Geopolitics to trump inflation as biggest risk of 2023

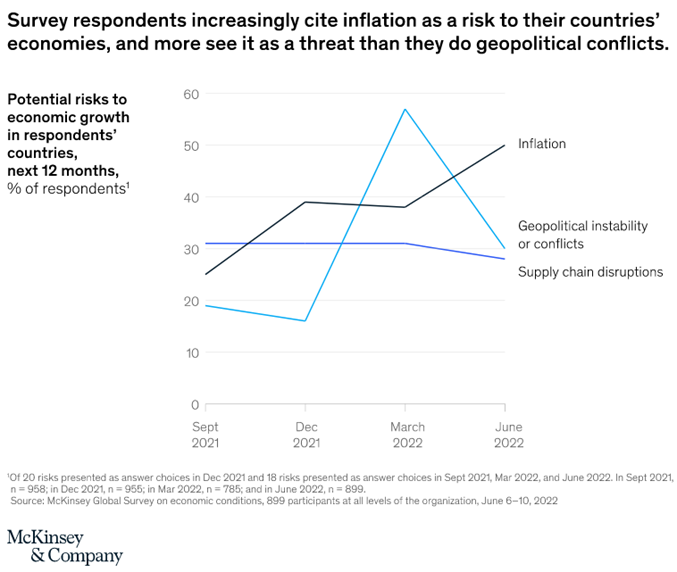

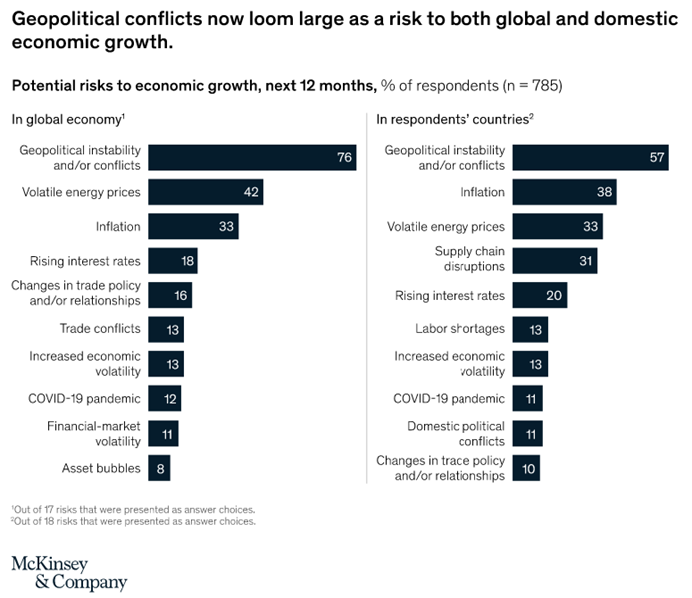

In a year shaped by geopolitical tensions, a pandemic, war, inflation and supply-chain disruptions, the number one threat perceived by the general public remains inflation. That’s according to McKinsey & Company’s Economic Conditions Outlook June 2022 survey, which found that inflation topped the list of perceived economic hazards in respondents’ home countries, while geopolitical conflicts remain a top threat to the global economy.

The report found that there was an overall “pessimism” about the second half of 2022, which it has compared to the early months of the pandemic of 2020. The difference here is that there is a more positive mood with those that responded in the Asia-Pacific region and greater China. This could be due to the fact that the Asia-Pacific region’s recovery post-COVID was a lot better than the rest of the world.

Respondents in the Asia-Pacific and Greater China region expect their local economies to do well in the second half of 2022. And that bodes well for the recovery rally that follows on from June’s tax-loss selling. But on the flip side, the survey found that respondents in Europe and North America are a lot more pessimistic about the future compared to their Asia-Pacific counterparts.

What was interesting is that the pandemic has finally taken a back seat; it wasn’t cited as the top risk to global growth. Global instability and conflicts loom large in the global and domestic economies with the majority of respondents citing this as the number-one risk. And of course, inflation together with volatile energy prices, was cited as the next biggest risk to the global economy.

While global instability and conflicts are major risks to economic growth, rising interest rates are among the top five risks to near-term growth in the global economy. The percentage of respondents that are tipping a significant rise in near-term interest rates has more than doubled since the previous quarter.

Overall, McKinsey says, “While respondents tend to report improving — rather than worsening —conditions in the global economy and in their home countries, the percentages of executives saying so continue to decrease over time.” The survey paints a rather downbeat image for the next six months. “Forty-three per cent of respondents believe the global economy will improve over the next six months, a share that’s nearly equal to the 40 per cent who think conditions will worsen. This month’s result also marks the first time since July 2020 that less than a majority of respondents feel optimistic about the global economy’s prospects,” the consultancy firm says.