ETF Securities launches a semiconductor ETF

ETF Securities has released a new ETF, the ETFs Semiconductor ETF (ASX Code: SEMI), which offers investors exposure to the hottest sector at the moment, the global semiconductor market. The semiconductor market is largely controlled by the US and Taiwan, with most manufacturing centred in Taiwan. Semiconductors or chips are a vital component in most modern-day digital components such as smartphones, laptops, automobiles and drones.

However over the last year, the semiconductor industry faced heightened demand which resulted in a shortage crisis as the Covid-19 pandemic and trade tensions constrained supply and value chains.

The shortage quickly turned into a high-stakes geopolitical issue and a source of tension between the US, China and Taiwan. It sent the share prices of semiconductor companies sky high.

With the demand for these chips continuing to rise, driven by the growing use of electronic devices, ETFs Securities has made the move to tap into this exciting technology trend via the launch of ETFS Semiconductor ETF ( ASX: SEMI). It’s the first Australian listed ETF that is a “pure play” on this sector.

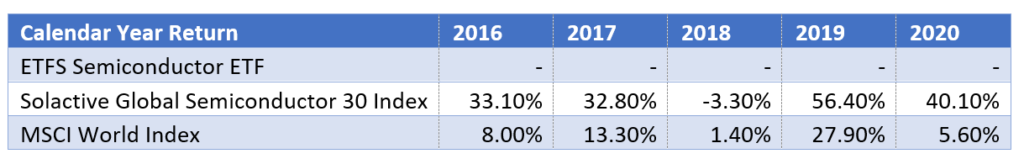

The ETF invests in the most influential semiconductor companies in the world that account for the majority of global chip production. ETFs Securities says, “SEMI tracks the Solactive Global Semiconductor 30 Index, which is a portfolio of 30 companies in developed markets, plus Taiwan and South Korea, which are active across the semiconductor value chain.”

ETF Securities head of distribution Kanish Chugh says, “By following megatrends, investors can access high-growth opportunities, which are not yet fully captured by conventional sectors or unexpressed by factors. Additionally, they can manage risk by hedging against the disruption that global economic ructions can cause. Correctly identifying and acting on megatrends can offer enormous upside.”

With 5G, AI and driverless cars lurking just around the corner, the demand for semiconductors is well-supported, as semiconductors form the key component underpinning the development of many other megatrend technologies.

ETF Securities says: “The coronavirus pandemic has boosted the demand for electronic goods. With more people working, shopping and entertaining themselves from home, electronic devices that enable a remote existence have never been more in-demand. Annual sales growth of semiconductors is forecast to hit a whopping 20% a year in 2021.”

There are several newer megatrends also contributing to semiconductor demand – Cryptocurrency, artificial intelligence (AI), video games, cloud computing, and servers. All of these sectors are experiencing rapid growth, further supporting semiconductor demand.

Stocks included in the portfolio include:

- Taiwan Semiconductor, TSMC (TPE: 2330), the world’s leading chipmaker, which owns over half of the market, is now developing the 3-nanometre (nm) production process and is expected to have 2-nm chips hit the market in 2025.

- ASML (AMS: AMSL): Dutch company that makes lithography machines that put transistors onto microchips.

- Nvidia (NASDAQ: NVDA): US company that makes graphics processing units, or graphics cards, which allow many detailed processes to be run at the same time.

The industry is volatile and fraught with risk, especially considering China’s aggressive moves to threaten Taiwan. Over the long term, though, demand for semiconductors should continue to rise as these chips remain an integral part of technology and innovation.