Smart income derivative equity funds gain ascendancy during volatility cycle

In an economic environment, characterised by fluctuating global inflation and interest rate uncertainty, derivative equity income funds are an option for investors seeking regular income, downside protection and capital growth.

Derivative income equity funds tend to primarily invest in dividend-paying stocks, while utilising a variety of financial instruments and derivatives to manage downside risk and hedge against capital market drawdowns. Here are some of the key derivatives and instruments used:

Futures contracts: Used to hedge against market movements and manage risk exposure. They can lock in prices for future transactions, providing more predictable outcomes.

Swaps: Equity swaps allow derivative equity income funds to exchange cash flows based on the performance of equity indices or individual stocks, providing another layer of income or hedging.

Covered calls: Writing covered calls involves selling call options on stocks that the fund owns. This generates premium income, which enhances the overall yield of the fund. If the stock price remains below the strike price, the fund keeps the premium without selling the stock.

Put options: Buying put options provides downside protection by allowing the fund to sell the stock at a predetermined price, thereby limiting losses if the stock price falls.

Convertible bonds: These are bonds that can be converted into a predetermined number of shares of the issuing company’s stock. They provide regular interest income and the potential for capital appreciation if the stock performs well.

Convertible preferred shares: Like convertible bonds, these shares provide fixed dividends and the option to convert into common stock, combining income with potential equity upside.

Preferred shares: These shares have a fixed dividend and are senior to common stock in the event of liquidation. They provide a higher yield than common stocks and have priority over them in dividend payments.

Managing a derivative equity income portfolio involves several complex challenges. Firstly, market volatility can significantly impact the value of derivatives, requiring precise timing and strategies to mitigate losses. Ensuring the sustainability of income generated from derivatives, such as options premiums, can be difficult during periods of market instability.

The sensitivity of derivatives to interest rate changes and their potential to amplify losses if the market moves unfavourably adds another layer of risk. Managing sector concentration risks and regulatory changes is also crucial, as these can affect the underlying assets from which derivatives derive their value. Secondly, the use of leverage in derivatives can enhance returns but also magnify losses, making risk management paramount. Liquidity management is critical, as derivatives can be less liquid than their underlying assets, leading to challenges in executing trades without significant price impacts.

Finally, understanding and managing the tax implications of derivative transactions, which can be complex and vary by jurisdiction, requiring specialised knowledge and expertise. These challenges necessitate a strategic, well-informed approach to effectively manage and mitigate risks while aiming to deliver consistent income to investors.

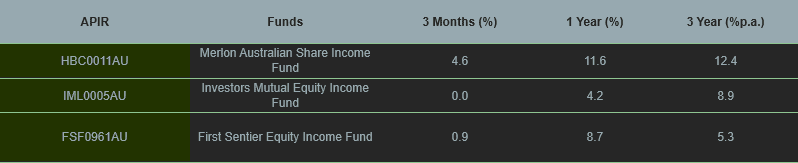

From the Atchison APL there were 22 funds assessed under the Derivative equity income category, with the average 3-year return as at 30 April 2024, being 6.2 per cent while the average 1 year return was 7.3 per cent.

Merlon Australian Share Income Fund

The Merlon Australian Share Income Fund aims to provide above-market sustainable income through a diversified portfolio of Australian equities. The fund emphasises capital preservation and uses derivatives, such as options to manage market exposure and reduce risk while retaining dividends and franking credits. The fund’s integrated ESG approach ensures that governance, social and environmental factors are deeply considered in investment decisions. Most recently the top ten holdings includes: a2 milk co, QBE insurance group, ASX and Woolworths group.

Investors Mutual Equity Income Fund

The fund focuses on providing a high-income stream with lower volatility. It invests in quality Australian shares and employs an options strategy to generate additional income. It is designed to offer a smoother return profile and some capital growth over time. The fund uses equity options to enhance income and manage risk, recently capitalising on market volatility to write options on holdings. Some recent key contributors were National Australia Bank, Telstra, BHP and CSL.

First Sentier Equity Income Fund

The fund’s strategy is founded on the belief that maximizing income from Australian shares involves investing in companies capable of long-term earnings growth, thereby increasing their dividend stream. Income is generated from multiple sources, including dividends, franking credits, and capital returns from Australian shares, alongside income from equity options.

Investment opportunities are identified through comprehensive fundamental research of all companies within the investible universe, irrespective of their dividend yield. The integration of equity options with Australian shares aims to enhance the proportion of total return delivered as income while reducing return volatility. As at 30 April 2024, some top holdings were: ResMed, National Australia Bank, James Hardie and BHP Group.