Australian Ethical zeroes in on energy transition with new infrastructure debt fund

Ethical fund manager Australian Ethical is investing in societal sustainability, teaming up with infrastructure debt specialists Infradebt recently to launch a new fund that will provide capital for projects involving renewable energy, social infrastructure and other property projects designed to bring about social or environmental benefit.

The Australian Ethical Infrastructure Debt Fund is the latest in a series of funds created by the ethical manager, which was founded in 1986 and has almost $10 billion in funds under management.

The new fund has a core focus on supporting activities that contribute to helping the country achieve its ambitious energy transition goals. Australian Ethical’s partner in the fund, Infradebt – which has been appointed as a sub-investment manager and will manage the infrastructure investments in the portfolio – is an ubiquitous presence in the Australian energy transition movement, having funded 40 renewable projects to date.

While the specific energy infrastructure projects are yet to be announced, Australian Ethical has committed to give investor in the fund direct visibility of the underlying activities being finances. The types of projects forecasted as part of the tie-up include solar, wind, hydro, geothermal power generation and energy storage.

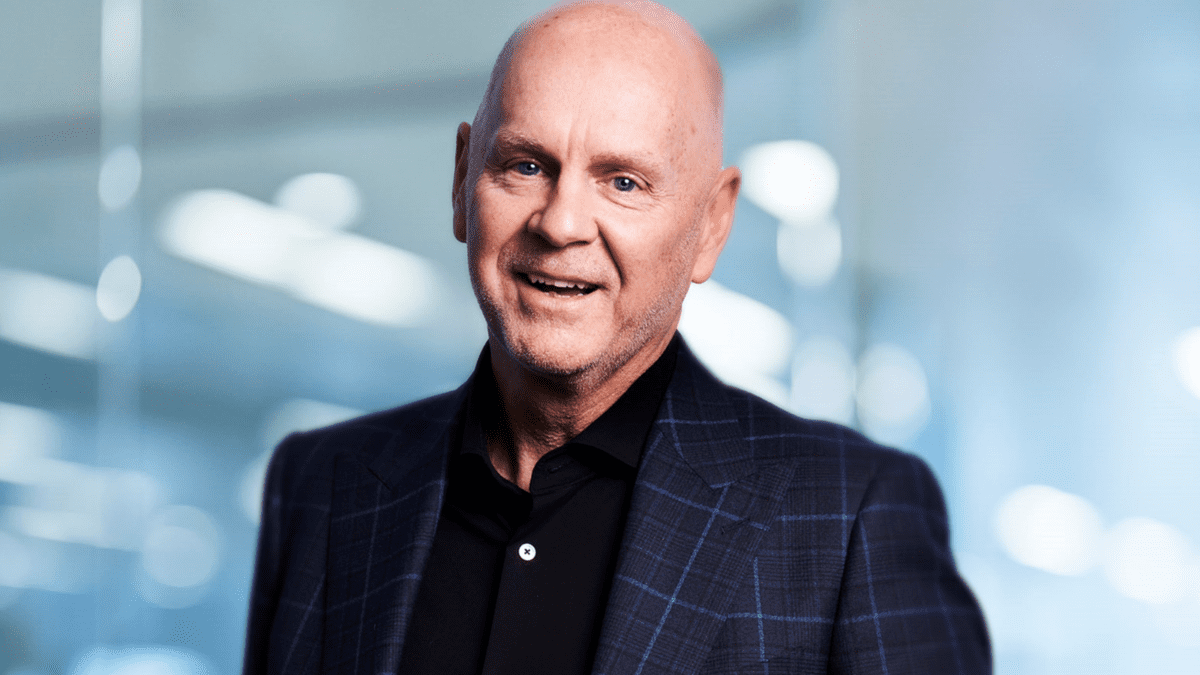

According to Australian Ethical chief investment officer Ludovic Theau (pictured), infrastructure debt will be a key tool in Australia’s quest to transition to renewable energy sources. Large scale funding like the kind offered by institutional providers brings the kind of scale to these projects that turns a breath of support into a major tailwind.

“We estimate that debt capital will provide 50 to 60 per cent of the total capital expenditure that’s required to meet Australia’s renewable energy transition targets,” Theau said. “Given Australia is aiming to increase its renewable energy generation from 39 per cent today to 82 per cent by 2030, Australian Ethical considers its expansion into infrastructure debt as an important growth opportunity that will serve a dual purpose – of delivering good risk-adjusted returns and contribute towards meeting these targets.

Australian Ethical has doubled its funds under management in the past three years, Theau noted, adding that product innovation and the diversification it offers is an important part of the Australian Ethical growth strategy.

“This partnership with Infradebt, also a leader in its field, allows us to bolster our investment capabilities by bringing in-depth expertise across new asset classes,” he added.

Infradebt investment director and co-founder Alex Ramsay was candid about how difficult it is to develop and implement contemporary renewable energy projects, but also about how important it is for investment leaders to bear the responsibility. “The energy transition is of paramount importance to our community,” he said. “It will be complicated and challenging, and the fund will allow investors to access the requisite investment capability to participate and make a meaningful contribution.”

Notwithstanding social and environmental ambition, the very nature of infrastructure debt also means it can provide investors with reliable risk-adjusted returns that can act as a hedge against both market volatility and inflation.

“By sitting higher in the capital structure, Infrastructure debt tends to offer investors stable and predictable cash flow, and diversification away from more commonly held equity portfolios,” Ramsay said.