-

Sort By

-

Newest

-

Newest

-

Oldest

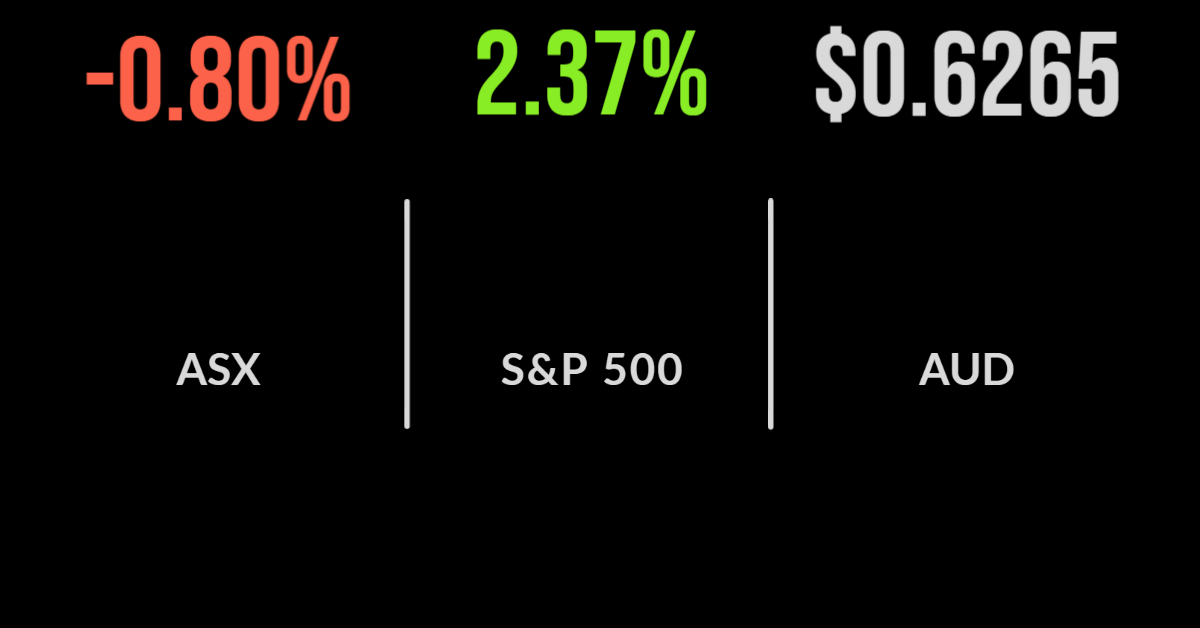

The miners led the local market higher on Monday, with the S&P/ASX 200 Index advancing 1.5 per cent, or 102.6 points, to 6779.4, while the broader All Ordinaries gauge ended up 108.5 points, or 1.6 per cent, to 6978.4. Gold stocks were prominent in the rise, after the yellow metal’s 1.8 per cent gain to $US1,658 an ounce in New…

A sustained rally in the energy sector, which finished 2 per cent higher on Friday, wasn’t enough to reverse broader losses with the S&P/ASX200 ultimately finishing 0.8 per cent lower. The utilities and real estate sectors were the hardest hit, falling 2.3 and 1.8 per cent on growing concerns about the regulatory environment for the…

