Global rally supports market, energy, financials jump on UK caution

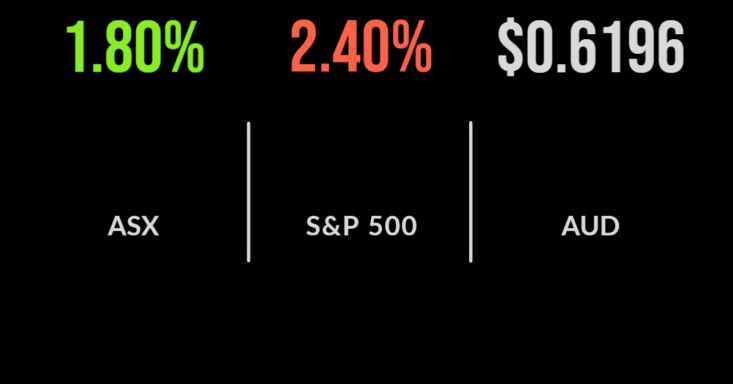

The S&P/ASX200 managed to offset the majority of the week’s losses on Friday, finishing 1.8 per cent higher on the back of a significant jump in the energy and utilities sectors. Every sector finished higher on the day. The likelihood of a disorderly transition of the energy sector and increasing oil prices globally supported energy to a 3.8 per cent gain, behind a rally in the likes of Beach (ASX:BPT) and Santos (ASX:STO) which were 5.6 and 4.4 per cent higher. It was a similar story for the financial sector, which carried on the strength from Bank of Queensland’s (ASX:BOQ) strong report earlier this week to gain 1.6 per cent on Friday. The driver today was news that the UK government was considering on tax cuts that had sent the world into a tailspin. UK-exposed stocks like Virgin Money (ASX:VUK) and Janus Henderson (ASX:JHG) jumped by 9.5 and 6.1 per cent each. Shares in Qantas (ASX:QAN) also gained more than 3 per cent after a series of broker upgrades on the back of a better than expected quarterly report. Across the week, Bank of Queensland was the standout, adding 12.5 per cent, with Qantas gaining 8.4 and Westpac (ASX:WBC) 7.4 per cent. The market lost 0.1 per cent over the five days, with financials the standout, up 3.1 per cent.

Rally reverses, investment banks, United Health report, inflation expectations jump

All three US benchmarks were pushed lower on Friday, with news that the Michigan Consumer Inflation index suggested that the popular are now expecting inflation to increase to 5.1 per cent. Expectations are an important part of the inflation equation as they risk entrenching higher costs into the broader economy. The result was a 3.1 per cent fall in the Nasdaq, a 2.4 per cent fall in the S&P500 and a 1.3 per cent drop in the Dow Jones. The weakness came after a ‘strange’ rally on Friday, when hotter than expected inflation data sent the market higher. Reporting season has begun in earnest, with Wells Fargo (NYSE:WFC) and Morgan Stanley (NYSE:MS) among the first. Wells Fargo added 1.9 per cent after reporting a 5 per cent increase in revenue but a 30 per cent reduction in profit due to prior remediation payments. Morgan Stanley shares fell by more than 5 per cent after the company reported a 20 per cent drop in revenue as activity continued to slow. Wealth management saw another US$65 billion in new assets. Hospital and insurer United Health (NYSE:UNH) finished slightly higher after the company upgraded expectations as more patients visit each of their facilities. Revenue increase by close to 12 per cent with insurance premiums a key contributor. Over the week, the Dow Jones gained 1.2 per cent on the stronger gas price, the S&P500 and Nasdaq fell 1.6 and 3.1 per cent respectively.

The worst may have passed, China inflation, cybersecurity in focus

An unexpectedly strong finish to the week has some experts now suggesting the market is looking beyond the worst of the hiking cycle and inflationary outbreak. While the majority of headlines focus on the doom and gloom of increasing interest rates, these assume no change in the current trajectory or reversal of the monetary policy trend that has supported economic growth for decades. Inflation is slowing in most major countries, albeit not as quickly as many expected, as supply chains continue to ease. Case in point is in China, where domestic inflation increased to just 2.8 per cent during the month, with the country clearly not facing the energy and food issues afflicting the rest of the world. The more vertically integrated nature of the economy is showing greater resilience, and the ability to adjust, while an improving supply chain is setting the economy up for a strong 2023. Cybersecurity is once again the focus of management in Australian, with NIB and Medibank announcing IT challenges, just a few weeks after a massive hack of Optus client data.