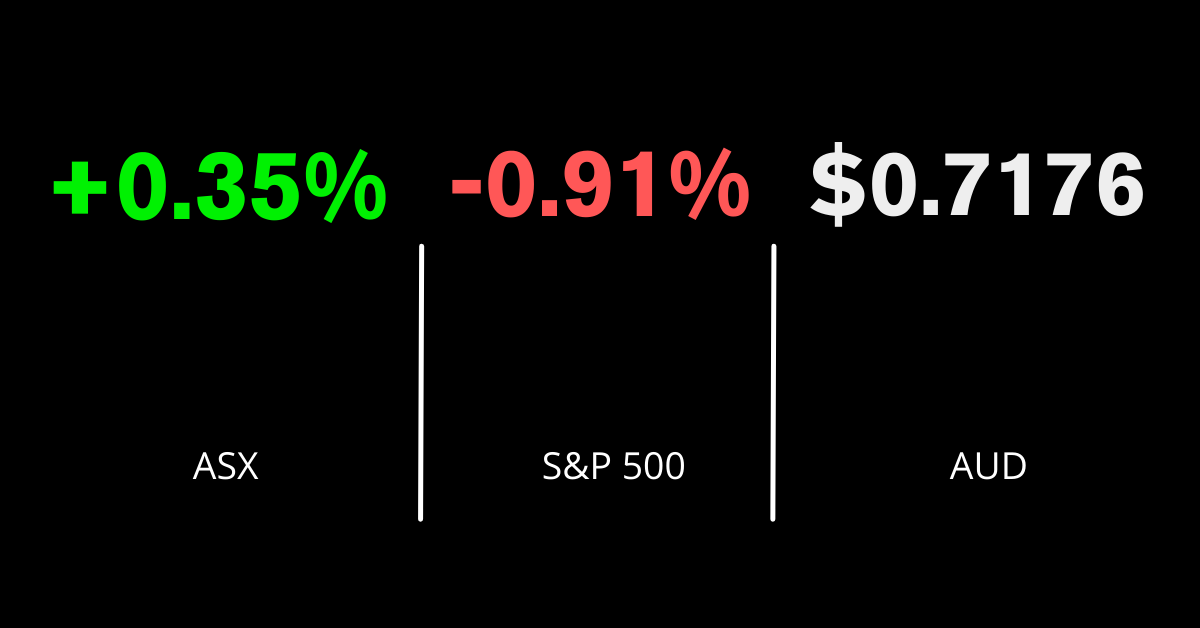

ASX gains on materials, real estate sector upgrades, Ramsay goes back to basics The S&P/ASX200 (ASX: XJO) managed another strong opening, gaining 0.4 per cent on Monday, ahead of the summer holiday slowdown that typically occurs. The energy, mining and real estate sectors were the biggest contributors to the rally with Charter Hall (ASX: CHC) gaining 5.6 per cent, BHP (ASX: BHP) 2.7 per…

Melbourne-based global equity manager, Bell Asset Management, best known for its small and mid-cap equity strategies, has a launched a new ‘sustainable’ equity strategy. The Bell Global Sustainable Fund will add to the firm’s growing suite of products and offer another option for diversification, as a number of leading equity managers continue to underperform. With…

As we enter a post-Covid world, interest rates remain at all-time lows with seemingly no immediate respite. To compound matters, the Reserve Bank of Australia (RBA) has given “a very low probability” to the current surge in inflation triggering an early increase in official rates. Inflation has risen somewhat, but in underlying terms the rate…

A quiet announcement from one of Australia’s leading industry/union super funds at the beginning of December piqued my interest. The announcement came amid a busy week for investment announcements, with nearly every investor offering up an outlook statement. But this one was much more straightforward and delivered without any fanfare. It was the decision by…