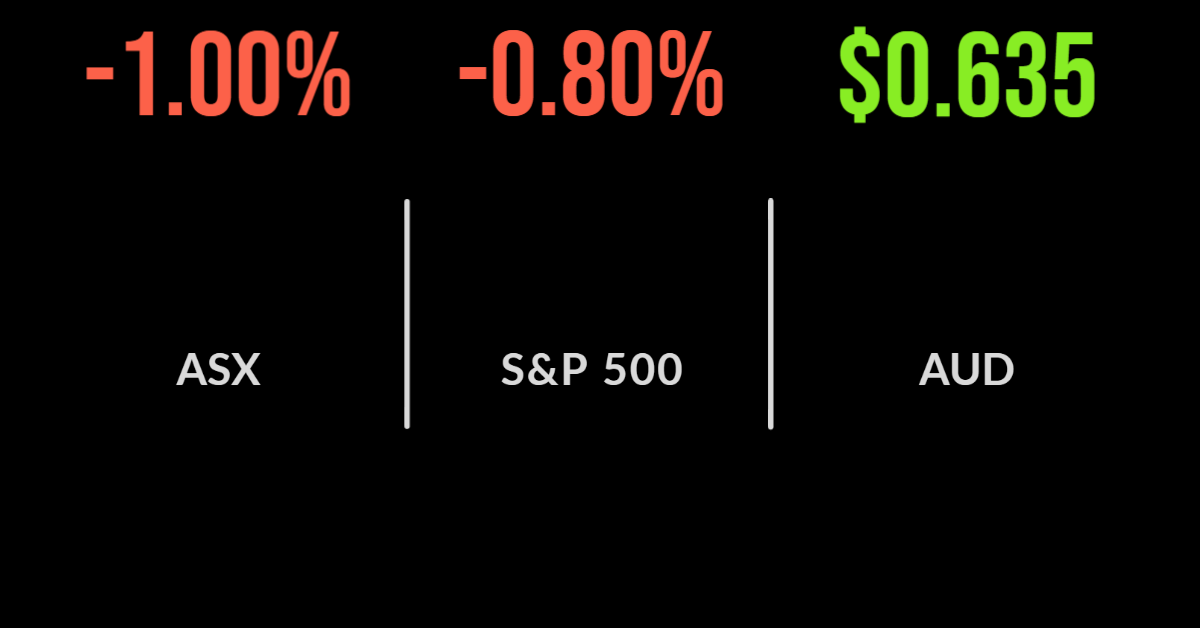

Thursday saw a retreat from the benchmark S&P/ASX 200 Index, which dropped 69.4 points, or 1 per cent, to 6370.7 points, while the broader All Ordinaries Index surrendered 81.1 points, or 1.2 per cent, to 6,918.7. The bond market sell-off extended as benchmark risk-free US 10-year bond yields added 2 basis points to 4.15 per…

