-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Advice

-

Marketing

-

Technology

-

Transactions

The Financial Planning Association (FPA) this week released guidance on best-practice approaches to file note records to support more transparent and detailed record-keeping. The changes come in response to consumer complaints that highlighted gaps in records as part of subsequent investigations. The FPA said “The new guidance provides innovative ways for financial planners to create…

As highlighted in our article recently covering the formation of the ‘single disciplinary body’ to govern and regulate individual financial advisers, the landscape continues to evolve on a near daily basis. Comments from ASIC in response to their call for submissions to make financial advice more affordable, suggested the Record of Advice could be set…

More high-net-worth (HNW) investors are open to receiving financial advice than a year ago, but they are yet to do so, according to the latest report from Investment Trends. There were an estimated 485,000 such investors on September 30 last. The report, the 13th in the firm’s annual series, is billed as the largest of…

The 12th edition of the Managed Accounts Report, a joint effort between State Street Global Advisers and Investment Trends, was released this week, with the results offering powerful insights into a fast-evolving financial planning industry. The diverse, but high-growth, sector spans everything from separately managed accounts, to individually managed and managed discretionary accounts, which according to the Institute…

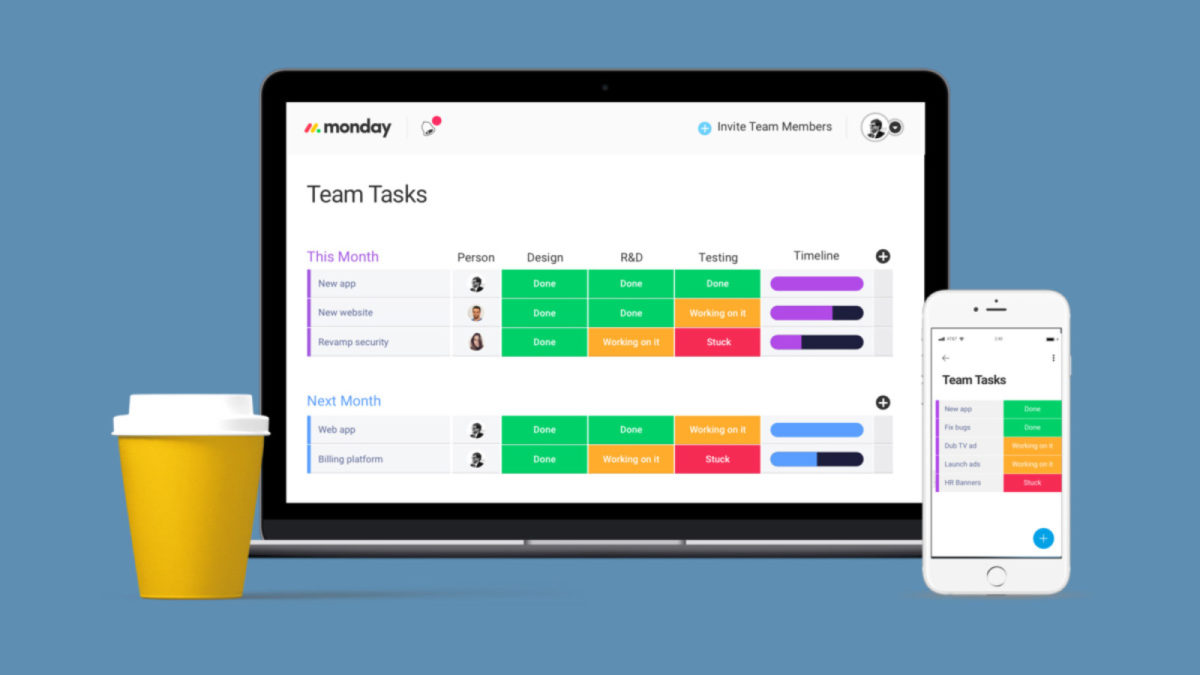

The shift towards non-aligned platform advice forced structural change within wealth management in a way never seen before. Findings from the Banking Royal Commission helped drive the push towards independent platforms and product providers with a renewed client focus. New technology-based platforms have given financial advisers the ability to hold, transact and administer on a much…

Not that long ago a fund manager could provide a mesmerising presentation slide on how it uses “big data.” Examples might be using Google Earth to discern real-time movement in shopping centres, building activity based on shadowing over the day and seasons as structures grew in size, right down to the mundane of what was…

Managed funds research and ratings start-up Foresight Analytics is expanding further in the ultra-competitive retail and advised investment sector through the acquisition of the analytics business of Australia Ratings Group. This follows a tie-up announced earlier this month with Style Analytics Group, a factor analysis firm with offices in Boston and London, which provides research…

Despite hope that the vaccines would see a return to normal life in 2021, it appears we will live through at least another 12 months of uncertainty. Few people, outside of the obvious, have felt the emotional and operational brunt of the pandemic more than financial advisers. Most advisers I speak to were inundated with…

The innovative wealth management platform is recognised as Australia’s Best Platform Overall by Investment Trends, and its managed portfolio solution recognised as the Best Platform Managed Accounts Functionality – a title the platform has held close to its chest for the last five years. The Investment Trends Competitive Analysis and Benchmarking report “measures platform functionality across a…

Every advice firm is interested in growing its business – in tapping-into the addressable market. But what is the advice market? Is it those that receive financial advice today, or is it those people who are not receiving advice, but should (or at least) could receive it? The ASX-listed investment platform and wealth management fintech…

Summary: There has been a rapid and large-scale shift across many industries towards working remotely. Organisations are investing in remote working technology and infrastructure. The popularity of virtual communication platforms has surged. COVID-19 took the world by storm, bringing economies to their knees, schools deserted, shopping centres empty, entire sectors were closed as people were…

Part 3 – Daintree Capital Core Income Trust Sydney-based Daintree Capital is an ultra-modern, specialist absolute return funds management boutique with a primary focus on protecting client capital against downside risk. How is Daintree innovating? Daintree has developed an innovative short-duration, active fixed income strategy that manages risk in a ‘lower for longer’ or rising…