-

Sort By

-

Newest

-

Newest

-

Oldest

China’s ongoing regulatory crackdown has investors running scared. But China still wants to be a global player – and its most successful companies aren’t going anywhere. China’s recent regulatory efforts have sent a chill down the spine of even the most bullish investors, with questions swirling about where and when the aggressive crackdown – which…

“Look through the macro” were the words used by portfolio manager Adam Chandler in a recent update on Claremont Global’s high-conviction global equity strategy. In a recent update delivered after the stellar US reporting season the group stressed the importance of “organic” rather than headline growth in its approach. Having invested through the crises in…

In the Allianz Retire+ five phases of retirement, wedged between phases three, ‘liberation’, and four, ‘reorientation’, comes ‘disenchantment’. It is often the most challenging and important for an adviser to manage. In a webinar last week (September 8), Alex Brown, Allianz Retire + senior business development manager, chaired the third in a series for advisers…

Morgan Stanley Investment Management has reiterated its focus on investing in those seeking out those companies that are delivering high and sustainable returns on operating capital. In their recent ‘Global Equity Observer’ update, William Lock Head of International Equity, reiterated the power of compounding returns and the characteristics his team continue to covet. Every professional…

The environment has seemingly never been better for investors. After an incredible collapse in 2020 sharemarkets have staged a remarkable comeback, with the likes of the Nasdaq Composite Index near-doubling from their lowest 2020 levels. Buoyed by monetary policy, excess savings and in many cases, investors stuck at home with little else to do but…

Sharemarkets, excluding dividends, are now as much as 70 per cent higher than their March 2020 bottoms. Overseas the recovery has been even stronger, with the Nasdaq Composite Index having doubled over the same period, and the S&P 500 having delivered over 50 record closes already this year. Complacency is now kicking in, according to…

When talking about emerging markets, one thing naturally comes to mind: China. China is by far the largest EM economy; in fact it’s the second largest economy in the world, just behind the US. And this poses a problem for EM indices with almost half of all emerging market ETF assets being invested in Chinese…

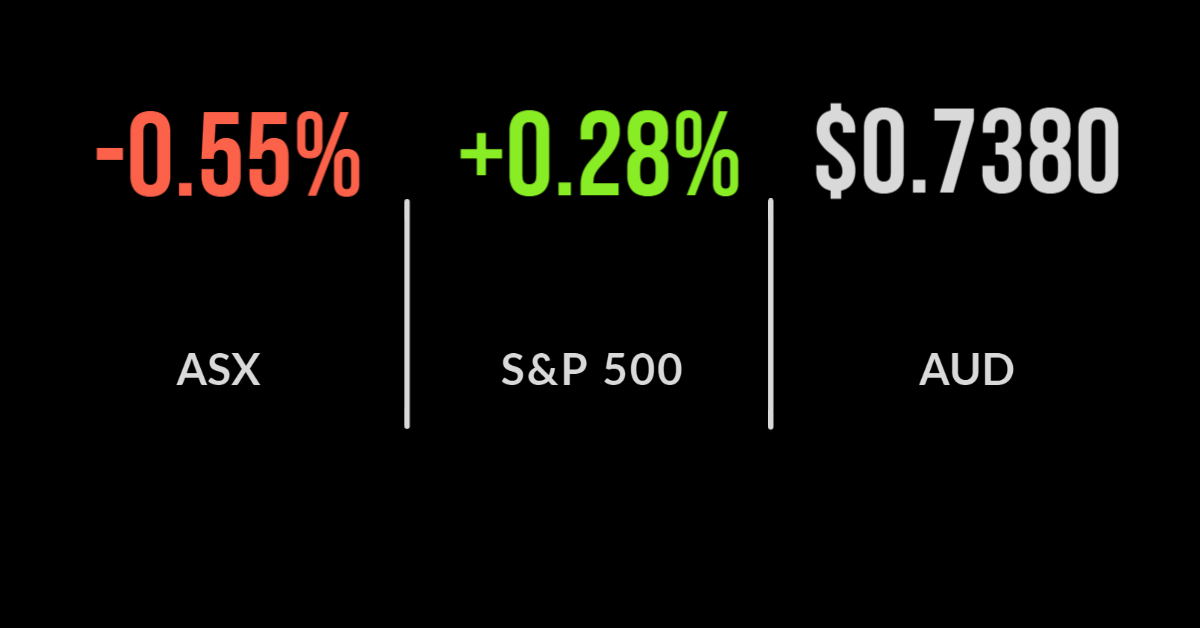

Dividends drag market lower, record trade balance on commodities The ASX200 (ASX: XJO) finished around 0.6% lower as a swathe of dividend payments were extracted from the market. On a second level it was broadly mixed with materials and mining falling 2.5%, whilst staples and healthcare were both down similarly, around 1% each. The impact of dividend payments and ex-dividend…