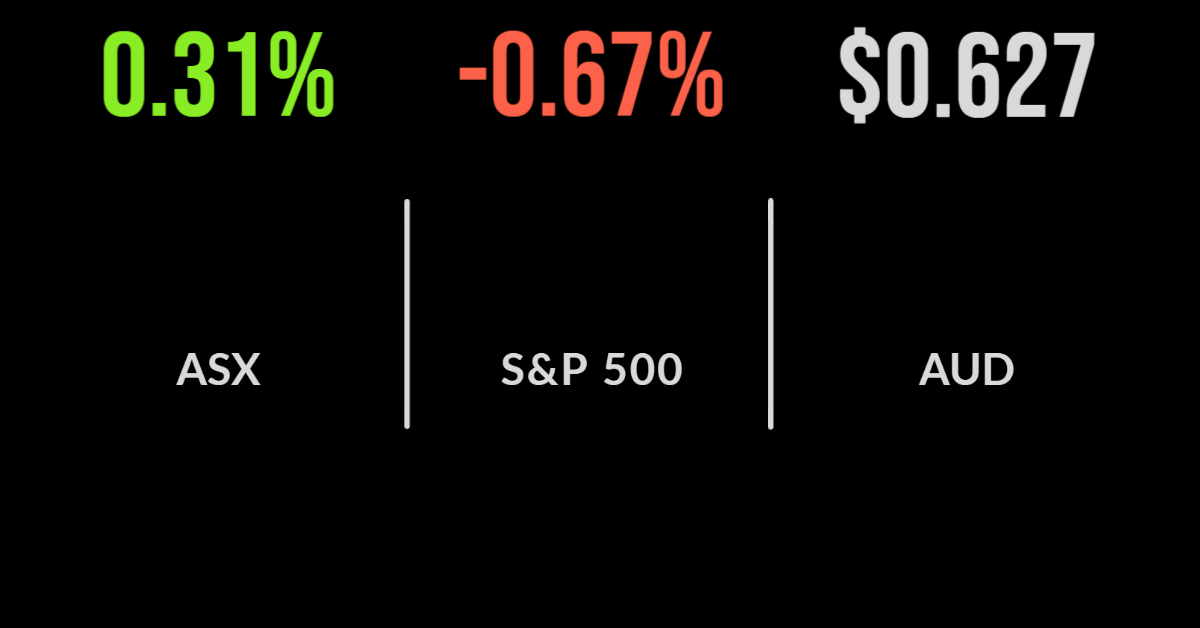

The Australian share market backed-up its Tuesday effort with a solid performance on Wednesday, with the benchmark S&P/ASX200 index gaining 20.9 points, or 0.3 per cent, to 6,800.1, while the 500-stock All Ordinaries index added 23.6 points, or 0.3 per cent, to 6,999.8. Among the big miners, Rio Tinto eased 26 cents, or 0.3 per cent, to $94.01; South32 slipped 8 cents,…

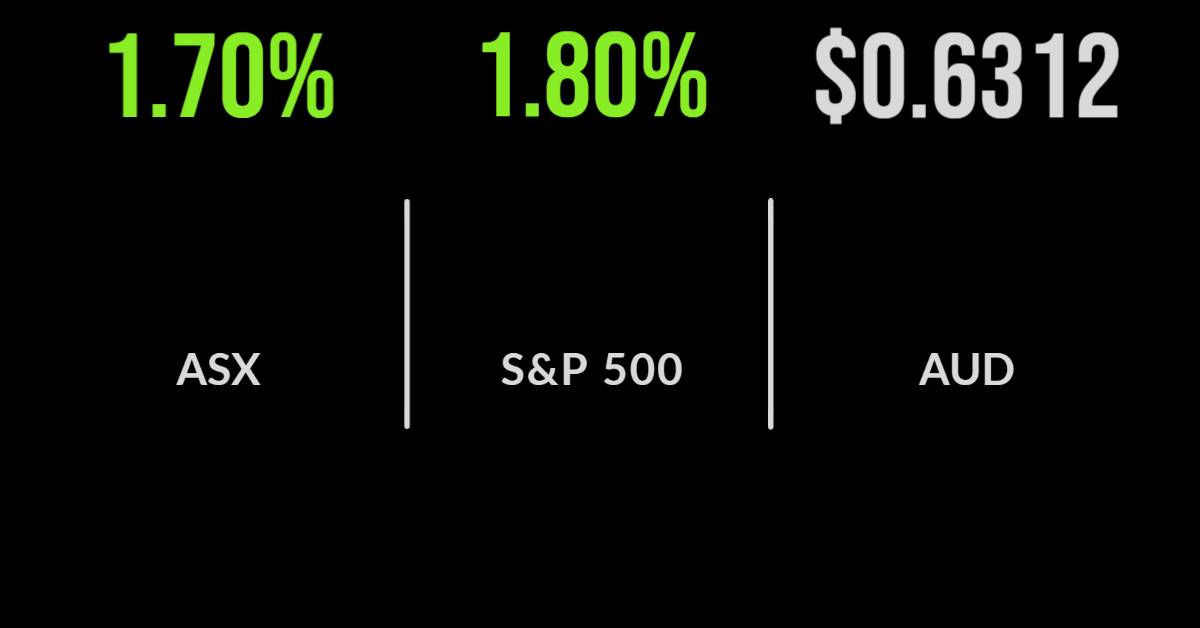

A strong lead-in from Wall Street gave solid impetus to the Australian market on Tuesday, and the result was a lift of 114.8 points, or 1.7 per cent, in the benchmark S&P/ASX 200 Index, to 6779.2; while the broader S&P/ASX All Ordinaries index added 121.9 points, or 1.8 per cent, to 6976.2. Resources led the rise,…

