Franklin, Hyperion lead Morningstar award finalists

Last week, investment research firm Morningstar Australasia announced the finalists of the 2021 Morningstar Australia awards. Some of the big names include First Sentier Investors, Franklin Templeton and Hyperion Asset Management – all in the running to win the prized fund manager of the year award. Each of these funds has delivered exceptional returns to their investors during the pandemic and subsequent recovery, generally through a focus on ‘growth’ opportunities.

Morningstar Australasia’s director Aman Ramrakha says the unprecedented market volatility over the ongoing fallout of the pandemic “brought uncertainty and challenges to even the most sophisticated of investors” in 2020. “Despite the turbulent past year, our nominated fund managers demonstrated an ability to deliver quality, high-performing investments and have stood above peers with exceptional returns over the longer term,” he says.

Each finalist has been picked using a combination of qualitative research by Morningstar, including risk-adjusted returns over the long-term, as well as, but not solely focused on, performance in 2020.

First Sentier Investors (previously known as Colonial First State Global Asset Management) is a stand-alone global asset management firm known for the independent and focused nature of its investment teams. Portfolio manager Dawn Kanelleas, who looked after the First Sentier Small Companies fund, was able to return 24.7 per cent in calendar 2020, well and truly outpacing the S&P/ASX Small Ordinaries Index, which returned 9.2%. During the pandemic, Kanelleas backed companies that stood out as COVID beneficiaries, including Breville (ASX: BRG) and ARB Corp (ASX: ARB).

Similarly, the Franklin Global Growth Team, led by Donald Huber, returned 31 per cent over 2020, outperforming its benchmark, which delivered just 5.7%. The performance was made all the more valuable given that the company did not hold any of the well-known mega-cap FAANG names, or Tesla, and achieved returns by backing fast-growing businesses like Mercado Libre, Shopify and Zebra Technologies.

And then there is Hyperion Asset Management, which has a Small Growth Companies fund and Australian Growth Companies Fund. The Hyperion Small Growth Companies Fund is made up of Hyperion’s ‘best’ Australian small-cap companies with high growth potential. The fund recorded a 31.9 per cent return for the year. Its biggest holdings included Afterpay (ASX: APT), WiseTech Global (ASX: WTC) and Xero (ASX: XRO).

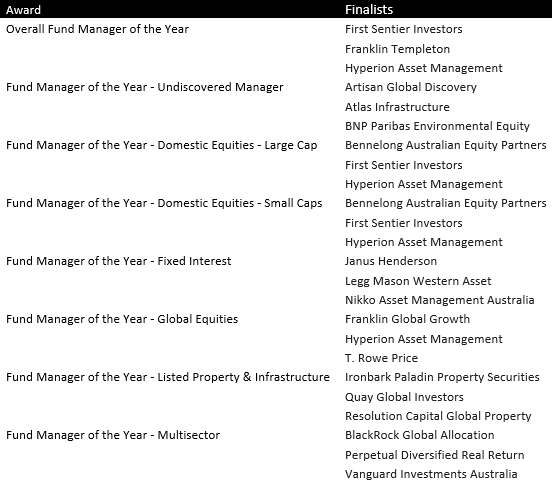

Looking at the awards shown in the table below, it was definitely a year for growth managers, with earnings and sales growth paying off in spades. However, the vaccine-led recovery to finish 2020 pointed towards a return of ‘value’ stocks; only time will tell which style leads in 2021.

Highlights among the other finalists was continued growth in the sustainable investing sector, including BNP Paribas and their Environment Equity Fund, as well as First Sentier, which has a strong focus on ‘responsible’ investment.

The awards will be announced this Friday, which we will cover next week.