Quality rules the value vs. growth debate

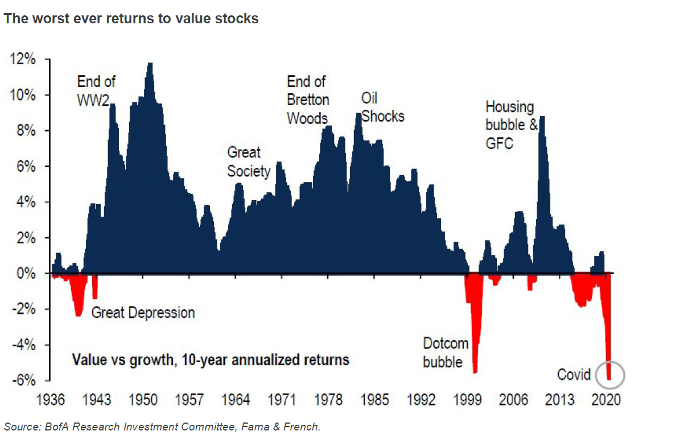

It’s the age-old battle, “value” versus “growth,” that seems to still polarise market participants and populate columns of the financial press. It has been a while since “value investing” made sense. The style has suffered a dreadful stretch of performance since the 2008 financial crisis. The Warren Buffett style of buying low (cheap) and selling high has seen value firms underperform the market year after year for over a decade.

But according to DNR Capital value investing isn’t dead. Its view is that “the history of the stock market is punctuated with periods where both styles have been in and out of favour.” Value investing simply is not in favour right now.

DNR has released a detailed whitepaper titled “Qualifying Value and Growth,” where it goes through each investment style.

Value Investing

DNR Capital agrees that “there is no consensus on what defines value or growth, but a range of generally accepted metrics are applied by analysts, asset allocators and index providers.” In simple terms, a security trading at a “discount to its underlying worth today, is regarded as value. Growth stocks offer earnings (or revenue) profiles growing materially above Gross Domestic Product (GDP), and generally trade on higher multiples than value peers.” DNR has identified a non-exhaustive list of categories under which value stocks can be categorised:

- ‘Vanilla’ value – Stocks are generally out of favour with the market. Underlying business model is intact, but earnings growth is negative, and the stock is unable to garner investor interest.

- Deep value – Stocks trading at significant discounts to the market and their perceived value.

- Value traps – Draw investors in with large perceived discounts to intrinsic or asset value, but the business models are challenged.

- ‘Cigar butts’ – Stocks at the extreme end of value: companies with limited prospects trading at such steep discounts to underlying asset value, one final “puff” of value can (hopefully) be extracted.

Growth Investing

DNR Capital says growth stocks “offer revenue or earnings growth materially above GDP, with opportunities to deploy capital into projects or products that will generate greater value in the future.”

Buying a company with the potential for future growth today generally results in higher near-term valuation multiples. As with value, DNR has listed growth stocks into a few categories, according to their differing risk profiles:

- Early–stage growth – Stocks are immature businesses, utilising all cash flows to iteratively invest in product, sales and marketing, and R&D to achieve scale.

- Cyclical growth – Stocks are more acutely exposed to business cycles, like “big-box” retail today.

- Structural growth – Stocks participate in economic shifts or industry-level disruption, offering growth opportunities as new products, services, or business models are developed.

- Defensive growth – Stocks benefit from growing industries with lower exposure to business cycles.

What is DNR Capital’s approach in this environment?

DNR Capital has taken a “focus on quality” approach. The asset manager says that “positioning specifically for growth or value characteristics does not yield the best outcomes over the long term,” and instead to focus on quality.

DNR focuses on the intersection of both styles or more commonly known as ‘quality at a reasonable price’. This means identifying “quality businesses that are mispriced” – “quality” companies being those that have the following five attributes;

1. Earnings strength (particularly improving returns).

2. Superior industry position.

3. Sound balance sheet.

4. Strong management.

5. Low ESG risk.

DNR Capital seeks to exploit opportunities present when quality businesses are mispriced. There are three opportunities it seeks to identify:

- Improving quality not yet recognised by the market.

- De-rated quality where a security might be devalued on concern of deteriorating quality.

- Undervalued long-term opportunity that arises from a quality business’s ability to reinvest its capital.

The current economic environment has produced an environment supportive for growth investing due to factors such as falling interest rates disruption and scarcity. But where are we now?

DNR says “exceptionally high-quality stocks are uncommon” and “both value and growth styles have their time in the sun.” Which doesn’t give investors much comfort when searching for the magic solution. And that is because there simply isn’t one.

In the end, DNR concludes that in an environment of extremes, the only solution is to fall back on its “process and philosophy of balance, without an over-arching anchor to value or growth, but always with a strong bias towards quality.”