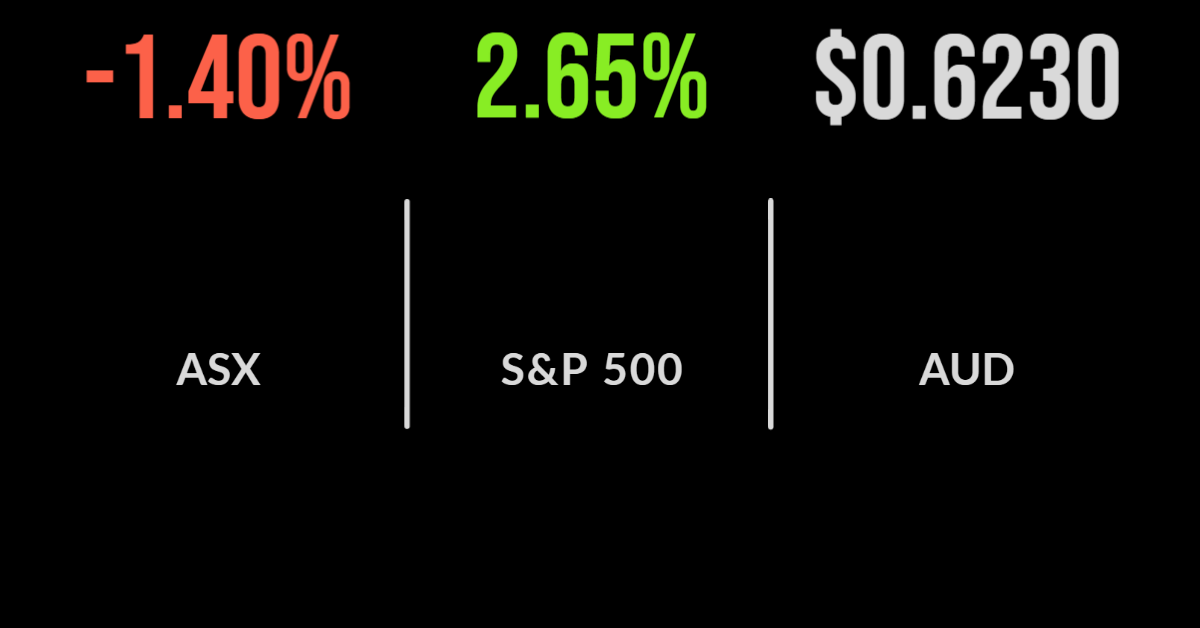

An ugly 2.4 per cent slide in the S&P 500 index on Wall Street at the weekend was never going to give the Australian market a boost as it opened the week, and so it proved, with the benchmark S&P/ASX200 index closing down 94.4 points, or 1.4 per cent, to 6664.4 on Monday, and the…

