Managed accounts deliver amid flood of capital

In the wake of a disastrous pandemic that brought the global economy to its knees, the need for financial advice has never been greater. Digital disruption has helped keep the industry alive by allowing people to make contact with their financial advisers during this period of hardship.

Not only did the sector do well but it went into overdrive. Lockdown laws restricted the movement of people but did not restrict communication between clients and their financial advisers. The demand for financial advice during COVID-19 reached a level greater than it has ever been.

According to 2020 figures from research group Investment Trends, 2.6 million Aussies said they intended to seek help from a financial adviser over the next two years, up from 2.1 million in 2019. An additional 500,000 non-clients say they intend to seek advice compared to 12 months ago. And it was during this period that financial services were needed the most.

Financial advisers in general are time-poor. This was especially true during Covid when advisers found themselves inundated with an overload of work gained during the pandemic. That meant, for an adviser to manage this increase, an adviser needed to free up time so that their primary focus was on client engagement. Everything else is non-core and can be done at a later stage or delegated to another team member.

Delegate, delegate and delegate.

Outsource as many non-core functions as possible to appropriate team members. Administration, and investment management related tasks are a prime example.

When it comes to picking investments, an increasingly common choice is to use managed discretionary accounts (MDAs), such as individual managed accounts (IMAs) or separately managed accounts (SMAs), to simplify this task. IMAs have grown in popularity and are managed at the individual client account level, holding a wide variety of assets (ETFs, direct equities, managed funds etc). The benefit is that model portfolios can be used for different risk profiles, which is an easy process for an adviser.

An MDA is a portfolio management service in which an investment professional invests your assets on your behalf with discretion. By choosing to invest in an MDA, you get direct access to a highly experienced investment manager, well-versed in different types of investments and financial instruments.

They are up to date with the investment strategies by constantly monitoring such investment vehicles as stocks, bonds, forex, derivatives, and options. These professionals are also experts in the active management of your MDA. They let you concentrate on the more important aspects of your life by reacting proactively to the continually changing market conditions.

According to Dynamic Asset, “Managed discretionary accounts (MDAs) address two critical issues facing financial advice firms; the rising costs and inefficiencies caused by increased compliance requirements and changing client expectations for better transparency and investment performance.”

What about performance?

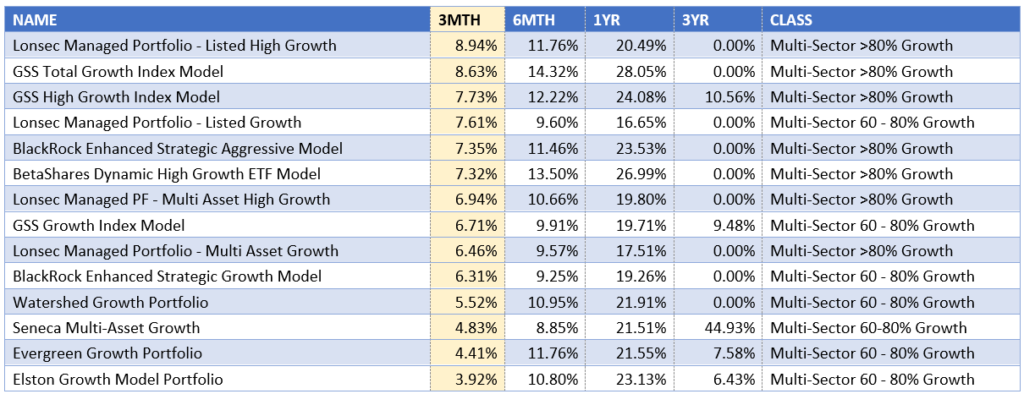

Looking at the MDA performance table, what stands out is the strong performances across the board, or at least from those providers with significant size and scale. The table below includes both growth and high-growth options, with Lonsec’ s Managed Portfolio and Netwealth’s GSS Total Growth Index Model, which utilises BlackRock’s products, delivering 8.94% and 8.63% respectively in the June quarter. Over the financial year, results were a little more mixed with the likes of Netwealth, Blackrock, Betashares, Watershed and Evergreen all exceeding 20 per cent ultimately putting them in the discussion for the best performance ‘growth’ funds including the industry supersector.

The Lonsec Managed Portfolio invests predominantly in growth assets, which may include Australian and global equities as well as property and infrastructure. The GSS Total Growth Index Model is a Netwealth run model portfolio with BlackRock managing the asset allocation strategy. The model invests using the Netwealth GSS index managed funds. The model uses a strategic asset allocation (SAA) that provides long-term exposures to each asset class through a passive underlying investment strategy.

Both MDAs have also done well over the year returning 20.49% and 28.05% for the year. Classified under the multi-sector growth category, the performance of these MDAs are quite comparable to normal balanced funds, but with added flexibility.