-

Sort By

-

Newest

-

Newest

-

Oldest

Credit and equity markets both suffered a very bad 2022, as the collapse of negative correlation between stock and bond prices left no safe haven for investors. But 2023 could be a big year for bonds, with analysts warning investors waiting on the sidelines that they risk missing out.

The US economy should experience a “benign disinflation” over the next six months as pandemic-infused snarls unravel. That should mean good things for stocks, at least in the short term.

A recent survey shows 74 per cent of Australian business leaders expect profits to increase in the year ahead, despite a still-challenging outlook and sticky inflation.

Green shoots of relief from central banks will take some time to filter into the economy due to a confluence of factors according to Sage Capital.

Household wealth in September recorded its third largest quarterly decline since the Australian Bureau of Statistics began keeping records in 1989. And wealth is likely to keep falling in the coming quarters, as the lagged effects of interest rate hikes flow through.

This year’s recalibration of bond prices now reflects the higher interest rate environment, making future returns attractive again for fixed income in 2023 as deteriorating fundamentals threaten other asset classes.

Economists agree the outlook for house prices in 2023 is largely dependent on upcoming interest rate decisions by the Reserve Bank of Australia, and signs of weakness are already appearing. Complicating matters further, borrowers face an impending fixed-rate cliff.

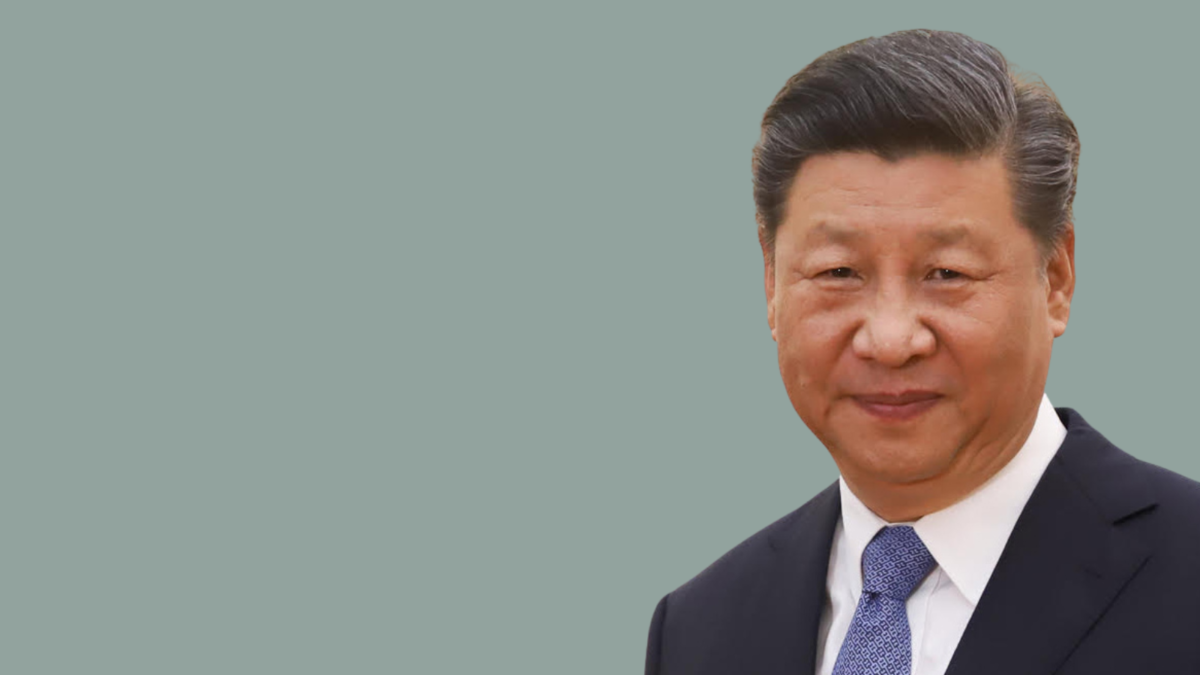

While the market is broadly underweight China, South African-based Foord Asset Management is confident that President Xi Jinping’s economic plan for the country will bear fruit over time.

The Chinese government’s announcement of less onerous isolation guidelines prompted markets to rally in anticipating of a move away from zero-COVID policies. While significant short-term challenges remain, market sources say renewed growth may be in sight, representing future opportunity.

Alceon Group maintained its view that the sector will remain strong for the remainder of this year given its robustness and healthy deal pipeline.

The Reserve Bank of Australia is sticking to its view that inflation will be temporary, despite its poor forecasting track record. Economists aren’t so sure.

Central banks are likely to continue inflating interest rates around the world, with the US federal reserve at the vanguard. Be wary of thinking markets have gone through the fire already, Sage Capital warns.