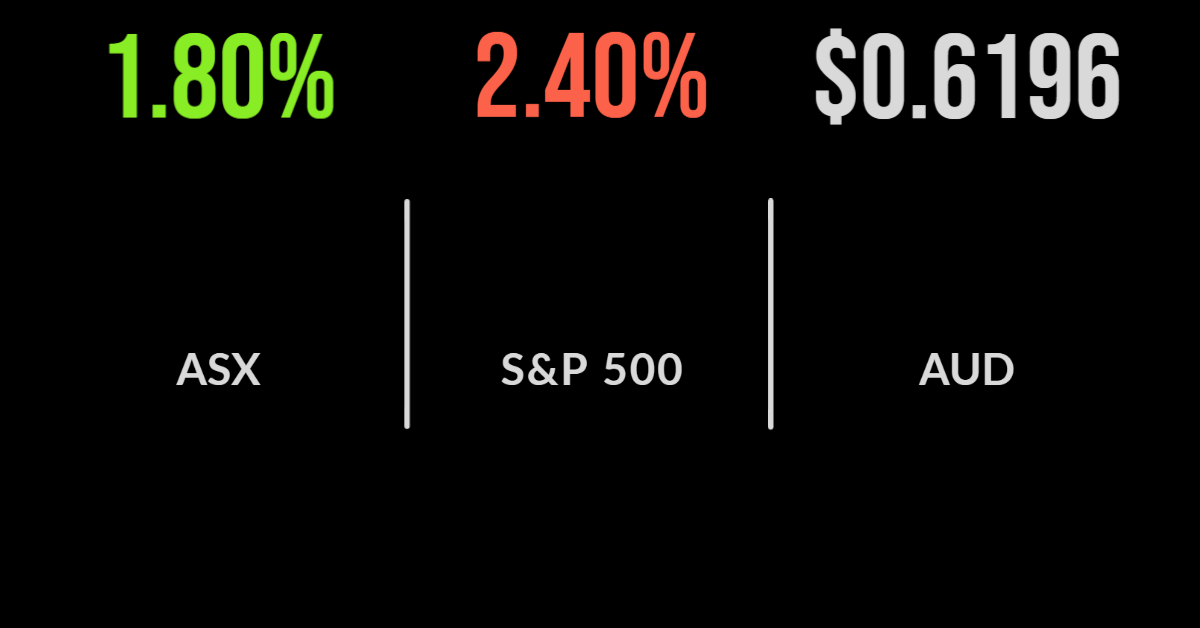

The S&P/ASX200 managed to offset the majority of the week’s losses on Friday, finishing 1.8 per cent higher on the back of a significant jump in the energy and utilities sectors. Every sector finished higher on the day. The likelihood of a disorderly transition of the energy sector and increasing oil prices globally supported energy…

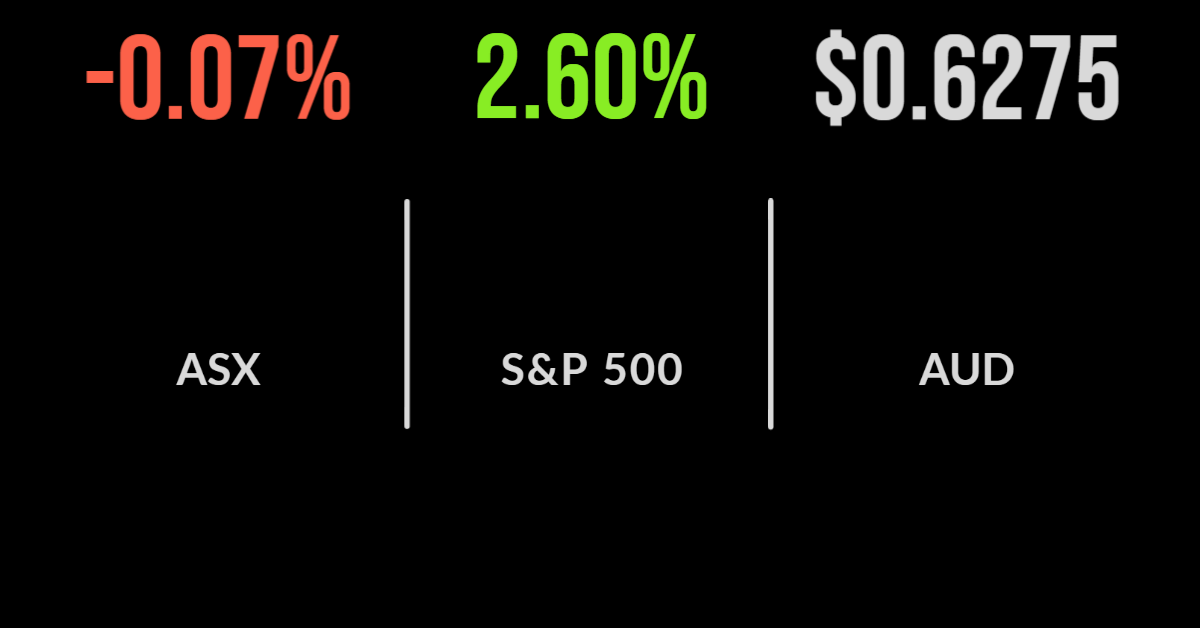

The local market overcame selling pressure ahead of awaited US inflation data to post a small loss of 0.1 per cent. The financials sector was the standout, gaining 1.4 per cent, with the likes of National Australian Bank (ASX:NAB), up 2 per cent, buoyed by the improving profitability of Bank of Queensland which reported yesterday….