“Iron ore remains a commodity that polarises the market” according to Ausbil’s local investment team. Among the stable of strategies is the Ausbil Global Resources Fund which, as the name suggests, must have a strong view on almost every major commodity. 2021 has been dominated by talk of another commodity super cycle. Buoyed by massive…

After being a dirty word for close to a decade, ‘value’ investing has been back in vogue, for a few months at least anyway. Spurred on by the approval of COVID-19 vaccines in late 2020 the ‘recovery’ trade which involved increasing exposure to cyclical sectors like energy and banks has paid off in the short-term…

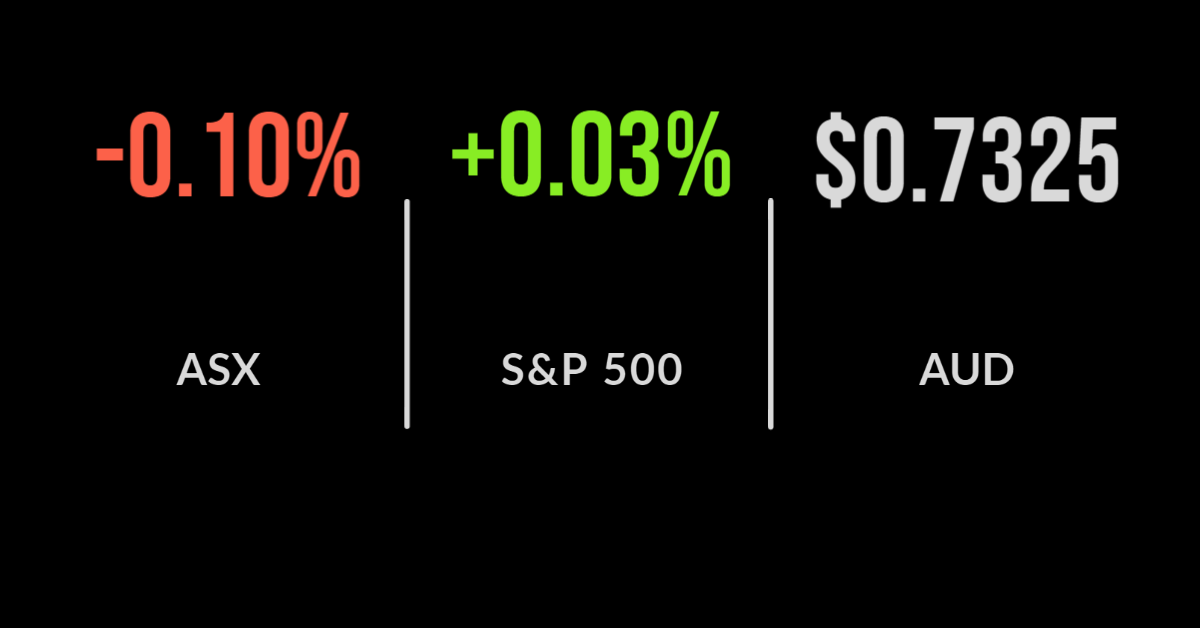

September begins with a loss, GDP surprises again, Metcash sales weaken After delivering an eleventh straight month of gains by finishing 1.9% higher in August, the ASX200 (ASX: XJO) fell 0.1% to begin September. Given the busy month that was August market volatility will likely recede as investors turn to the outlook for vaccination rates and border…

Over the past 20 years, UK corporate earnings growth has been up and down, but largely in an overall decline. This gloomy picture has stuck around. Fast-forward to today, and the storm is clearing. Following the pandemic, already beaten-down stocks are in much better shape than before, putting the UK on a path for a…