-

Sort By

-

Newest

-

Newest

-

Oldest

While the buzz surrounding its introduction just over ten years ago has abated, an increasing body of research is building on the value of robo-advice. A new paper shows the benefits can be wide-reaching. More than a marketing tool for index managers or various asset allocators and other agents, robo-advice, when properly constructed with a…

Dip buyers emerge, ASX moves higher, EML Payments enters trading halt, Nuix continues to fall The ASX200 (ASX:XJO) fell throughout the day despite a positive open, finishing 0.1% higher as dip buyers emerged following last week’s unexpected sell-off. The IT and energy sectors were the stories of the day, with the former returning to normal heading 1.2% higher…

The shift towards non-aligned platform advice forced structural change within the wealth management that was long overdue. Findings from the Royal Banking Commission helped drive the push towards independent platforms and product providers because of their renewed client focus. New technology-based platforms have allowed financial advisers the ability to hold, transact and administer on a…

A rare losing week for markets, Tyro (ASX:TYR) takes a hit, Afterpay (ASX:APT) overtakes Telstra (ASX:TLS) The ASX200 (ASX:XJO) finished flat on Friday, sending the index to its first negative week in over a month, down 0.6%. Afterpay Ltd (ASX:APT) was once again the standout, moving 10.0% higher and overtaking Telstra Corporation (ASX:TLS) as it moved to a market capitalisation…

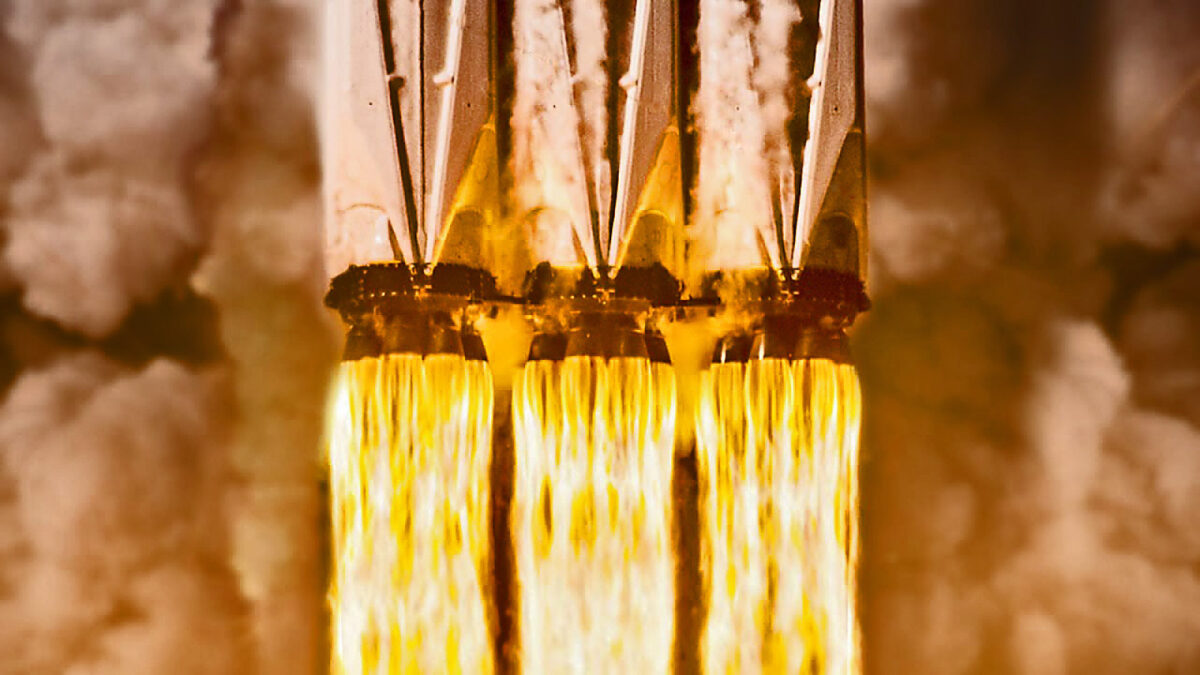

WLTH is a brand-new financial services neo-platform providing Australians with a smarter, sustainability-focused solution to financial products but particular residential and commercial loans. WLTH is the latest ‘non-bank’ digital lending and payments platform seeking to disrupt the financial services industry in Australia. The launch follows the recent shutdown of neo-bank Xinja after it failed to…

The recent surge in the market value of Bitcoin (BTC) has made headlines this holiday season as the underlying structure of the market continues to attract more institutional investors. Recent announcements from global leading fund managers, corporations and insurance companies have highlighted a seismic shift in an investor base focused on Bitcoin’s value proposition of…

The Banking Royal Commission was a watershed moment for the financial advising industry, and almost two years on, has there been change? In one word, yes. Too much change. So much change, that Australian Securities and Investments Commission (ASIC) and the Morrison government, along with a long list of industry leaders are all saying that…

This week we interviewed Co-founder and Co-CEO Orni Daniel from Gefen Technologies, an Israeli-based digital distribution platform that has been initially aimed at Australia’s insurance market. The company is looking at an ASX listing towards the end of the year. After speaking with Daniel, it was immediately apparent that Gefen Technologies has built what looks…

Another fintech is heading for the ASX screens, with online mortgage provider Lendi poised to push “go” on an initial public offering (IPO) that could see it list at a market capitalisation of between $500 million-$550 million. Lendi specialises in the home loan market: its software platform matches borrowers with more than 35 lenders. The…