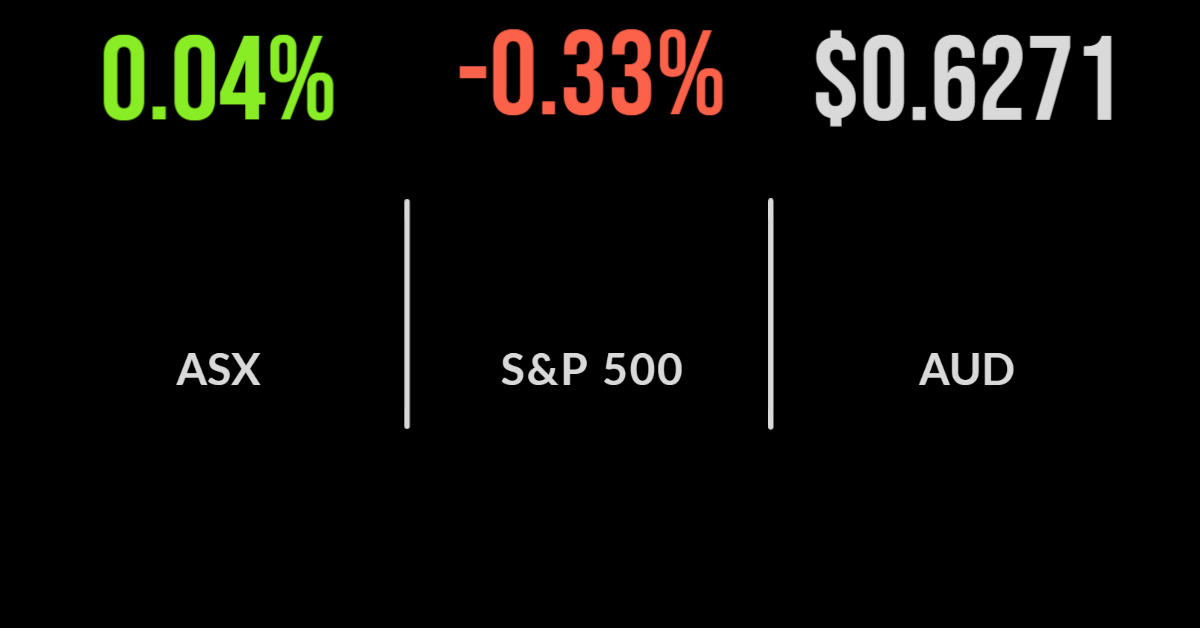

The local sharemarket managed to overcome global weakness, posting a 2.5 point gain behind a significantly rally in the financial sector, up 1.9 per cent. The property sector also added 1 per cent, with energy and utilities falling 1.5 and 2.2 per cent following significant commentary around the future of energy policy in Australia. Shares…

The S&P/ASX200 continued to weaken as the guidance flows in from numerous sectors of the economy. The industrials sector was the rare highlight, gaining 0.4 per cent, with the energy and technology sectors finished down 1.6 and 1 per cent respectively. Among the biggest drivers was a continued weakening of the AUD even as the…

The local market opened the week on a negative note, with the threat of US recession sending every sector lower. The rate sensitive sectors were the hardest hit, with utilities falling 3.2 per cent and technology 2.6 per cent behind the likes of Zip Co (ASX:ZIP) which fell 7.4 per cent. Among the biggest losers…

The local sharemarket finished the week on a negative tone, falling 0.8 per cent, but it wasn’t enough offset the exuberance on Tuesday. Only the energy sector managed to post a positive result on Friday, up 1 per cent, behind a rally in Origin (ASX:ORG) and Santos (ASX:STO) which gained 1.2 and 1.9 per cent….