-

Sort By

-

Newest

-

Newest

-

Oldest

The recent slavery scandal surrounding the fast fashion brand Boohoo has further intensified the focus on the “S” element within ESG factors. The “S” pillar has been gaining prominence since the start of the pandemic, with increased attention on how companies treat their workers.

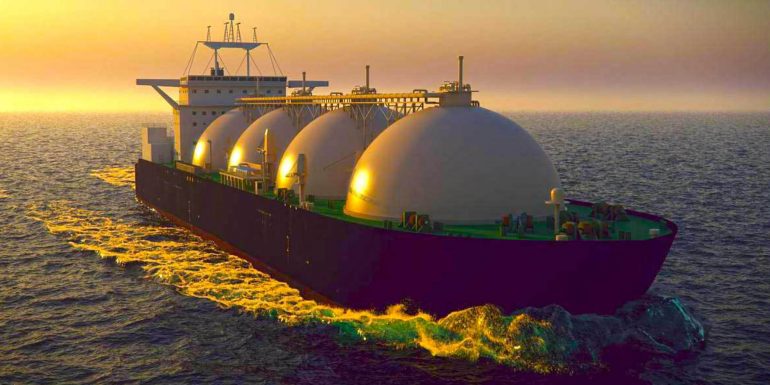

A focus on oil and gas abandonment and implications for the ASX.

Liquidity is said to be the driver of this cycle. No hiding here as central banks provide largesse without restraint, while governments fret about re-election cycles to spew money at any likely voter.

The broad ESG framework is experiencing a sea change. In the past, governance and environmental issues sparked investor interest, a paradigm COVID-19 is challenging. Although climate change remains a major global issue, rapidly changing economic and financial circumstances induced by COVID-19 have investors focusing more on social issues and societal challenges.

For much of the investment industry, committing to ESG (Environmental, Social and Governance) has become a recently-adopted core belief. A concept that was brought into focus 15 years ago at the 2005 Who Cares Wins conference, which examined its role in asset management and financial research, ESG has now become entrenched across the industry. Although there are still widely varying degrees of commitment to ESG, investing today in assets that adhere to these principles comfortably exceeds $US30 trillion – and is growing rapidly.

The quarter saw an onslaught of record-breaking economic data, as Australia officially entered its first recession in nearly 30 years. The economy contracted a comparatively strong 0.3% in the March quarter and is expected to fall as much as 8-10% in June as the worst of the economic shutdowns hit. It’s clear that Australia’s world leading fiscal stimulus is very much needed to support a recovery.

A new take on environmental, social and governance (ESG) investing has emerged with the launch of a fund tackling sustainable opportunities in the water and waste management sectors. Fidelity International recently launched the Fidelity Sustainable Water and Waste Fund in Australia. In what is an under-researched sector, the fund seeks to deliver strong risk-adjusted returns…

Amongst the headline noise on virus affected financial conditions, it is surprising that ESG seems to have gained an even stronger foothold.

Markets around the world finished last week on yet another strong note with the USA’s S&P 500 up 1.7% on Friday and Australia’s ASX 200 remaining weaker but improving 0.5%.

Shareholder activist groups are diverting company management’s time and energy towards narrow environmental and social causes. We explore why active ownership and purposeful engagement can achieve a better outcome for all stakeholders.

I recently tried an experiment. I changed several light bulbs, and since one required a little rewiring, I sent my wife (also known as the majority shareholder) a bill for $110.50 (plus GST). In return, she sent me a bill of $457.98 for her preparation in late December of a sumptuous meal, plus her work managing all social connections associated with the holidays.

I recently returned from a research trip to China and was struck by how seriously environmental issues are now being taken by government and town planners. As China continues to develop, environmental issues are increasingly front and centre in what is described in the country as a “war” against pollution.