-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Analysis

-

Asset management

-

Economics

-

Retirement

-

Value proposition

Clients have a right to know how advisers justify a fee of $15,000 per year when the investment income on a $1.5 million portfolio is only $75,000, says Drew Meredith. Maybe they should also have a hand in deciding how the fee is calculated.

Betting on mega-caps has rarely paid off for active managers, but investors who want exposure to the US market are often forced to take on massive stock specific risk for or against the Magnificent Seven. A mega-cap mean-reversion could be a tailwind once again.

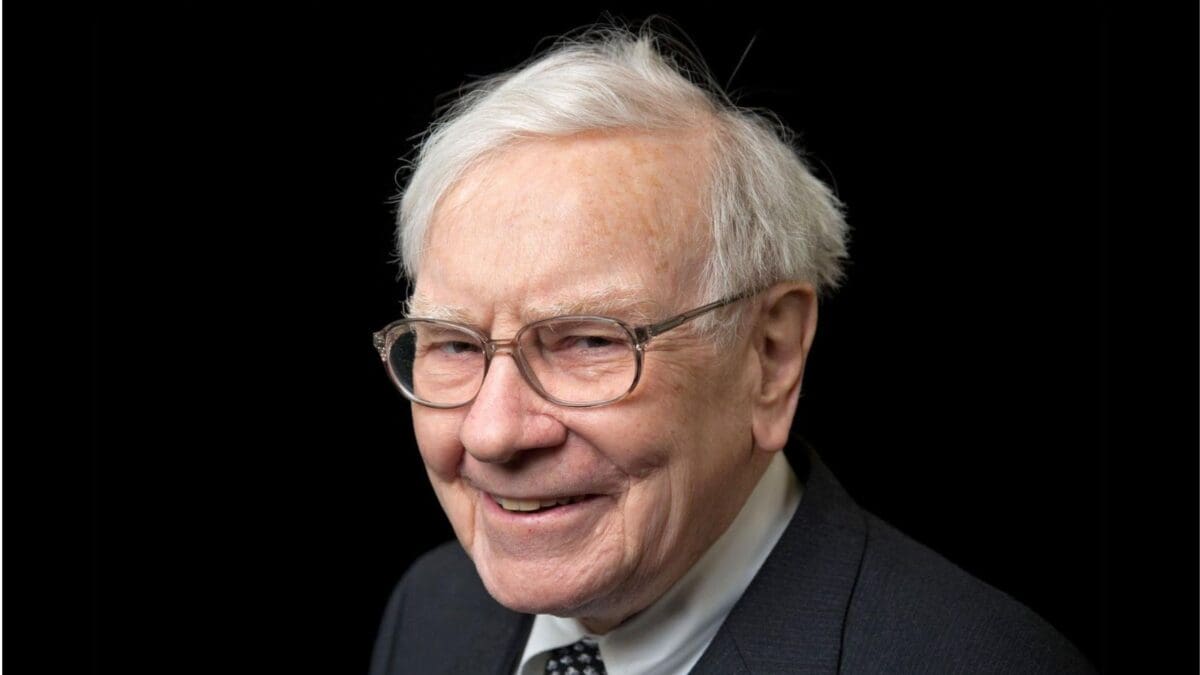

Berkshire Hathaway is built to last, and probably will, with low debt levels and a vast waterfall of earnings that both insulate it against market mania and give it the capacity to act decisively during it. But when your market cap is nearly a trillion US dollars, there’s few deals that can truly move the needle.

It’s a spectacular transaction, one that marks not only the likely nadir of Iress but what should be the end of five very frothy years of M&A activity in the investment platform space.

True diversification is the only way for investors to protect themselves against global risk, says Jamie Green. “This includes diversification across asset classes, geographies, industries and even company sizes.”

The current market isn’t just a poor marking stick for active investment expertise, but a dangerous one, with concentration risk at alarmingly high levels. Are fund managers right to be wrong?

It’s hard to exceed stratospheric expectations, which is the proposition investors buying into the big US tech stocks face. Hunting for lower bars to hurdle likely makes sense in this unique market era, according to Orbis Investments.

Toohey notes that on top of softening inflation, small caps will also be buoyed by enhanced consumer sentiment and a better lending environment. “The sector now looks extremely attractive,” he says.

Historical information may have limited value, but its ability to assist investment managers in identifying trends cannot be understated. Of course, understanding (let alone pulling apart) economic data is not always straightforward.

The financial needs of a staggering 64 per cent of retirees sit beyond the comprehension of super funds, a new report states, because there is too much complexity involved when retirement income isn’t enough to satisfy lifestyle ambitions.

An evolutionary leap in the retail investment product landscape is taking place, with asset consultants displacing financial advisers across rich corners of the value chain. Scarcity Partners’ big bet on Evidentia, and how it’s being received, brings into focus just how seismic the shift really is.

One domestic bond manager stands out when measuring over both one and three year terms, according to the latest data from the Atchison Consultants approved product list.