Energy offsets losses, Adairs confirms, coal stocks at record levels

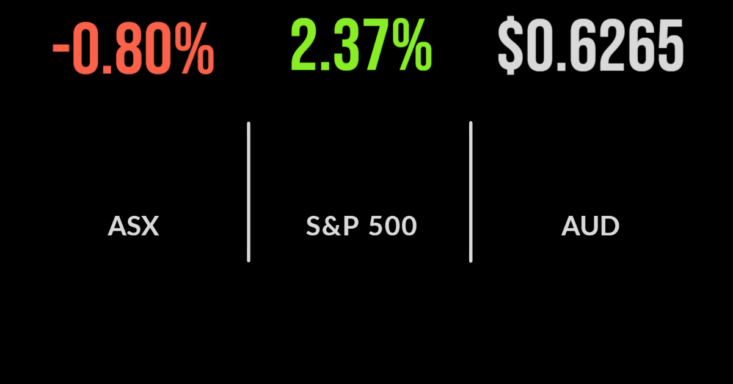

A sustained rally in the energy sector, which finished 2 per cent higher on Friday, wasn’t enough to reverse broader losses with the S&P/ASX200 ultimately finishing 0.8 per cent lower.

The utilities and real estate sectors were the hardest hit, falling 2.3 and 1.8 per cent on growing concerns about the regulatory environment for the energy sector; Origin (ASX:ORG) fell 4.4 per cent.

Fossil fuel companies continue to benefit from the energy crisis with New Hope Coal (ASX:NHC) gaining 7.7 per cent to a record high and Whitehaven Coal (ASX:WHC) up 4.6 per cent after seeking approval for an extension to its on market buy back.

There was broadly positive news elsewhere in the market, with furniture retailer Adairs (ASX:ADH) a rare company that offered full year guidance, confirming the group was on track for a significant jump in sales for the full year; shares gained 3.9 per cent.

While the rest of the lithium sector gained, led by Mineral Resources (ASX:MIN) up 3.1 per cent, Allkem (ASX:AKE) bucked the trend falling 1.8 per cent after announcing revenue of $298 million for the quarter, below expectations.

The local market finished 1.2 per cent lower over the week, with a similar trend to Friday, as the energy sector was the only one to post a gain, of 1.6 per cent.

Financials were broadly flat with company specific issues sending St Barbara (ASX:SBM) and Megaport (ASX:MP1) to losses of 24 and 36 per cent over the five days.

US rallies to best week since June, Snap snips earnings, rate hikes to slow

The US market was boosted by a report on Friday that suggested the Federal Reserve may be ready to slow down the pace of rate hikes, with the Dow Jones gaining 2.5, the S&P500 2.4 and the Nasdaq 2.3 per cent.

Comments from a Fed member reduced the likelihood of a 75 basis point hike in both November and December, sending bond yields lower and buoying almost every company.

With earnings season now truly underway, estimates suggest some 72 per cent of companies have reported a ‘positive surprise’ on the earnings side despite the gloom and doom.

One company unable to avoid the pressure was Snap (NYSE:SNAP) which fell more than 28 per cent after reporting that revenue increased by just 6 per cent on the prior year.

Management blamed inflation for cuts to marketing budgets across the economy.

Facebook (NYSE:FB) was caught up in the weakness, underperforming and falling 1.2 per cent.

Despite this every index posted the strongest week since June this year, with the Dow Jones finishing 4.9, the S&P500 4.7 and the Nasdaq 2.3 per cent higher.

Beginning of the end, UK markets pressure politics, coal miners gain

2022 has seen the most significant change in monetary and financial conditions than at almost any point in history.

The increase in interest rates is close to unprecedented and has seen a repricing of almost every asset in the world, property, and equities chief among them.

There are signs, however, that the shift in rates may be turning, following commentary from the Federal Reserve this week.

This would bode well for markets, but it is becoming increasingly clear that a rising tide will not lift all boats and even in this environment selectivity will be key.

Usually, politicians are putting pressure on markets and businesses through their own policy, yet this time it was markets essentially pushing Liz Truss, Prime Minister of the UK out the door.

An abrupt resignation following an ill-fated and poorly received budget has the UK looking at an extended period of uncertainty, however, markets are beginning to settle.

The performance of fossil fuel companies has been the surprise of the year with many sitting at record highs as global demand surges, even as regulatory and political sentiment towards a faster transition to cleaner energy gathers steam.

It remains difficult to see the long-term future profitability of this sector despite the short-term strength.