An abundance of value, or is the market just presenting more value traps?

As recession risks grow, investors and their financial custodians need to be on the lookout for value traps. While a low share price can be a lure for investors, it does not indicate a quality investment; financial advisers and their contemporaries demonstrate their value by looking for warning signs on a company’s profitability and earnings sustainability.

For investors keen to do their own research, it is important to identify the cause of price fluctuations and whether those reasons are temporary or permanent.

According to Peter Gardner, senior portfolio manager at Plato Investment Management, the lure of generous dividends can often be a trap in itself. He identifies three main factors that can be used to predict what can be termed ‘dividend traps’.

First, Gardner suggests investors look out for stocks that have very high yields to begin with, particularly those with yields over 10 per cent.

“If the stock is paying out more than 10 per cent, then the market is clearly suggesting that the stock isn’t a sustainable yield going forward or else everybody else would be buying that stock and its price would be going up,” Gardner says.

Second, he warns again investors buying stocks when the price is falling.

“When a stock price is falling it’s generally because the market is telling you the earnings prospects of the stock is going down,” he says. “When the earnings are going down that obviously means the company has less ability to pay out dividends going forwards, and so their payout ratio starts to increase, which is the third main factor.

“Stocks that have very high payout ratios… they’re often not sustainable as well – particularly when they are over 100 per cent – but even as they get up towards 100 per cent.”

Sifting value traps

Chris Hotop, portfolio manager for Australian Value Equities at Maple-Brown Abbott, says value traps are “stocks that look cheap but are cheap for a reason and usually continue to get cheaper still”. The fund manager has a process aimed at reducing the risk of investing in value traps.

“We have identified a range of factors that indicate a heightened risk of a stock being a value trap,” he says. “Has there been a structural change in the industry that means the business won’t be as profitable in the future as it has been in the past? Does the stock require management to execute a complex turnaround? Has there been recent management change or are insiders selling the stock? Are there material sustainability concerns? Does the company have too much debt?

“These are just a few of the questions we ask. Over the years, we have seen many examples of value traps. Companies in sunset industries are among the classic examples, like print media or coal-fired power generation. Looking ahead, with rapid technological and social change, no doubt there will be many more. And that is something that keeps us on our toes,” he says.

Maroun Younes (pictured), co-portfolio manager at Fidelity Global Future Leaders Fund, says that if a company’s price is falling due to an underlying cause such as structural or permanent changes in an industry, or a new disruptive technology emerging, then it’s more likely to be a value trap.

However, with a share that represents good value, “what you’re looking for here is a temporary or transient cause such as a cyclical downturn for the relevant sector, a broader economic recession, or a few simple management missteps that can easily be rectified”.

Another factor to closely examine is the company’s balance sheet. “A stressed balance sheet lowers survivability rates, as well as restricts options available to management. Good bargains should ideally have healthy balance sheets,” Younes says.

Some sectors riskier than others

Daniel Pennell, portfolio manager of the Plato Global Shares Income Fund, warns some consumer discretionary stocks may face more difficult times ahead given rising interest rates, leading to a heightened risk of dividend traps.

“One sector we’re watching very closely for potential dividend traps is Consumer Discretionary, where yields strengthened further over the past year driven by surprisingly strong household balance sheets,” Pennell says. “It will be interesting to see how the sector goes, given it historically struggles when we see cost of living pressures and weakening consumer sentiment.

“Across the sector, we’re cautious that some companies have seen sales starting drop as inflation and higher mortgage repayments take their toll on household budgets.”

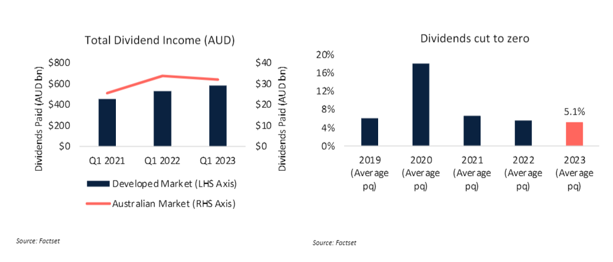

Plato Investment Management’s propriety Dividend Cut Model is showing an 11.2 per cent chance of dividend cuts in global developed markets in 2023, which is below the long-term average. In the first quarter of 2023, a small number of companies cut their dividends to zero, just 5.1 per cent. Outside of that, 12 per cent of companies globally reduced payouts due to the more challenging economic environment.