‘More professional’ adviser cohort sees AFCA complaint levels plummet

The number of financial advice issues that made their way to the Australian Financial Complaints Authority plummeted in the 2023/24 financial year, despite all the consumer harm and associated complaints linked to the collapse of Dixons Advisory.

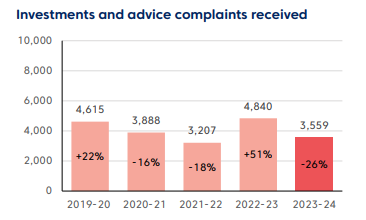

Advice complaints dropped 26 per cent in the financial year, according to AFCA’s recent annual review, down from 4,840 to 3,559. This continues a downward trend for complaints about advice and investments across the five years AFCA has been in operation, with the only anomaly being a spike in complaints last year.

According to AFCA senior ombudsman for advice and investments, Alexandra Sidoti, the “growing trend” towards less complaints reaching AFCA can be primarily attributed to a more professionalised industry that has higher standards of education and compliance than it did in the period before the Hayne Royal Commission.

“The figures for last year are pleasing, but the level of complaints has been decreasing in the previous years as well,” Sidoti tells The Inside Adviser. “There’s a growing professionalism in the industry and higher education standards are flowing through.”

Last year’s spike in complaints, she says, was due to “batching issues” and not representative of the typical workflow AFCA sees. The authority has “two speeds”, Sidoti explains; everyday complaint work and separate batch work, which represent cases that get grouped together for varying reasons. “We had a lot that were batched together and came through last year,” she adds.

Apart from the anomolous results AFCA posted last year, the trend for advice is a positive one after years of negative press in the wake of the royal commission. The subsequent advice industry clean-out has seen the practices that have weak compliance processes and poor governance fall by the wayside or get swallowed up, while the sharper businesses that are less prone to complaints have prospered. “The education standards and higher levels of professionalism have weeded out some advisory firms, that’s been a huge part of it,” she says.

Another important factor that has contributed to the decline in complaints is the improvement in client communication levels at advice practices, Sidoti says. Better communication between advisers and clients about potential disputes means that more issues get settled during the Internal Dispute Resolution (IDR) phase and don’t get escalated to AFCA, she explained.

“Anecdotally, better levels of communications between advisers and clients has made a huge difference,” she says. “Complaints are being handled a bit better.”

Sidoti believes the trend will continue and the industry still has room to lower levels of complaints. “I would certainly hope there was room for further decline,” she says. “It’s been a consistent downward trend.”

One thing does stand in the way of further immediate improvement, however; less than 100 of the cases related to Dixons Advisory have actually made it to the regulator to date, with a huge slate of complaints yet to file in.