-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Launches

-

M&A

-

People

-

Regulation

The recovery from 2020’s “massive period of turbulence” hasn’t lifted all boats, and there are still plenty of bargains to be had, if you know where to look. Gareth James, Morningstar’s Sydney-based equity research strategist, expects Link Administration (ASX: LNK), for instance, to bounce back from “a tough few years” of regulatory changes and the…

The Clearbridge RARE Infrastructure Income fund was last week awarded Money Management’s Fund Manager of the Year award for the Infrastructure Securities category. This comes after a strong recovery to April and an impressive long-term track record. According to Money Management, it was Clearbridge’s ability to “focus on the best ideas and staying index-unaware” that…

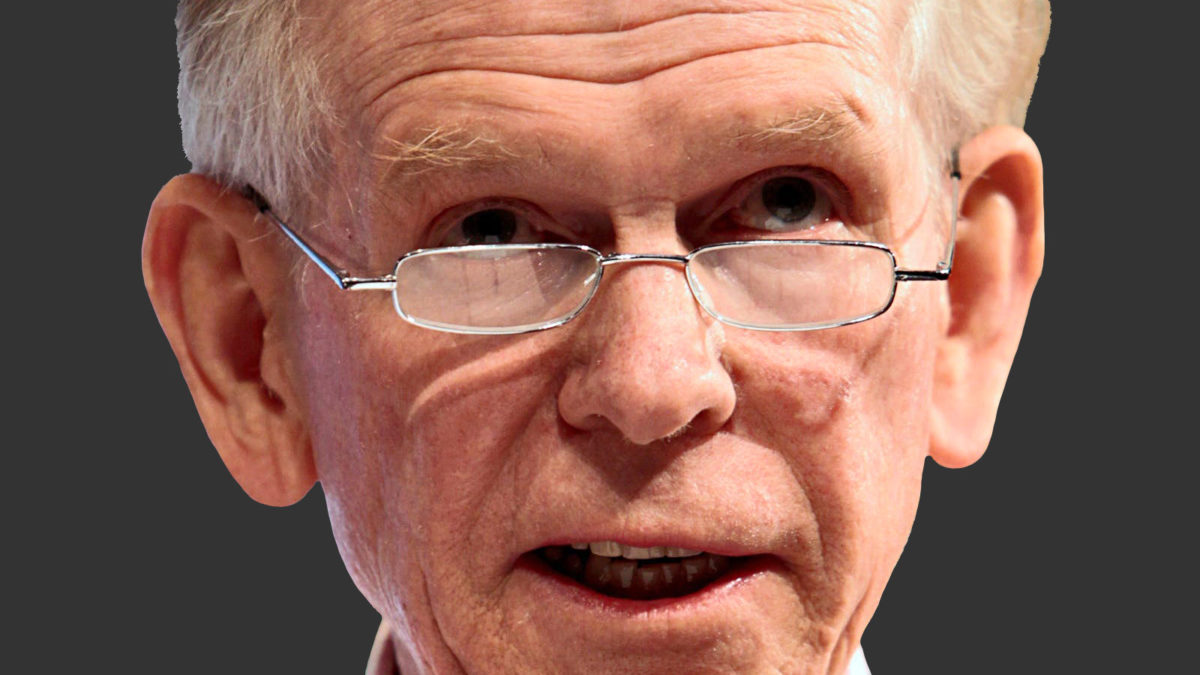

Legendary investor Jeremy Grantham says that while markets are in what he’s called “one of the great bubbles of financial history,” there’s “no traditional pin” to pop it. Speaking to Morningstar CEO Kunal Kapoor, Grantham – who famously dodged the Japanese asset price bubble in the 1980s, as well as the Tech Wreck and the…

AMP’s wealth management arm will launch a cost-cutting program and make sweeping redundancies across its workforce in a bid to turn the troubled business around. While “Ms Fixit” Alexis George is yet to step into her new role as AMP Limited chief executive after leaving ANZ, AMP Australia – which is responsible for wealth management…

Fixed income allocations have experienced a difficult 12 months, with both performance and sentiment turning against the sector. The threat of higher interest rates has seen volatility in Government bond markets reach levels not seen in decades. With many experts now suggesting that the duration “tailwind” is over, being the capital gains offered by bonds…

Money Management held its fund manager of the year awards last week. Presented by TV personality Andrew Daddo, the awards recognise stellar fund manager performance at a time when markets underwent bouts of extreme volatility. There were numerous awards in various categories, but ultimately the Fund Manager of the Year Award for 2021 was taken…

Charter Hall Long WALE REIT (ASX: CLW) has announced that it has secured a $790 million investment portfolio to be owned by the REIT and Charter Hall Direct funds. The high-quality first-generation leased portfolio comprises three offices and one life science/industrial asset. The portfolio comprises four assets with a total net lettable area (NLA) of…

With records still being set by both equities and bond markets, investor uncertainty abounds. It would seem that these times are made for both active management and experience. Among bond markets, the possibility of higher inflation, especially in the US, is prompting fears of rising interest rates, and therefore falling prices, with investors looking further…

Stewart Investors is among the world’s leading ESG or responsible investment firms, yet a series of name and ownership changes have somewhat hidden this specialist investment firm. Originally part of the Colonial First State Global Asset Management (CFSGAM) stable, Stewart is now owned by First Sentier Investors, which itself is a subsidiary of Japanese investment…

Global small-caps consistently outperform their large-cap brethren – and do it with a better risk-adjusted return – but few investors are paying attention, according to Ausbil portfolio manager Tobias Bucks. “Global small-caps outperform global mid-and large caps. Like all maths, it’s boring but it’s true,”Mr Bucks told the Inside Network’s Equities and Growth Symposium on…

Towards the end of last year, ASIC began preparations to request relevant documentation from major dealer groups around life insurance advice. This year is a vital year for the life insurance industry because it’s when ASIC will review the Life Insurance Framework (LIF). The Federal Government had organised to this review back in 2017/18, when…

In a nutshell, value investing is buying ‘quality’ companies at share prices well below intrinsic value. Quality is defined using four characteristics: A high-quality business that sells high-quality products, usually market leaders. Low debt – tend to handle downturns better. Sound management. Recurring earnings – start-ups are not preferred. Warren Buffett’s famous saying “Finding an…