Aussie market starts new week on a downer

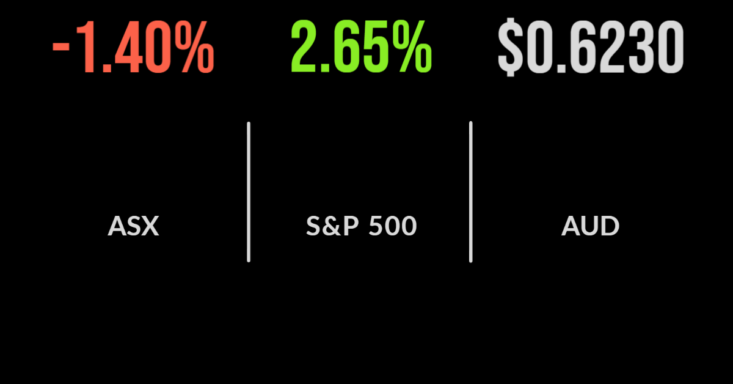

An ugly 2.4 per cent slide in the S&P 500 index on Wall Street at the weekend was never going to give the Australian market a boost as it opened the week, and so it proved, with the benchmark S&P/ASX200 index closing down 94.4 points, or 1.4 per cent, to 6664.4 on Monday, and the broader All Ordinaries losing 94.3 points, also 1.4 per cent, to 6854.3.

The resources sector was depressed by the rhetoric coming out of the Communist Party congress in Beijing. President Xi Jinping declared that there would be no retreat in the country’s war against COVID-19 – which commodities markets took as a sign that there would be no quick return to the levels of Chinese growth the sector typically expects.

Resources lead market lower

The mining sector surrendered 2.1 per cent as it digested that news, with

BHP easing 93 cents, or 2.3 per cent, to $39.09; Rio Tinto losing $2.47, or 2.6 per cent, to $94.14; South32 dipping 8 cents, or 2.1 per cent, to $3.76; and Fortescue Metals giving up 20 cents, or 1.2 per cent, to $16.91.

There was isolated joy in the lithium cohort, with producer Pilbara Minerals gaining 10 cents, or 2.1 per cent, to $4.79; project developer Liontown Resources up 8 cents, or 4.9 per cent, to $1.72; fellow developer Lake Resources gaining 3 cents, or 3.1 per cent, to $1.00; but elsewhere it was red ink, with Australian-Argentinian producer Allkem off 16 cents, or 1.1 per cent, to $14.40, and US-based project developer Piedmont Lithium down 4 cents, or 4.8 per cent, to 79 cents. Mineral Resources, which mines lithium and iron ore, shed $2.03, or 2.9 per cent, to $68.92, while IGO, which mines lithium and nickel, was down 25 cents, or 1.6 per cent, to $15.07 after announcing the sudden death of its 64-year-old chief executive, Peter Bradford.

The energy sector also struggled, down 2.1 per cent on the sectoral sub-index, with Woodside Energy down 82 cents, or 2.4 per cents, to $33.13; Santos down 23 cents, or 2.9 per cent, to $7.57; Beach Energy losing 6 cents, or 3.7 per cent, to $1.54; and Karoon Energy 5 cents, or 2.3 per cent, weaker at the close, at $2.10. On the coal front, Whitehaven Coal eased 2 cents to $10.80 but New Hope eked out a 1 cent gain, to $6.87. In gold, Northern Star dropped 32 cents, or 4 per cent, to $7.66, while St Barbara plunged 6 cents, or 8.2 per cent, to 67 cents.

The big banks were also lower, although ANZ managed a 5-cent gain, to $25.41. NAB lost 1 per cent, to $30.78, Commonwealth Bank was down 0.8 per cent, at $98.09; and Westpac eased 0.3 per cent, to $23.43.

Medibank retreated 3.4 per cent to $3.40 after giving an update on last week’s cyber-attack, saying there was no evidence that customer data was removed from its network. IAG gained 1.6 per cent to $4.89 as the insurance giant announced a share buy-back program of up to $350 million.

US stocks bump higher on earnings

In Wall Street’s opening for the week, the roller-coaster was on an upward swing, as better-then-expected earnings news eased some of investors’ fears and oversold tech names enjoyed a rebound rally.

The 30-stock Dow Jones Industrial Average gained 551 points, or 1.9 per cent, to close at 30,185.8, the broader S&P 500 added 94.9 points, or 2.7 per cent, to 3,677.9, and the tech heavy Nasdaq Composite index surged 354.4 points, or 3.43 per cent, to 10,675.8, in its best day since July. Better-then-expected earnings from Bank of America and Bank of New York-Mellon lifted those stocks by 6 per cent and 5 per cent respectively, helping the indices, while some big tech names also bounced back, led by Zoom, which was up 6 per cent.

US Treasury prices rose, pushing benchmark 10-year yields lower for the first time in three days following moves in the UK bond market, after new Chancellor Jeremy Hunt reversed most of Prime Minister Liz Truss’ economic growth plan. That gave global markets a hint of optimism after days of political and financial chaos.

On the commodities front, gold gained US$3.06, or 0.2 per cent, to US$1,650.66 an ounce, and Brent crude oil eased one cent to US$91.62 a barrel, while the West Texas Intermediate grade rose 53 cents, or 0.6 per cent, to US$85.99 a barrel. The Australian dollar is buying 62.93 US cents.